Captives, independent lenders, dealers fill financing gaps

New business volume rose 3% MoM in May

Captive finance companies and independent lenders increased new business volume and grew market share last month, while equipment dealers also looked to help customers obtain financing.

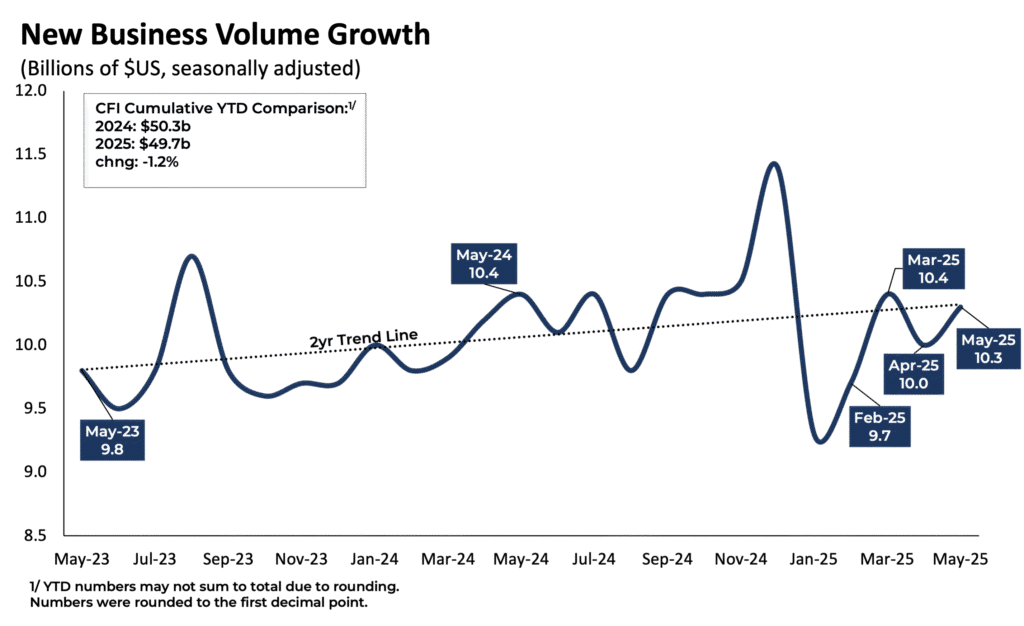

New business volume in the industry totaled $10.3 billion in May, up 3% from April and aligning with a two-year trend, according to the Equipment Leasing and Finance Association’s (ELFA) CapEx Finance Index (CFI), released June 25. The increase followed a 3.2% month-over-month decline in April, bringing new business volume to $49.7 billion through May, down 1.2% year over year.

The May survey showed strong early performance for the equipment finance industry in 2025, with rising demand, stable financial conditions and resilience despite potential challenges from tariffs and global conflicts, ELFA President and Chief Executive Leigh Lytle stated in the report.

“Demand for new equipment picked up in the latest data, particularly at captive businesses, and industrywide financial conditions remained healthy,” she said. “The slow bite of tariffs may still emerge this summer, and conflict abroad could affect energy prices and supply chains, but the string of solid CFI surveys is yet another clear indication that the equipment finance industry is going to be tough to slow down in 2025.”

Delinquencies rise despite volume growth

Overall credit approval rates dipped slightly to 77% in May, just below last month’s two-year high of 77.4%, while small-ticket approvals also edged down but remained near peak levels, according to the release. Industrywide delinquencies rose to 2.9% from 1.8%.

Small-ticket new business volumes rose 17.8% in May, reversing an 18.3% decline the previous month, according to the release. The swing in volume marks the fifth straight month of double-digit volatility.

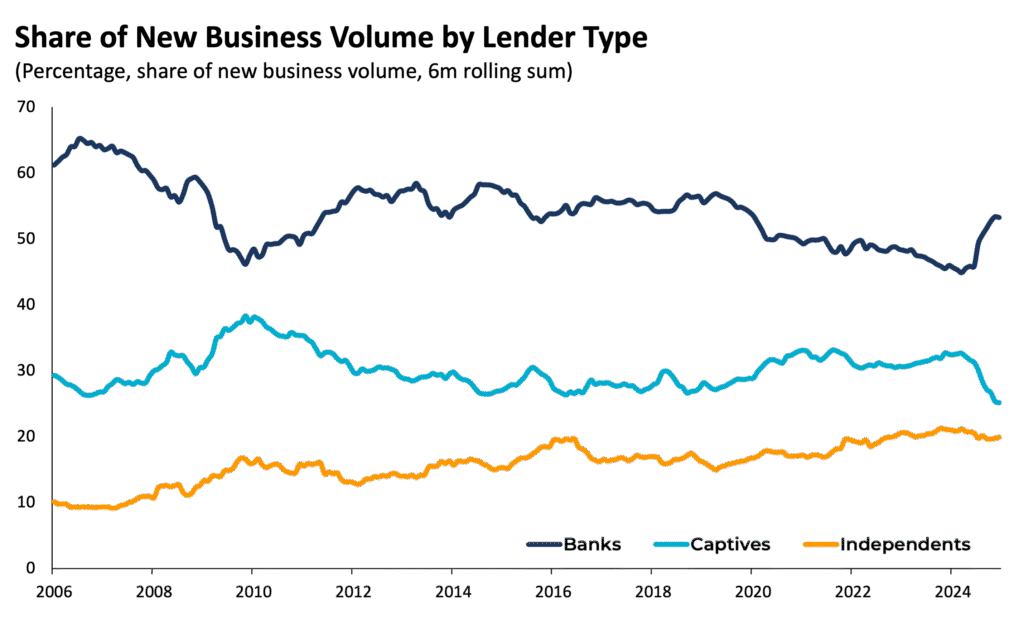

Meanwhile, May new business volume increased at captives and independents, up 14% and 5%, respectively; they fell 3% at banks, according to the release. Still, banks gained 7.3 percentage points in market share over the past year, giving them more than 50% market share, largely at the expense of captives.

OEMs, dealers fill financing gaps

OEM captive finance arms gained market share and increased financing volume as more OEMs used financing to stabilize operational growth and fill gaps in the financing market, Kirk Mann, executive vice president and general manager of transportation and vendor solutions at Mitsubishi HC Capital America, told Equipment Finance News.

“They are increasingly viewing financing as a strategic tool to navigate all these economic uncertainties and what started in 2020 with the supply chain disruptions,” he said. “Financing has become an essential part to help them maintain momentum in their modernization efforts without overextending capital.”

Dealers also continue to look for the best ways to help their customers with financing, especially in the farm sector, which is still trying to recover from a slow 2024 and start to 2025, Benet Snyder, used equipment manager at John Deere dealer Van Wall Equipment, which has 33 locations across the upper Midwest, said during a June 24 Tractor Zoom webinar.

“You’ve got to make sure you’re in line with market, and then at that point you can apply your incentives and get creative that way,” he said. “Every farmer is different in the way they want to buy, finance or the way they think about things.”

Register here for the free Equipment Finance News webinar “Technologies to Advance Your Equipment Financing Business” set for Thursday, July 17, at 11 a.m. ET.