Recent rate cuts support YoY equipment finance growth

New business volume up 1% YoY in November

Recent interest rate cuts are expected to support equipment demand heading into 2026 as the equipment leasing and finance sector remains resilient despite market volatility and signs of a slowing economy.

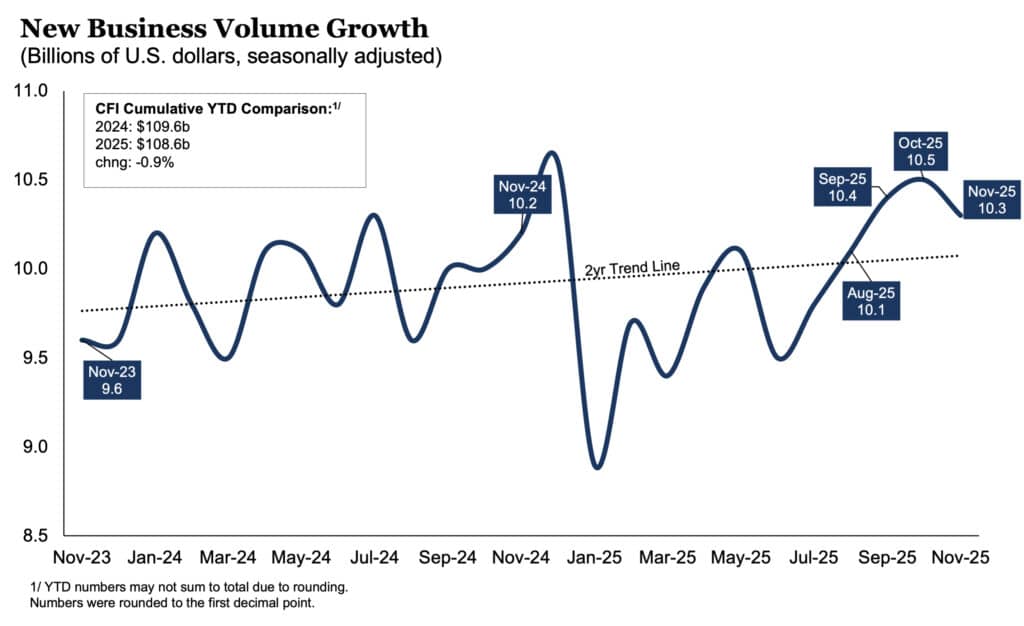

Total new business volume reached $10.3 billion in November on a seasonally adjusted basis, down 1.9% month over month but up 1% year over year, according to the latest CapEx Finance Index released today by the Equipment Leasing and Finance Association (ELFA). Year-to-date volume declined 0.9% YoY.

Equipment demand stayed strong through November, buoyed by the Federal Reserve’s decision to lower rates again at its December meeting, according to the ELFA release. Financial conditions across the industry remain healthy, suggesting limited impact if borrowing costs hold near current levels next year.

Despite a dip in December, confidence in the industry remains high as businesses continue to reassess capital deployment amid rapid technological change, Wayne Fowkes, executive vice president of the Americas at CHG-MERIDIAN, said in the release.

“With 2025 shaping up to be one of the strongest years for our industry, we expect this momentum to continue, supported by agile, future-ready investment strategies that set a more resilient path for long-term competitiveness,” he said.

Meanwhile, credit conditions remained favorable as the overall approval rate rose to 78.2%, according to the release. Additionally, delinquencies declined 0.23 percentage points to 2%, offsetting the prior month’s increase, while loss rates edged higher, with the overall rate increasing to 0.49%.

Check out our exclusive industry data here.