Equipment-as-a-Service sector strong in Q2

North American traditional rental performance up 64% YoY

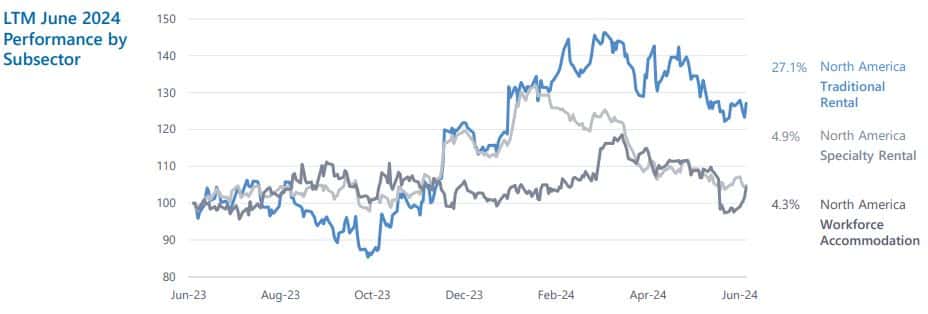

Equipment-as-a-Service performance showed strength in the second quarter as elevated interest rates and equipment demand persisted.

North American traditional rental activity, which includes Ashtead Group, United Rentals, H&E Equipment Services and Herc Rentals, experienced 27.1% growth year over year in Q2, according to global investment bank Houlihan Lokey’s Equipment-as-a-Service (EaaS) market update. North American traditional rental is up 64.2% over the past three years.

The EaaS market saw “stronger-than-expected” economic growth despite “persistent inflation” of 3% and elevated interest rates, according to S&P Global’s June 30 Capital IQ note.

EaaS, rental benefit from interest rates, M&A

Interest rates should begin to come down following the Federal Reserve’s interest rate cut last month, which still helps the EaaS sector by making it easier for dealers and rental houses to access funding. In addition, the EaaS and rental industries should also benefit from mergers and acquisitions, which are expected to remain strong as capital access improves, Hudson said.

For dealers and rental houses, activity continues to open up following years of tightness, Rob Jackson, director of sales and rental at Raleigh, N.C.-based Gregory Poole Equipment Co., told EFN.

“The last three years it’s been tough to grow a rental fleet when the supply chain had some issues, but we’ve successfully grown it, and at this point, we’re looking at right-sizing,” he said. “Some of our hope is that the customers will be a little bit more confident to either buy some used gear or convert some rentals that they have, and we’re starting to see a little bit of improvement in our quote activity over the last 30 to 60 days.”

Click here for more information and to register for the free webinar “Used equipment financing in 2025 as markets normalize,” taking place on Tuesday, Oct. 22, at 11 a.m. ET.