Durable goods orders fall again as transportation orders remain volatile

New orders for durable goods were down 2.8% in July

New orders for durable goods slid in July as transportation equipment orders fell for the third time in four months.

July’s seasonally adjusted new orders for durable goods landed at $302.8 billion, down 2.8% month over month, but up 3.2% year over year after a revised 9.4% drop in June compared to the initial estimate of a 9.3% decline, according to the Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders, released by the U.S. Census Bureau today.

Meanwhile, seasonally adjusted shipments for durable goods were $307.5 billion, up 1.4% MoM and 3.6% YoY in June, following a revised 0.7% increase compared to the initial estimate of a 0.5% increase for June, according to the report.

The decline in durable goods orders, while smaller than expected, was due in large part to weakness in orders for transportation equipment, which fell 9.7% MoM in July. Excluding transportation, orders rose 1.1%, the strongest monthly increase since September 2024, driven by tech, metals and machinery demand amid improved business optimism, according to a Wells Fargo research note.

“While one month doesn’t make a trend, especially given tariff uncertainty in recent months, this rebound in old-line manufacturing categories played a key role in today’s better-than-expected report,” the note stated.

Equipment finance originations during July forecasted a 0.1% increase in new durable goods orders, which the market failed to meet due to the transportation slowdown, according to the Equipment Leasing and Finance Association.

Equipment finance new business volume rose 1.7% MoM, but declined 6.8% YoY on a nonseasonally adjusted basis in July.

Core capital goods rise signals strength

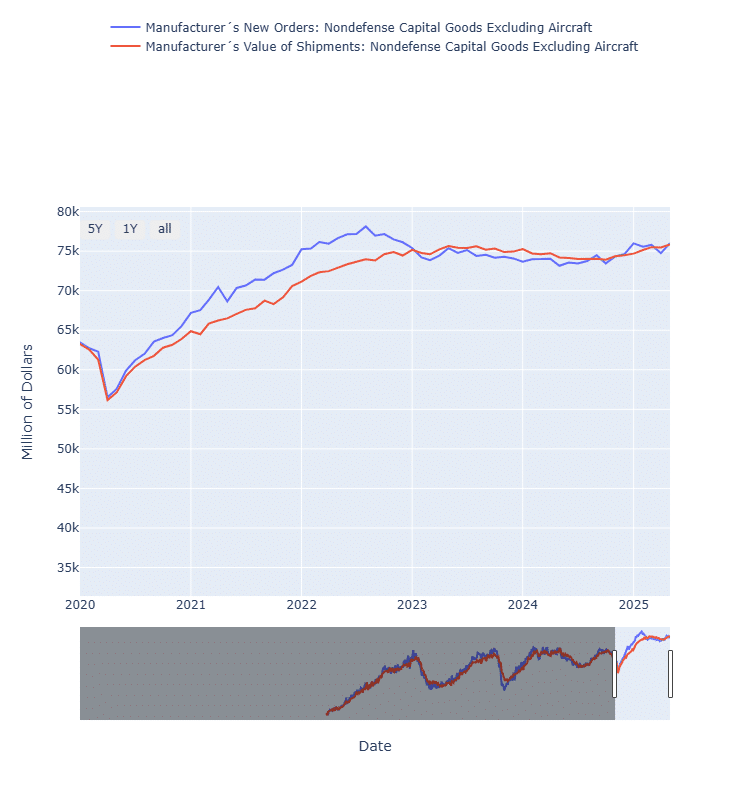

Despite the transportation slump affecting durable goods, the seasonally adjusted value of core capital goods orders, which excludes aircraft and defense equipment, totaled $76.4 billion, up 1.1% MoM and 4.1% YoY following a revised June decrease of 0.6% compared to the initial estimate of a 0.7% decrease. Seasonally adjusted shipments for core capital goods totaled $76.5 billion in July, up 0.7% MoM and 3.4% YoY from a 0.4% increase in June.

Core Capital Goods – Shipments & New Orders

Core capital goods orders rose, but a 1 percentage point decline in the Institute for Supply Management’s Manufacturing PMI survey and earnings caution suggests durable goods industries still face challenges, according to the Wells Fargo note.

“We doubt the revisions will provide any material lift to second-quarter investment spending when the GDP revisions come out on Thursday, but the stronger orders number does suggest a brighter outlook for the third quarter,” according to the note. “In terms of the outlook for business spending more broadly, today’s durable goods report offered the first unambiguously positive signal in recent memory after months of bad headlines.”

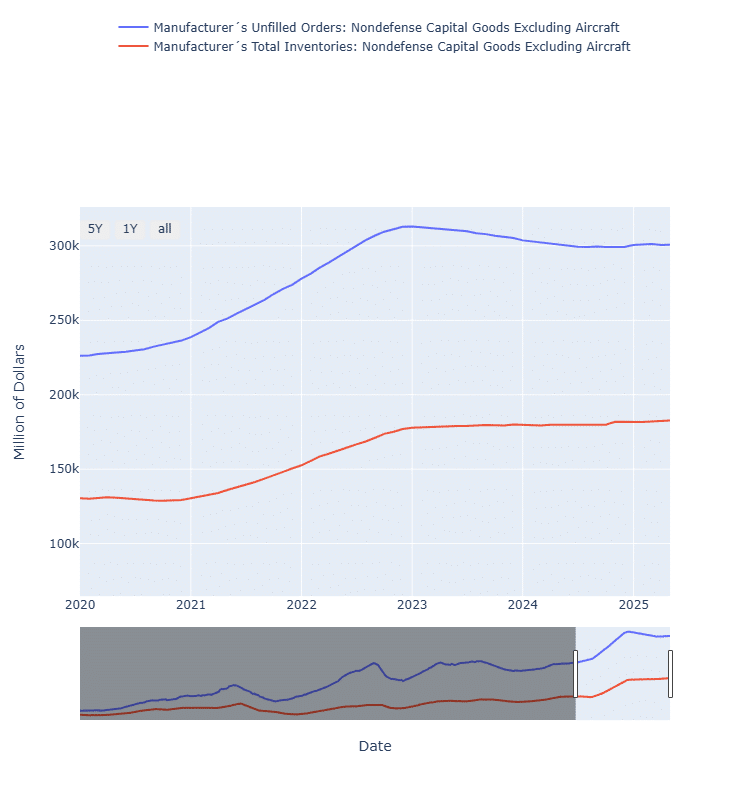

Unfilled orders, total inventories

Seasonally adjusted unfilled orders for core capital goods reached $300.4 billion in July, down 1 basis point MoM and 0.4% YoY from a 0.1% decrease in June. Seasonally adjusted total inventories for core capital goods hit $183.6 billion in July, up 0.2% MoM and 2.3% YoY after a 0.4% revision for June compared to the initial estimate of a 0.3% increase.

Core Capital Goods – Total Inventories & Unfilled Orders

Check out our exclusive industry data here.