Steady business volume props up lender confidence

8% of lenders expect increased demand in next 4 months

Tariff uncertainty continues to curb equipment lender confidence in the short-term, but steady business volume signals resilience in the market.

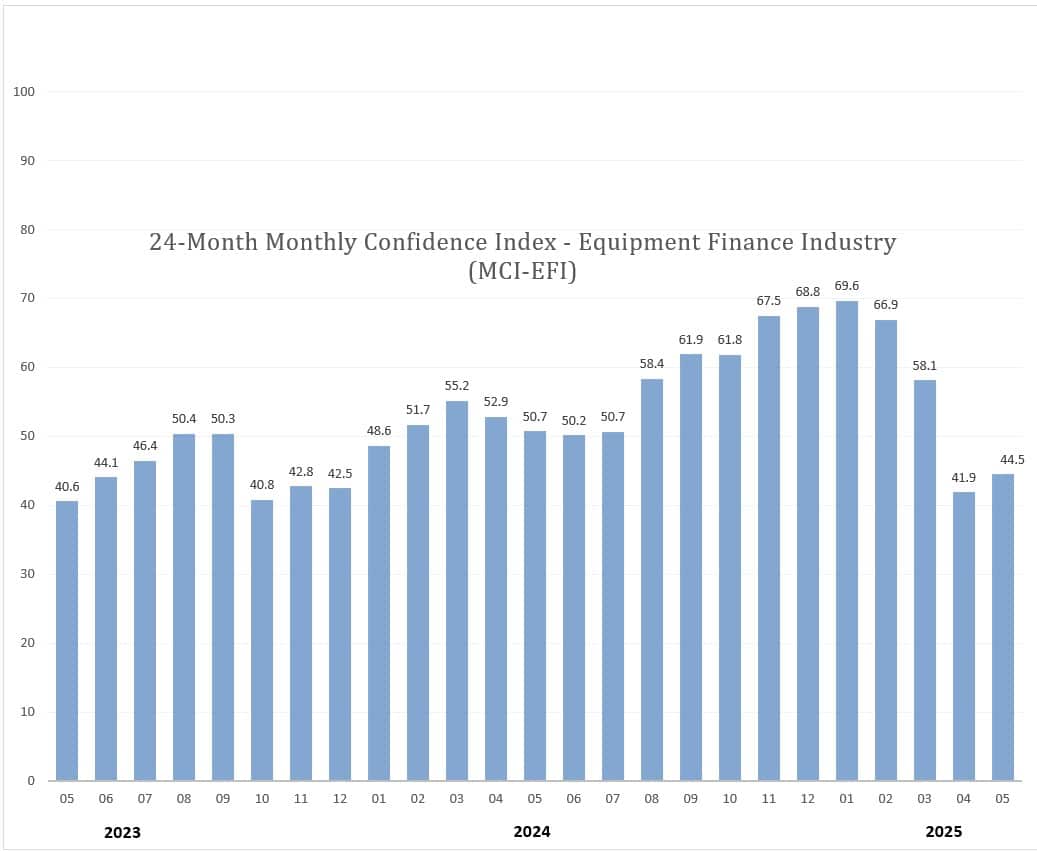

The Equipment Leasing and Finance Foundation’s (ELFF) Monthly Confidence Index, released May 20, reached 44.5 in May, up from 41.9 in April but at its second-lowest point since December 2023.

Despite economic uncertainty and higher new equipment prices, “actual volume has been strong” so far in 2025, David Normandin, president and chief executive at Wintrust Specialty Finance, stated in the report.

“So long as companies continue their investment in their businesses and finance more of those investments, 2025 could be a good year for the industry,” he said.

New business volume in equipment finance totaled $39.4 billion through the first four months of 2025, down 1% year over year, according to the Equipment Leasing and Finance Association.

However, lenders Wintrust and Commercial Capital Co. reported record net income and origination growth in the first quarter, respectively, and AP Equipment Financing anticipates a record-breaking year in terms of funding volume.

Still, just 4% of roughly 30 equipment financiers expect business conditions to improve over the next four months, down from 15.4% in April, according to the ELFF report. The percentage of lenders who expect business conditions to worsen fell to 44% from 57.7%.

Meanwhile, 8% of lenders anticipate increased loan and lease demand over the next four months, down from 11.5% in April, and those expecting greater access to capital dropped to 4.2% from 7.7%. Looking six months ahead, 12% anticipate improved economic conditions over that time period, up from 7.7%.

Lenders seek resilient borrowers

As new applicants come to the table, lenders can use historical data to determine their ability to navigate economic challenges, Tom Mariani, a strategic adviser for equipment lenders and dealers at Rinaldi Advisory Services, said last week at Equipment Finance Connect 2025 in Nashville, Tenn.

“If they survived through COVID, you should be able to push for more approvals on those types of customers, if they survive,” he said. “If they survived that, now is a good time to form that relationship, lend them money and build that bond.”