Equipment finance originations spike 5.7%

Credit approvals hit second-highest mark since 2016

The equipment finance industry continued to build momentum in October as originations jumped while credit approvals remained near historic highs.

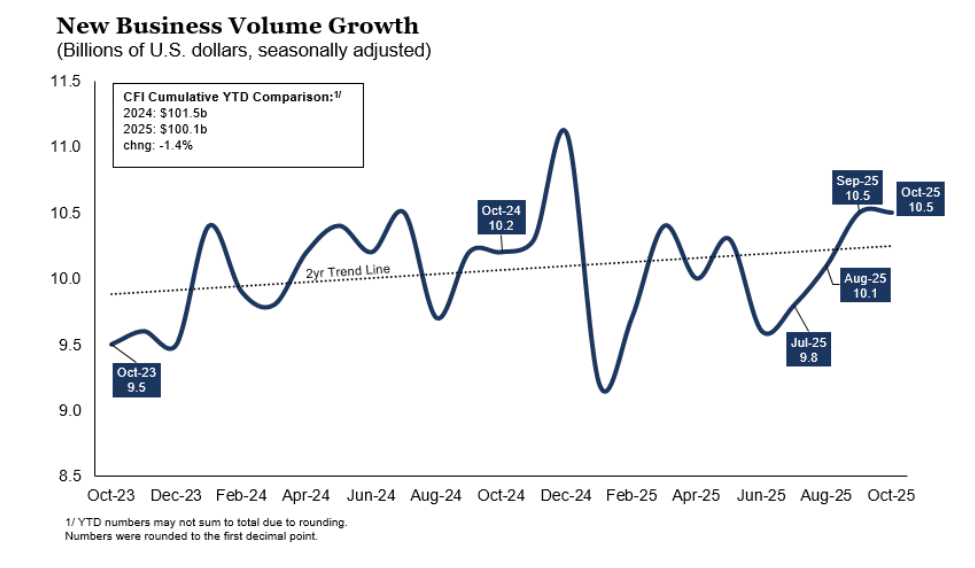

New business volume in equipment finance totaled $10.5 billion in October, up 5.7% year over year and unchanged from September, according to the Equipment Leasing and Finance Association’s (ELFA) CapEx Finance Index, released Nov. 25. New business volume was down 1.4% YoY through the first 10 months of 2025.

After seesawing throughout the first half of the year, originations have been on an upward trajectory since July despite ongoing tariff uncertainty.

The October index shows that businesses “continue to invest despite a volatile and unpredictable fall,” ELFA President and Chief Executive Leigh Lytle stated in the report.

“At the current pace, 2025 will end up as the second-best year for equipment demand in the history of our CFI survey, which goes back to 2006,” she said. “We’re going to see momentum really build as we put the government shutdown further in the rearview. The path for interest rates remains uncertain, but that doesn’t change the fact that our industry is financially healthy, setting us up for a strong start to 2026.”

Meanwhile, the average credit-approval rate ticked down 20 basis points (bps) month over month in October to 79% but still marked its second-highest reading since 2016, according to ELFA. Banks posted the highest approval rate at 82.1%, followed by captives at 82% and independents at 70.7%.

The overall delinquency rate rose 24 basis points to 2.2%, following a decline of 19 bps in September. Charge-offs dipped 4 bps to 0.44%.

Growth drivers

Despite economic uncertainty and financial stress in some equipment sectors, lenders are identifying multiple growth opportunities.

New equipment technologies, for one, are driving financing demand, David Normandin, president and CEO of Irvine, Calif.-based Wintrust Specialty Finance, told Equipment Finance News. This sector includes machines equipped with technologies like autonomous software, telematics, GPS systems and various services to support them.

“If you’re not in that space, you really should look at that and think hard about it,” he said. “The investments are there, and it’s a great growth area.”

In addition, reshoring and onshoring trends are creating more financing opportunities for manufacturing equipment, Normandin said.

“We finance all of those assets, and lenders industrywide will tell you they would love to do more of that business, myself included,” he said.

Lenders also continue to capitalize on large commercial construction projects, strong rental demand and materials handling growth, among other tailwinds.

As the industry builds momentum going into 2026, lenders must be wary of overconfidence, Freddy Jalilvand, program manager at Atlanta-based Ameris Bank Equipment Finance, told EFN.

“If things look too good, more investors pile in, competition heats up, rates drop and lenders might stretch credit too far,” he said. “The big opportunity is for lenders to get out there first, recapture relationships — whether with newer companies that haven’t built them yet or older ones that got overlooked.”

Register here for the free Equipment Finance News webinar “Tech-driven risk management: How innovation is reshaping equipment finance” set for Tuesday, Dec. 9, at 11 a.m. ET.