Equipment dealers, lenders lean into e-contracting technology

71% of equipment financiers are exploring AI for documentation

Equipment dealers and lenders are leaning into e-contracting to meet customers’ needs and take advantage of market opportunities like expanded bonus depreciation and AI improvements.

Technologies such as AI and optical character recognition (OCR) tools are helping to standardize diverse customer inputs — whether they originate from paper, email or digitally — into a single system, according to Jeffry Elliott, founder and CEO of Elevex Capital.

“The tow truck driver probably doesn’t want to do a digital app transaction,” Elliott said during a recent Equipment Finance News webinar. “We’re going to meet them where they’re at and then take it and convert it to digital in many ways. That’s the embedded finance approach.”

Watch the full EFN webinar here.

Managing varying levels of customer readiness for digital contracting and equipment finance digitalization is like managing a high-capacity highway, Tawnya Stone, vice president for strategic technology at GreatAmerica Financial Services, said during the webinar.

“Whatever on-ramp you want to use, we’re going to provide a super-fast one, but we’re also going to have slow lanes. Once you get on the highway, we’re going to treat it the same, and then we’re going to have similar off-ramps as well.” — Tawnya Stone, vice president for strategic technology at GreatAmerica Financial Services

Growing digitalization amid generational shift

While customer readiness remains mixed, e-contracting growth continues, with Wolters Kluwer’s equipment finance e-contracting index rising 9.9% year over year in the second quarter and financing activity up 17.7% quarter over quarter as the industry rebounded from tariff-related slowdowns. That signals continued commitment to long-term digital transformation strategies, Eric Capehart, associate director of market strategy for Wolters Kluwer’s digital lending solutions, told EFN.

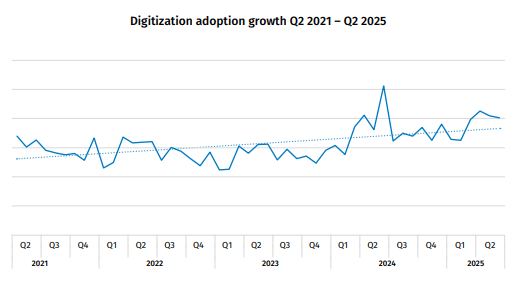

In addition, digital adoption has grown at an annual rate of 39.8% since Q2 2021, according to Wolters Kluwer, positioning institutions embracing e-contracting for sustained success.

Digital adoption in equipment finance is expected to rise while tolerance for manual processes will decline as a new generation of leaders demands mobile-friendly, fully digital solutions that match the convenience they experience in their personal lives, GreatAmerica’s Stone said.

“We need to be able to provide those solutions because our customers aren’t going to tolerate us not to. They’re going to go somewhere else.” — Tawnya Stone, vice president for strategic technology at GreatAmerica Financial Services

Balancing legal, regulatory, tech barriers

While Elevex Capital prefers digital documents, it handles paper when necessary and is adapting to processes like e-titling, which improves speed but requires flexibility to accommodate differing state regulations and customer needs, Elliott said.

“You’ve got to have a different path for all different customers with different laws, regulations and types of transactions, so it is difficult,” he said. “Somewhere in there, there are ways to implement the tools to speed it up and get it into your process, to make things more consistent.”

Adoption of digital documents in equipment finance remains uneven, largely due to legal resistance despite clear federal support from the E-SIGN Act and Uniform Electronic Transactions Act, Elliott said. While some segments including capital markets have progressed, segments such as municipal finance lag, often requiring paper-based processes.

The Electronic Signatures in Global and National Commerce Act (E-SIGN Act), effective Oct. 1, 2000, grants electronic signatures the same legal validity as handwritten ones for most commercial and consumer transactions in the United States, according to the FDIC.

The Uniform Electronic Transactions Act (UETA), proposed in 1999 by the Uniform Law Commission, provides a legal framework for use of electronic records and signatures in business and government transactions, giving them the same legal standing as paper counterparts, according to the Uniform Law Commission. UETA has been enacted in every state except New York, along with the District of Columbia, Puerto Rico and the U.S. Virgin Islands.

Equipment finance challenges with digital contracts

Although digital signatures offer superior security and traceability, many institutions, particularly smaller banks and legal professionals, are resistant to the change, creating barriers that affect broader industry adoption, Elevex’s Elliott said.

“You got some customers that just aren’t there from a technology standpoint, but I think it is more of a lessor or bank hesitancy by legal [departments] than it is customers,” he said.

“I think most customers would rather do a Docusign or an e-signature approach, and it’s the legal community and the banks that really need to come around and build it.” — Jeffry Elliott, founder and CEO of Elevex Capital

Finance companies prioritize risk management and won’t fully embrace digital solutions until they are confident they can still secure repayment. Even then, broader adoption depends on aligning business processes and ensuring comfort across all stakeholders, including dealers and end-users, Stone said.

“We definitely are focused on trying to get more and more agreements signed digitally, but we’re also … deferring a little bit to the comfort level of our customers,” she said. “It took a while for us to get comfortable, but now that we are, it’s full-steam ahead.”

