Equipment loan originations spike 8% in December

New business volume topped $123B in 2024

Equipment loan originations soared in December, with the banking sector registering its largest month-over-month increase on record.

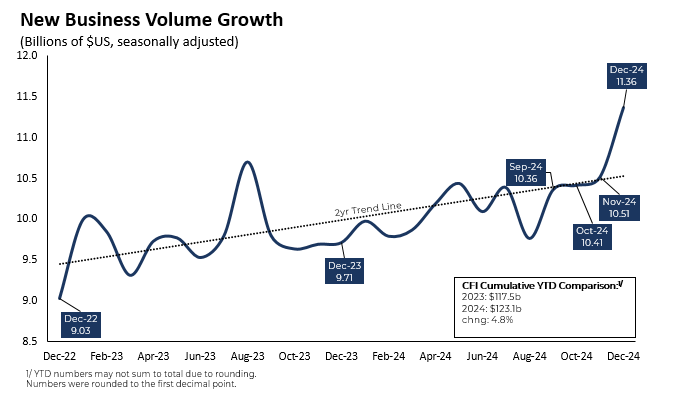

The equipment finance industry grew for a fourth straight month in December as new business volume rose 8.1% to nearly $11.4 billion, according to the Equipment Leasing and Finance Association’s (ELFA) CapEX Index, released Jan. 27. New business volume totaled $123.1 billion for all of 2024, up 4.8% from 2023.

Charge-offs dropped 80 basis points (bps) to 0.52% in December after rising 26 bps in November. Thirty-plus days delinquencies ticked up 10 bps to 2% but remained near two-year lows.

The jump in equipment financing last month stemmed from a record 36.2% surge in the banking sector, a notable figure given that many banks have been pulling back post-pandemic amid declining capital, high interest rates and tightened regulations, allowing independent lenders to emerge as key players. Moreover, banks accounted for 62% of new business volume, their largest share since the mid-2000s, according to the report.

While the surge hints that bank lending may open up this year, it was mostly a culmination of Federal Reserve rate cuts starting to take hold, election uncertainty being resolved, year–end tax breaks and expectations of bonus depreciation under President Donald Trump, an ELFA researcher, who asked to be anonymous to emphasize the collective work of the association, told Equipment Finance News.

“I think all of those things played a role in bringing in bank lending at the end of the year,” he said. “Whether this continues going forward, I don’t want to say yes or no yet. … We could see some additional catch up in the space as banks maybe jump back in … but there are some things that the current administration is doing that will help capital investment.”

Increased bank lending last month also reflects “an acknowledgment that interest rates may not fall much further in 2025,” ELFA President and Chief Executive Leigh Lytle stated in the report.

“I expect that momentum to continue even if activity slows a little in the months ahead,” she said.

Regional banks bouncing back?

Regional banks, especially, could reemerge in the equipment space in 2025 with more “pricing discipline” and “measured balance sheet growth focused predominantly on customers,” Rick Remiker, vice chairman of global advisory firm the Alta Group, told EFN on the Jan. 21 episode of “The Dig” podcast.

“I don’t think it’s an end to the glory days of independents and captives, but I think 2025, you’ll see the banks, particularly the regional banks, come back in a much stronger fashion,” he said.

While it’s still too early to tell how much an impact regional banks will have on equipment finance this year, their reemergence could yield increased commercial and industrial loans, the ELFA researcher said.

“There are a lot of things still at play, but if you come from the belief that the regional banking sector is about to experience a positive shock, or sequence of shocks, it would be within their realm to go into this space,” he said. “And that’s financial deepening, which gives borrowers more opportunity… and it increases the ability for the sector to absorb shocks.”

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.