AI agents transforming equipment finance

Data center capital spending to exceed $250B by 2030

The rising use of AI agents and proliferation of large data centers are reshaping the processes and lending environment for equipment financiers.

AI agents provide opportunities for lenders to address multiple operational issues, Jeffry Elliott, founder and chief executive of Elevex Capital, told Equipment Finance News on the most recent episode of “The Dig” podcast.

“We’ll have AI agents doing sales for us, doing lead generation, problem solving, analyzing documents, comparing a lease document against a base,” he said. “Those things cost a lot when you hire lawyers to do it, and AI can do it in a much faster and low-cost kind of way,” Elliott said, noting that the technology can “speed up the process using an embedded finance approach.”

One such AI tool, Wolters Kluwer’s Borrower Analytics AI, helps lenders manage Uniform Commercial Code filings by ensuring accurate names, jurisdictions and perfected transactions, Suzie Neff, consultant for collateral-based lending and an industry relations lead for Wolters Kluwer Lien Solutions, told EFN.

The tool enhances lenders’ certainty in bankruptcy proceedings by providing essential supporting data to verify their lien positions, while ensuring more consistent and accurate searches than when conducted by humans.

“Humans that do the same job over and over again are going to introduce variety into the process,” she said. “The AI won’t do that, and so you’re going to get a consistent, repeatable process.”

The development of AI agents, including the Equipment Leasing and Finance Association’s ELFie AI search tool, moves members of the equipment finance industry along in their AI journeys, Wintrust Specialty Finance President and Chief Executive David Normandin told EFN.

“There are clearly people in the industry, [Wintrust] included, that are fairly down the road with using some machine learning and AI,” he said. “There’s a lot of folks in the industry that aren’t, and I think this is a great step to help bridge that gap and bring people along.”

As more agentic AI tools develop, they will become a larger part of the value chain, Bill Verhelle, chief executive at Fairport, N.Y.-based equipment finance service provider QuickFi, told EFN.

“The really valuable thing of AI that’s coming next is going to be agentic AI technologies, and to use those throughout the whole customer value chain,” he said.

“From the time they start the application until they pay their 60th loan payment, and everything in between can be automated with agentic AI technology.”

Shifting AI-related capital

Mitsubishi HC Capital America expects a shift in capital to large-scale AI or cloud computing projects because it’s a major part of businesses, Brian Rosa, president of commercial finance, told EFN.

“These projects typically require a significant amount of time, capital and energy to complete, and will lead to an increased demand for capital investment in AI,” he said. “Supercomputing technologies particularly require significant capital investment infrastructure.”

Beyond investment in the infrastructure and construction space for equipment lenders, technology equipment and software development are opportunities for companies like his, Rosa said.

“This often requires state-of-the-art hardware, including advanced processors, GPUs and cloud infrastructure, and financing will be necessary to acquire and maintain this expensive type of equipment,” he said. “Companies will also need financing for significant research and development budgets in order to remain competitive, so financing will be required to fund the development of algorithms, machine learning models, data storage and processing capability. “

Data center development

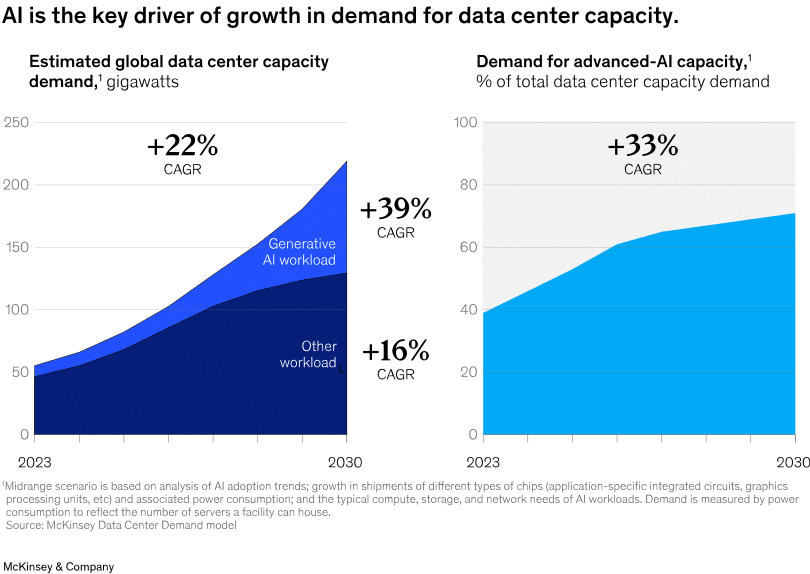

Capital spending on the development of data centers, needed to support the deployment of AI, will exceed $250 billion by 2030, according to estimates from business intelligence firm McKinsey. Demand for advanced AI capacity, as a percentage of total data center capacity demand, is also projected to increase 33% by 2030.

Already this year, Denver-based Vantage Data Centers, for one, secured a $3 billion loan, led by Wells Fargo Securities, to support the expansion of its North American data centers, according to Jan. 23 release.

The Dodge Momentum Index, which measures commercial construction activity, rose 0.7% month over month in February to 225.6, with commercial planning up 3.3% and institutional planning down 4.6%, according to data published on March 12 by the Dodge Construction Network.

These large data center projects and other large construction projects in the Dodge Momentum Index provide opportunities for equipment rental companies such as the Ashtead Group, parent company of Sunbelt Rentals, Ashtead Group CEO Brendan Horgan said during the company’s March 4 earnings call.

“Of the projects entering planning, 33 were valued at $100 million or more,” he said.

Six of the 33 projects were valued at $400 million and above, and 27 were below that, Horgan said, “which was a nice mix of lodging, hospitals, schools, warehouse and smaller data centers.”

As data center projects and other larger commercial construction projects continue to start, equipment dealers, equipment rental houses and equipment lenders will all play a role in the development process.

Internal, external technology investments

With the growth of data centers in the wider economy, equipment financiers such as Wells Fargo continue to invest in their own systems in addition to investing in data center development, Chief Financial Officer Mike Santomassimo said during the company’s fourth quarter earnings call on Jan. 15.

“We continue to invest in technology and digital platforms to transform how we serve both our consumer and commercial customers,” he said. “This includes continuing the transition of our applications to the cloud, migrating into new data centers and investing in data platforms to drive more insights.”

The commercial financing industry is already seeing a lot of investment in infrastructure financing, and there’s a lot of money being allocated to data center projects, Rosa said.

“These are high-dollar projects, and lower inflation and a bit of monetary easing will give green light to a lot of bigger projects that are being discussed over the past couple years, he said. “The data center build-outs right now to support AI growth, and we just would expect that to increase again, with the lower cost of capital.

In addition to its investments in data centers, Wells Fargo is the third-largest equipment financer by total assets at $39.9 billion, according to the 2024 Monitor 100. Meanwhile, Mitsubishi HC Capital America ranks 28th by total assets at $4.8 billion, according to the list.

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.