While the automotive industry uses integrated digital tools widely to generate disclosures and contracts that seamlessly connect to e-signature platforms, much of the equipment finance sector, aside from high-volume small-ticket lenders, still relies on manual processes for contract generation and deal documentation, Gary Brackenridge, executive vice president at global software, data and analytics provider Linedata, told EFN.

“They’re pretty manual at a lot of these firms, so somebody’s actually reviewing the final contract before you send it over and that’s still happening in equipment finance,” he said. “It’s going to be firm by firm who gets there. It’s not going to be some big initiative in the industry, as each company is going to have to decide that they’re ready to try it or not.”

Q4 acceleration and e-signature importance

With the return of 100% bonus depreciation under the recently signed One Big Beautiful Bill Act, the equipment finance industry anticipates a strong Q4 driven by yearend purchases, making speed and efficiency critical, John Boy, finance and sales administration manager at Bridgeville, Pa.-based Anderson Equipment, said in the webinar.

E-signatures and digital contracting will be essential to meet demand, as faster turnaround and integrated workflows will make lenders more competitive, he said.

“Especially as we move closer toward the end of the year, that’s going to be crucial,” he said.

More than 50% of Anderson Equipment customers use e-sign, and AI is increasingly used to verify and streamline transactions, even for those still uncomfortable with digital adoption, Boy added.

“We’re getting there, and the finance companies are actually leading the charge to try to be more competitive against each other as far as the timeline goes,” he said. “We’ll see if that continues as a trend, if the finance companies keep leading the way.”

Docusign’s expanding role in contract management

With an increased emphasis on digital signatures and e-contracting, e-signature provider Docusign intends to capitalize, Hiral Shah, director of product management, told EFN.

The company, which says it has more than 1.7 million customers and 1 billion users worldwide, is expanding beyond digital signatures to streamline the entire agreement process. This process has historically been complex and cumbersome, Shah said.

“Since last year, Docusign’s made a significant expansion … leveraging AI in a very AI-first way. Our AI has OCR capabilities that will analyze all of these images and then extract a lot of that key metadata that will help.” — Hiral Shah, director of product management at Docusign

Docusign plans to introduce new features in the next six months

The company also sees relationships between agreements — such as master leases and subsequent addendums — as key digital contracting opportunities. It plans to enable users to link and manage related contracts signed at different times as part of a unified, evolving agreement structure, Shah said.

Within the next six months, the company expects to introduce features that will help users view a complete hierarchy of prevailing terms across multiple agreements negotiated over time, Shah said.

Balancing analog, digital

To enable quality contract management, businesses must avoid generalizing their customer base when implementing digital processes, recognizing that because comfort with digital adoption varies, businesses need must offer flexible options that balance organizational goals with diverse client needs, Wolters Kluwer’s Capehart said.

“Successful organizations should be looking at ways to seamlessly integrate digitization into their workflows, while also maintaining a focus on areas where human expertise will continue to drive the business,” he said.

Still, digital transformation isn’t an all-or-nothing shift. Financial institutions should find the right balance between analog and digital processes by enhancing human-centered workflows with technology and making tech-driven processes more human-centric, Capehart said.

“It’s finding the ebbs and flows that are going to create success for them, their vision for the future, their customer base, because digital adoption can create efficiency and it can enhance risk management, but at the same time, that personalized service will always be key,” he said.

“The path forward requires adaptability and investment in both and understanding what that’s going to look like for them as a unique company, so they can still create that unique value proposition for themselves,” Eric Capehart, associate director of market strategy for Wolters Kluwer

AI revolutionizing digital contracts, equipment finance

The U.S. equipment finance industry saw modest growth in 2024, with new business volume rising 3.1%, up from 1.1% growth in 2023, according to the Equipment Leasing & Finance Association’s 2025 Survey of Equipment Finance Activity, released Aug. 4. The approximately 100 equipment leasing and finance companies surveyed indicated that the industry faced tightening credit conditions, rising charge-offs and declining profitability, with independents outperforming banks and captives in new business growth.

Despite negative market conditions, equipment finance portfolios remained healthy in 2024 with 98.7% current accounts, though rising gross charge-offs and net losses signal early signs of credit deterioration amid tighter underwriting standards, according to ELFA’s release. As credit tightens, AI adoption is accelerating, with 45% of firms using it in sales and underwriting, 71% exploring its use in documentation and 65% exploring its use in credit evaluation.

Docusign’s Shah said the company is prioritizing the digitalization of contracts as a foundational step while investing heavily in AI to help equipment finance and leasing industries leap ahead in digital maturity.

“AI is revolutionizing every industry, including equipment finance and leasing, and we see that all the time,” she said. “When you think about the12- to-18-month horizon, we do expect a lot of these industries to be able to adopt … AI … and that’s where Docusign has the advantage and the differentiation is we’re built on the modern stack leveraging AI and LLM capabilities that are available.”

Equipment finance companies must balance AI efficiency with human interaction because personalized service and deep client understanding remain key differentiators that risk being lost in a fully automated, self-service model, Linedata’s Brackenridge said.

“Use some AI to do the basics, but when you want to actually get to a human, you want the human available,” he said.

Check out our exclusive industry data here.