Equipment finance charge-offs near 5-year high

Originations jumped 7% MoM in March

Small-ticket loans fed equipment finance growth last month, but charge-offs hit their highest mark in nearly five years, signaling a potential dip in credit quality.

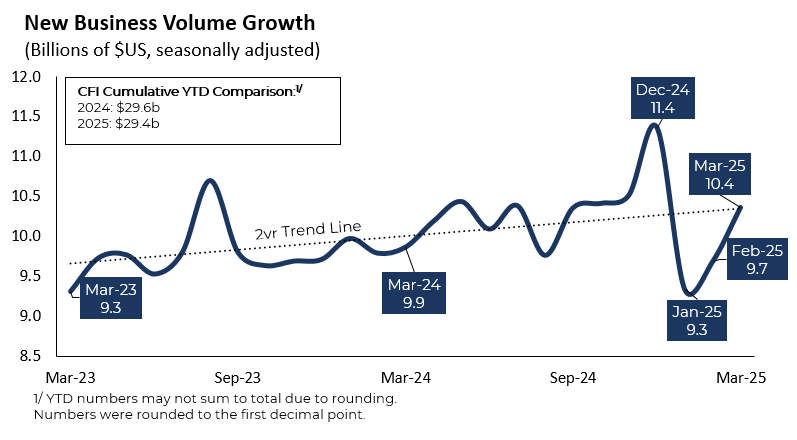

New business volume in the industry totaled $10.4 billion in March, up 7% from February and the third-largest month-over-month jump in the past two years, according to Equipment Leasing and Finance Association’s (ELFA) CapEx Finance Index, released April 23. That followed a 3.7% MoM increase in February, bringing new business volume to $29.4 billion in the first quarter, down 0.8% year over year.

Meanwhile, charge-offs rose 5 basis points (bps) MoM to 0.6%, their highest level since September 2020. Thirty-plus-days delinquencies jumped 25 bps to 2.3%, while credit approvals rose nearly 70 bps to 76%.

The industry’s performance last month sends “conflicting messages” as lenders capitalize on strong demand in some markets while grappling with tariff-fueled uncertainty, ELFA President and Chief Executive Leigh Lytle stated in the report.

“Economic uncertainty remains exceptionally elevated, and the rise in charge-offs may be an early indication that end-users are experiencing financial stress,” she said. “The strength in equipment demand should not be understated — the sector is on solid ground — but I’ll be watching the financial data closely for signs of further deterioration as we enter what is expected to be a volatile spring and summer.”

Small-ticket lending spikes

Driving origination growth, small-ticket loans increased 21.7% MoM in March after they rose 15.9% in February, according to the report.

Small-ticket financing — typically defined as deals valued at less than $250,000 — is a segment in which independents thrive, especially with banks pulling back in recent years, Paul Fogle, managing director at Carmel, Ind.-based Quality Equipment Finance, told Equipment Finance News.

Even banks have started “dipping their toe back in the water” in 2025, but economic uncertainty hints at a potential slowdown in small-ticket loans, he said.

“It’s sort of a mixed bag right now. Has there been a slowdown in applications? Some are saying yes, some are saying no. I think it’s taking longer to close deals. … I wouldn’t say there’s a really definable slowdown in the small-ticket arena, but I think there’s some caution,” Fogle said.

With the industry in flux, it’s important for lenders to be patient, John Gougeon, president of Ann Arbor, Mich.-based UniFi Equipment Finance, told EFN.

“Let the market have a chance to evolve, and it will always seek equilibrium,” he said. “The guys that are out of the gate first are the ones that stand the greatest risk and greatest chance of loss. … Let the market come to you unless you’re under pressure to grow, and then you don’t really have the option to be patient.”

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.