Equipment dealers face mounting tariff concerns

With uncertainty, next 60 days will be key to tariff outlook

Equipment dealers face rising costs and uncertainty, creating a greater need for strong dealer advocacy with lawmakers and mitigation efforts such as advanced purchases, pricing actions and OEM risk-sharing to limit financial impact.

The United States-Mexico-Canada Agreement is entering a critical renegotiation period, with indications suggesting its tariff exemptions may remain in place for now despite complex, country-specific trade rules, Daniel Fisher, senior vice president, government and external affairs at Associated Equipment Distributors (AED), said during an Aug. 8 webinar.

As a result of continued tariff negotiations, there are increasing instances of OEMs passing tariffs on to dealers, Fisher said.

“As far as OEMs passing on 100% or a portion of the tariff, anecdotally, we’ve certainly heard of tariff surcharges and whatnot out there,” he said. It “just varies based on the OEM, which country the products are coming from, but [we’re] certainly starting to hear more and more of that, that the tariffs are being passed along to the dealer.”

Businesses front-loaded purchases to avoid tariffs, and major automakers and equipment companies are already reporting significant tariff-related losses, strengthening calls from the business community for a more strategic approach to tariffs by the U.S. and Canadian governments, Huw Williams, president of Ottawa, Ontario-based government relations firm Impact Public Affairs, said during the AED webinar.

“We’ve had a period of time where tariff impacts were there, but business was actively shipping goods in preparation that the trading situation might be worse,” he said. “We’re now going into a period where, if we don’t get a deal in the next 60 days, that we may see a more protracted need to see what these tariffs look like.”

Current tariff environment

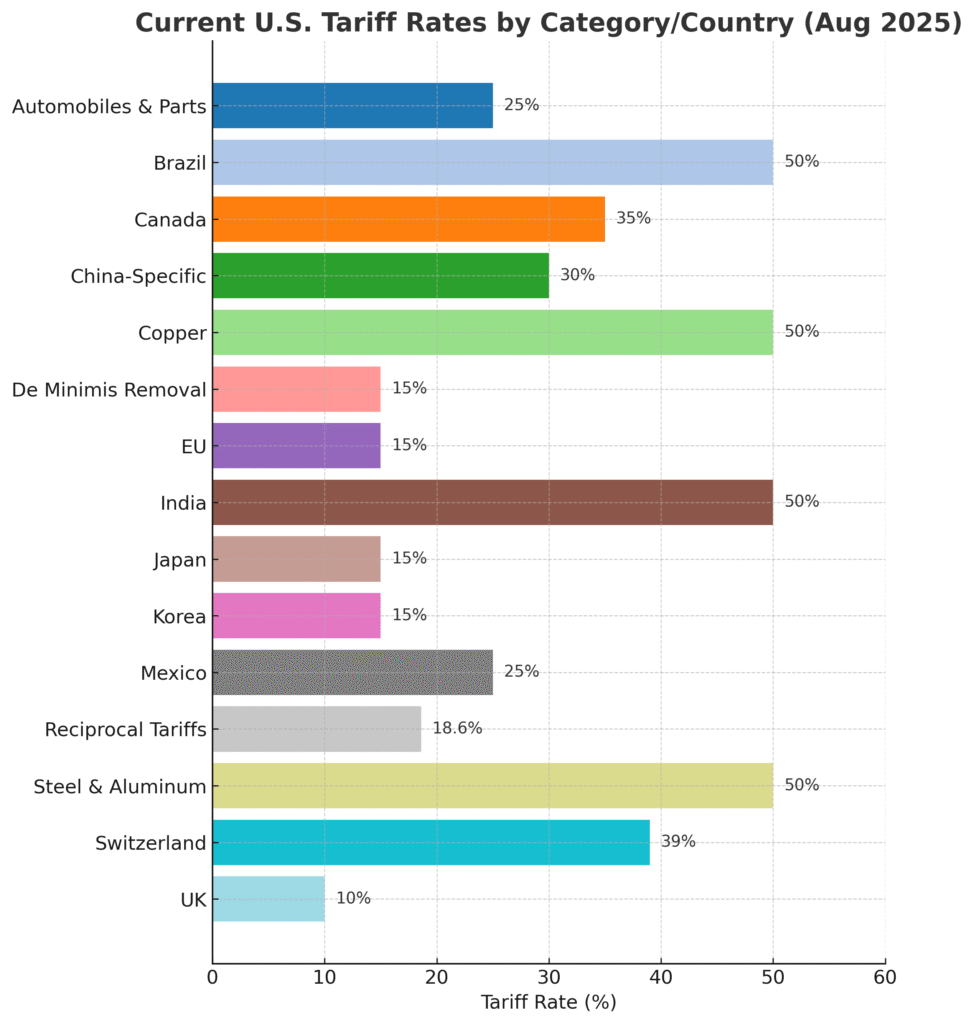

The United States implemented sweeping tariff hikes last week, including 15% on the EU, Japan and South Korea; 20% on Taiwan, Vietnam and Bangladesh; and up to 39% on Swiss goods, according to the White House. In addition, the White House’s announced 50% tariffs on Brazilian goods took effect on August 6, the White House announced a 50% tariff on Indian goods, effective August 27, and announced a 90-day extension of the China tariff truce today.

The recent trade deals with Japan, the EU, and South Korea to impose 15% tariffs on their goods while securing major U.S. investment and purchase commitments, Fisher said. However, these agreements are short, nonbinding documents without congressional approval or strong enforcement, leaving terms subject to change and creating uncertainty as discrepancies and evolving interpretations already emerge.

Equipment dealers need to engage lawmakers directly by hosting visits to their facilities and attending policy events to advocate on tariffs, AED President and Chief Executive Brian McGuire said during the webinar.

“This is not a year you want to sit home with the dealership,” he said. “It is very important to communicate with our lawmakers, not just on tariffs, but on all issues.”

Dealers facing varied impacts

Equipment dealers continue to face mixed effects from tariffs, with truck dealer Custom Truck One Source expecting minimal tariff impact this year due to advanced chassis purchases and supply chain management, with some costs appearing in late 2025, CEO Ryan McMonagle said. Gross margins improved in the second quarter compared with Q1, he said during the company’s July 31 Q2 earnings call.

“We continue to hear about uncertainty related to new equipment purchase decisions from some of our smaller customers,” he said. “We obviously continue to monitor changes to the [Trump] administration’s product and regional tariff policies and will adjust our responses accordingly.”

Meanwhile, Alta Equipment Group has taken steps to minimize tariff impact, Chief Financial Officer Tony Colucci said during the equipment dealer’s Aug. 7 Q2 earnings call.

“Ultimately, a more stable trade environment between the United States and the European Union will enhance predictability for our business and our customers,” he said. “In the meantime, we’ve taken mitigating measures in terms of pricing actions and OEM risk-sharing to best maneuver through this situation and are cautiously optimistic that the mitigation efforts will take hold through the second half of the year.”

OEM support

On the OEM side, CNH Industrial intends to help North American dealers navigate excess ag inventory amid the current tariff environment, after the company reduced it to $800 million from about $1 billion in the second quarter, with remaining surpluses mainly in small and medium tractors in North America, Chief Executive Gerrit Marx said during the company’s Aug. 1 earnings call.

“It’s important to bear in mind that these machines are imported, and so we have longer supply chains, and we took cautious actions, obviously, to keep a certain amount of stock in the region in light of uncertainties in global trade and tariffs,” he said. “While these levels on smaller machines in North America are elevated, I’m not too concerned about those in light of the current situation around tariffs and the restart of global supply chains.”

Check out our exclusive industry data here.