Equipment finance confidence up, credit quality still a concern

Leases, loan demand expected to hold steady for the next 4 months

Confidence in the equipment finance market grew in February as the industry was optimistic about demand for leases, loans and the economy.

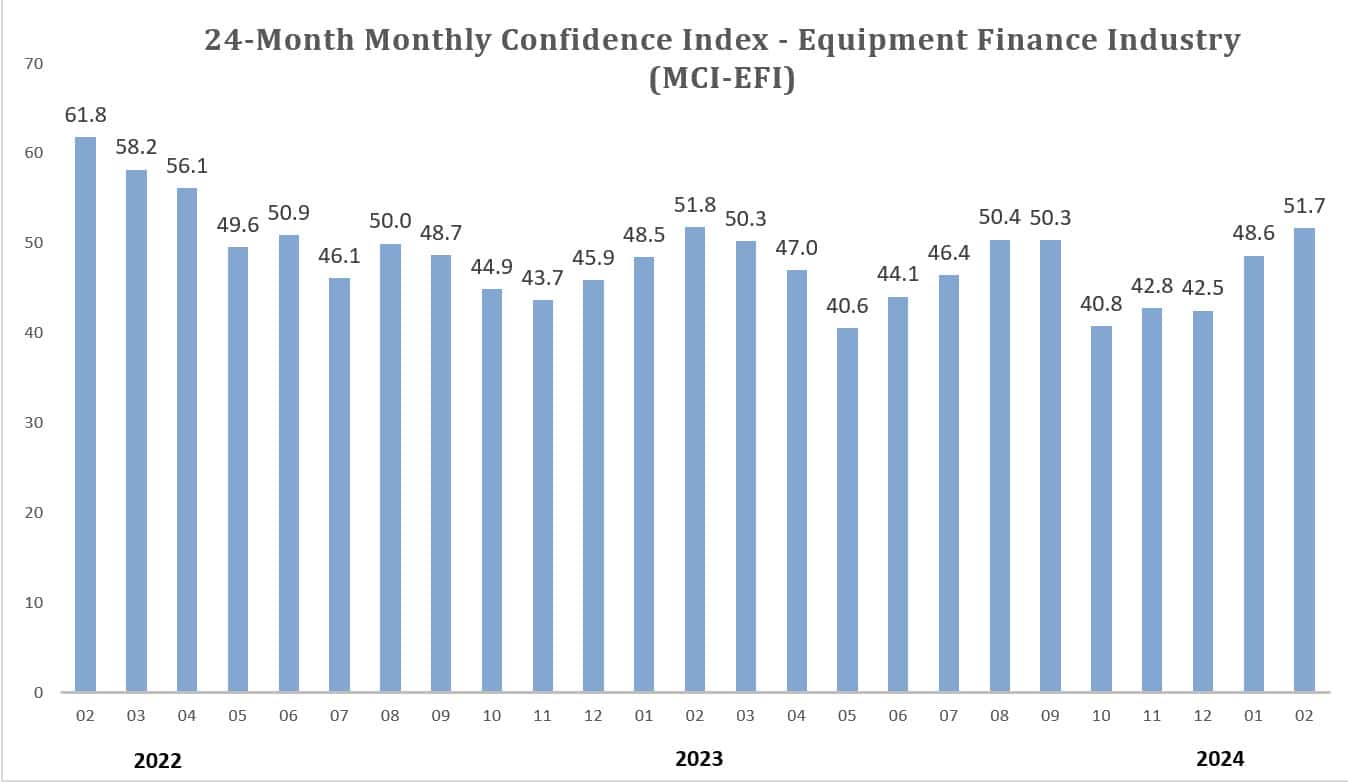

The Equipment Leasing and Finance Foundation’s February 2024 Monthly Confidence Index was 51.7, up from 48.6 in January. The industry confidence metric was 51.8 in February 2023.

Demand for loans expected to hold steady

More than 78% of the 50 respondents told ELFF they expect demand for leases and loans to remain stable during the next four months, up from 65.5% from January. Meanwhile, only 7.1% of those surveyed expected demand to increase by June, down from 13.8% last month.

However, fewer lenders expect a decline in lease and loan activity. Of those polled, 14.3% said they expected demand to decline in coming months, down 6.4 percentage points from 20.7% January.

“We believe there is a 50-50 chance of a recession this year, which will likely result in lower CapEx spending on equipment, at least in the first half or until interest rates decline,” Jeffry Elliott, president of Huntington Equipment Finance, said in a statement. “However, following the significant delay in equipment acquisitions last year, we still expect considerable activity this year, as equipment wears out and replacement can be delayed only so long.

“The speed of onshoring and reshoring also will determine the demand for acquiring equipment or CapEx. Fortunately, long-term growth prospects for the United States and North America are strong, and we think the largest-ever expansion in our nation’s history is on the horizon,” he added.

Credit quality remains concern

Lenders face a possible decline in customer credit quality, even amid steady or increased loan demand, David Normandin, chief executive of Chicago-based equipment lender Wintrust Specialty Finance, told Equipment Finance News.

It’s difficult for lenders to cut deals if borrower credit is subpar, he said. “We’re seeing people more leveraged and we’re seeing lower credit quality than we’ve historically seen in some time, so it does mean that the credits of smaller and midsize businesses are stressed more than they’ve historically been,” Normandin added.

The problem, in part, can be attributed to increased cost burden on small and midsize dealers, Normandin said, adding that insurance, fuel and overhead costs also are increasing.

“You can only pass some of that on to your customers, so they’re getting squeezed and having a harder time making their bills,” he said.

Inflation has also exerted pressure across the market.

“We’ve seen a dramatic increase in rates, so that causes people’s debt service to increase dramatically. All those things have put a lot of businesses in financial distress and therefore they’re not able to make their bills all the time,” Normandin said. “People have been slower or maybe not paying them at all.”

Internal Wintrust Specialty Finance data shows that bankruptcies increased 72% in 2023 year over year, he said.

Lower credit quality means creative financing

Most survey respondents were not optimistic on the economy; It was rated as “fair” by 89.3% of lenders, down from 93.1% last month. The economy was rated as “poor” by 7.1% of respondents, up slightly from 6.9% in January.

Wintrust Specialty Finance clients, typically small to midsize firms, are less concerned about overall economic risk, Normandin said.

“People that own small to medium-sized businesses are generally very positive,” he said. “They’re generally looking at the opportunity, and less concerned about the risk.”

He added that lenders like Wintrust Specialty Finance need to be “nimble” and offer creative financing solutions for those with less than stellar credit so they can keep their businesses running and still drive returns for the bank.

Normandin said lower credit quality means Wintrust Specialty Finance and other lenders should evaluate more opportunities.

“We haven’t changed our underwriting guidelines, we haven’t gotten more conservative,” Normandin said. “We’ve done exactly what we’ve always done. However, the quality of those applicants has gotten lower and so that means our approval rate is lower than it’s been, [so] we’re having to look at more opportunities.”

Registration is now open for Equipment Finance Connect, the nation’s only dealer-centric equipment lending and leasing event, which will take place May 5-7 in Nashville, Tenn. Learn about the event and free dealer registration at EquipmentFinanceConnect.com.