Risk management crucial for equipment lenders as flexible financing gains steam

Equipment, software investment projected to rise 6.3% in 2025

As more equipment lenders offer flexible financing options such as skip payments and extended terms to alleviate economic challenges, they must also manage the associated risks.

Equipment lenders are increasingly offering flexible financing, also called “tailored-schedule financing,” as lenders seek creative ways to lower monthly payments in the face of tariffs, high interest rates, high input costs and rising new equipment prices.

These unconventional loans and leases cater to borrowers’ specific needs and include:

- Skip payments;

- Seasonal payments;

- Floating-rate loans;

- Terminal rental adjustment clause (TRAC) leases;

- Fair market value (FMV) leases; and

- Extended terms.

Equipment lenders are offering these terms amid sporadic signs of financial stress. Some examples:

- Roughly 30 trucking companies have filed for bankruptcy since the start of the second quarter.

- Farm debt is projected to hit a record $561.8 billion this year, according to the U.S. Department of Agriculture.

- Equipment finance charge-offs reached 0.6% in March, the highest level since September 2020, according to the Equipment Leasing and Finance Association.

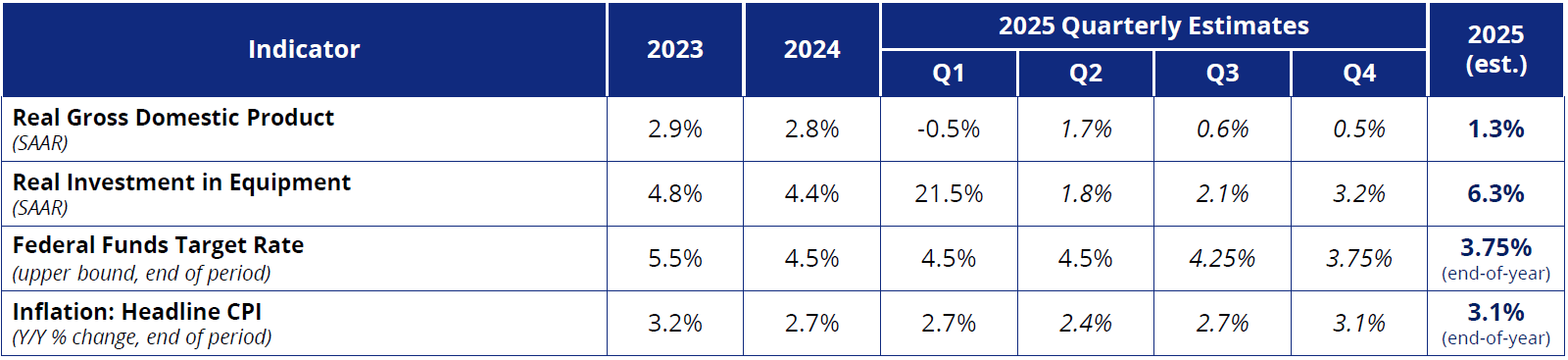

Despite this stress, the equipment finance industry remains poised for growth, with equipment and software investment projected to increase 6.3% year over year in 2025, according to the Equipment Leasing and Finance Foundation.

ELFF Economic Forecasts

As lenders look to capitalize on growth opportunities they are turning to flexible financing to address borrowers’ concerns over economic uncertainty, Mark French, president of Atlanta-based Crest Capital, told Equipment Finance News.

“In response to hesitant customers waiting for rate cuts, we started offering hybrid floaters with [consumer price index] caps to let customers ride the coming [Federal Reserve] cuts while giving us a bit of protection if inflation re‑accelerates,” he said.

In addition, Crest Capital is embedding revolving credit lines inside equipment loans so upgrades and maintenance “never trigger a re‑underwrite.” The lender is considering “revenue‑share leases,” floating monthly payments aligned with monthly revenue that a machine generates, French said.

Know borrowers, know industry

Understanding the nuances of a borrower’s business and their industry is crucial to managing risk when exploring flexible financing solutions, Paul Fogle, managing director at Carmel, Ind.-based Quality Equipment Finance, told EFN. In the agriculture equipment sector, for instance, seasonal or quarterly payments are more feasible for some crop producers.

“You’ve got to figure out when the quarterly payment can come in, but you may skip the following quarter,” Fogle said. “I think some of the risks are, there’s a lot that can happen in six months.”

“You may not know of a cash flow situation or a negative business situation until whenever that payment is due.”

— Paul Fogle, managing director, Quality Equipment Finance

Lenders can mitigate these risks by requiring a larger down payment, shortening the term or finding another unique way to structure the deal, Fogle said.

“We’re not trying to find ways to kick deals out, we’re trying to find ways of how to get deals done,” he said.

