Equipment lenders are offering various leasing models while carefully setting residual values as rising new truck prices and operating costs strain borrowers.

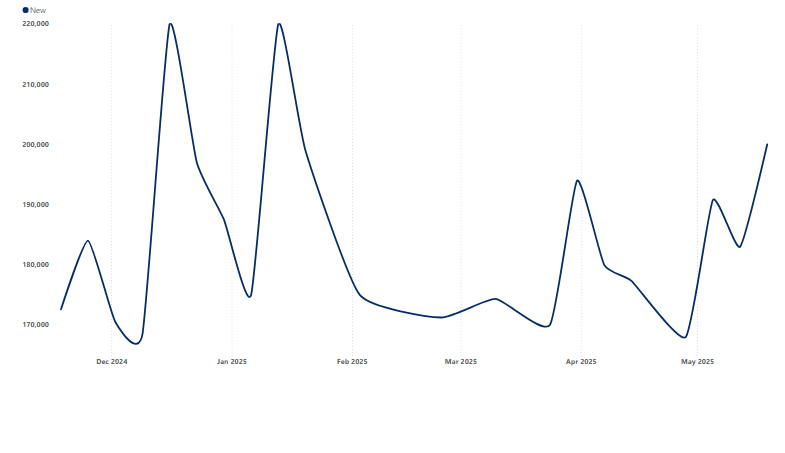

The average price of a new heavy-duty sleeper truck was nearly $200,000 as of May 19, up 14.3% from $174,950 on Jan. 6, according to Equipment Finance News’ Average Truck Price Trends dataset. New truck prices increased 3% year over year in the first quarter, according to IronAdvisor Insights.

Average Price of New Sleeper Truck

Rising truck prices are straining the truck financing segment as making monthly payments becomes more difficult for fleet operators, Kirk Mann, executive vice president and head of transportation at Mitsubishi HC Capital America, told EFN.

“It hasn’t helped that interest rates have risen and insurance costs are certainly not down,” he said. “So really, the truck operator is getting squeezed from a number of standpoints, but just the price of the truck themselves has created some difficulty there.”

Adding to affordability challenges, tariffs have prompted truck manufacturers to implement surcharges ranging from $3,500 to $4,000.

Leasing eases cost burdens

With high interest costs also pressuring dealers to sell, lenders are structuring deals to mitigate as much of the pain of increased truck prices as possible, Mann said. The lender is offering terminal rental adjustment clause (TRAC) leases and fair market value (FML) leases to lower monthly payments, he said.

A TRAC lease is a deal in which the lessee and lessor agree on a pre-determined residual value, granting more flexibility to the borrower. An FMV lease allows the lessee to make fixed monthly payments for a set period, with an option to return, continue leasing or purchase the vehicle at its current market value at the end of the term.

“It’s getting to a point where they need some relief on payment,” Mann said. “Every single day, we just have to work with the dealer, and the dealer has to work with the customer and determine what the best structure is for them.”

Estimating the value of a truck at the end of a five-year term is one challenge with FMV leases, though, Mann said.

“So, we have to be careful and make sure that we don’t get too far out over our skis when we’re setting residuals four or five, sometimes six years out,” he said.

Carefully setting residuals as tech advances

New truck prices are steadily increasing due to “the integration of advanced safety and emissions technologies,” Jennifer Sablowski, vice president of equipment finance at Chattanooga, Tenn.-based Transport Enterprise Leasing, told EFN.

“These safety systems, which have already proven effective in the automotive industry, include multiple radar and camera systems integrated into the drivetrain and steering systems,” she said.

While new emissions technology aims to improve fuel efficiency and reduce total cost of ownership, these advancements have typically added $10,000 to $15,000 to the cost of a Class 8 truck, Sablowski said.

“Consequently, first-year models experience a significant price increase with uncertain residual values due to unproven emissions components,” she said.

As new technologies drive up new truck prices, “a conservative approach is recommended when setting residuals for these first-year models,” Sablowski said.

“If the technology proves effective and reliable, residual values can be adjusted for second and third-generation trucks,” she said.

Lenders should also focus on credit quality and fleet size when financing high-tech trucks that are new to the market, Mitsubishi HC Capital America’s Mann said.

“Because if there is a problem with the new technology, you want to be sure that your customer has the balance sheet to deal with that and that they have replacement units that they can put into a situation where they’re trying to serve a customer,” he said.