Managing risk

Eduardo Cruz, president of Addison, Texas-based Commercial Equipment Financing, similarly told EFN that mitigating flexible financing risks is “very industry specific.” In some cases, construction lenders may allow 60 or 90 days until first payment if a contractor is buying specialized equipment before a job, providing them enough overhead to pay for labor and materials.

“How they are managing the risk on those tailored financing is, they’re only doing it for the industries that have been performing for them.”

— Eduardo Cruz, president, Commercial Equipment Financing

“I’ve even seen some banks dig into their portfolio performance and just completely cut off [segments] because those financial sectors just weren’t performing in their portfolio,” Cruz added.

Construction is considered to be a strongly performing equipment finance market. In fact, Dodge Construction Network is projecting nonresidential construction starts to rise 7% YoY to $478 billion in 2025 and infrastructure starts to jump 10% to $360 billion.

Lenders have also named the following as emerging growth markets:

- Vocational vehicles;

- manufacturing; and

- materials handling.

Digging deep

Lenders must dig deep to understand the purpose of an acquired piece of equipment when considering tailored financing, John Gougeon, president of Ann Arbor, Mich.-based UniFi Equipment Finance, told EFN, emphasizing the “essentiality of the equipment relative to their business.”

“I can pull a FICO or a PayNet [credit assessment] and get a number, but that doesn’t really tell me a lot about the company or the acquisition of equipment,” he said. “We try to ascertain the purpose for the acquisition. … Is this a project acquisition or is this a long-term acquisition? Because if it’s tied to a project, the credit risk notwithstanding, there’s a big risk of things coming back at the end of the project.”

In addition, lenders can ask borrowers to provide job contracts, reference letters, cash-flow metrics and long-term business plans to inspire confidence, Commercial Equipment’s Cruz said.

For some lenders, dynamic cash-trap covenants — loan provisions that require a portion of a borrower’s cash flow to be diverted to a lender’s account — “catch trouble sooner than fixed [debt-service-coverage-ratio] tests,” Crest Capital’s French said.

Vital role of dealers

Other flexible financing options are also gaining steam, Jody Ray, relationship manager at BMO Bank North America, told EFN. These include:

- OEM-partnered factory programs like 0% financing;

- FMV leases;

- TRAC leases; and

- longer terms.

He noted that 60 months or less has been the standard offering, but this is changing.

“With the price tags of large equipment and price increases on other products, 72 months is seen more and more, and we’ve even seen a few extend to 84 months.”

— Jody Ray, relationship manager, BMO Bank North America

“These longer terms increase risk, so lenders will have to be mindful of balancing performance with term. But with price creep over the last few years, it is a way to give a consumer a lower payment.”

As lenders seek the best product, term and payment structure, setting a customer up for success “starts with the dealer,” he said.

“Experienced underwriters and credit team members work with an automated scorecard and algorithm to see what’s in the box and — sometimes more importantly — what’s outside the box to make the deal work,” he said. “When all three pieces work together, the dealer and the lender send the customer down a path that successfully and profitably works for everyone.”

What should borrowers do?

Businesses across every equipment sector are still being squeezed on multiple fronts.

Construction input costs have increased 41.8% since February 2020, according to a June report by the Associated Builders and Contractors.

What’s more, agriculture commodity prices have dropped 4.5% over the past three years and are projected to fall another 3.2% in 2025, according to global financial institution World Bank Group. And, truck insurance premiums have soared 43.7% over the past five years, reaching a record 10.2 cents per mile in 2024, according to the American Transportation Research Institute.

However, borrowers can take action to increase their chances for obtaining a tailored-schedule loan or lease, Crest Capital’s French said.

For instance, Crest Capital’s risk management strategies for flexible financing include liquidation-value models — a measure of a company’s assets if they were to be sold.

A business can quickly boost the value of its assets without making a large investment by installing “QR-coded displays linking to maintenance logs” because buyers “pay more and buy faster when they can instantly verify operating history,” French said.

Borrowers can also “spend around $3,000 on autonomy-ready sensor packages,” he said. “Even if you never activate the sensors, it shows the asset can handle some future tech integration.”

In addition, buyers seeking a creative structure with skip payments should be open to accepting maintenance and return conditions, UniFi’s Gougeon said.

“Maybe instead of 50% remaining useful life, they’re required to maintain the equipment at a 75% remaining useful life level so that in the event that the deal goes bad in the near term, you have some reliance that there’s some value left in the equipment,” he said.

Installing GPS or telematics can help extend the longevity of a machine by providing real-time data on performance, location and condition, ensuring routine maintenance, Gougeon said.

“It’s important to know where the vehicle is and have access to it,” he said. “So, if it’s a troubled credit or a difficult transaction, we may ask for something like GPS.”

Check out our exclusive industry data here.