Core capital goods orders slide by most in 6 months

Core capital goods unfilled orders down 20 bps MoM in April

New orders for new core capital goods slipped in April, as equipment investment slowed and businesses looked to avoid large capital outlays.

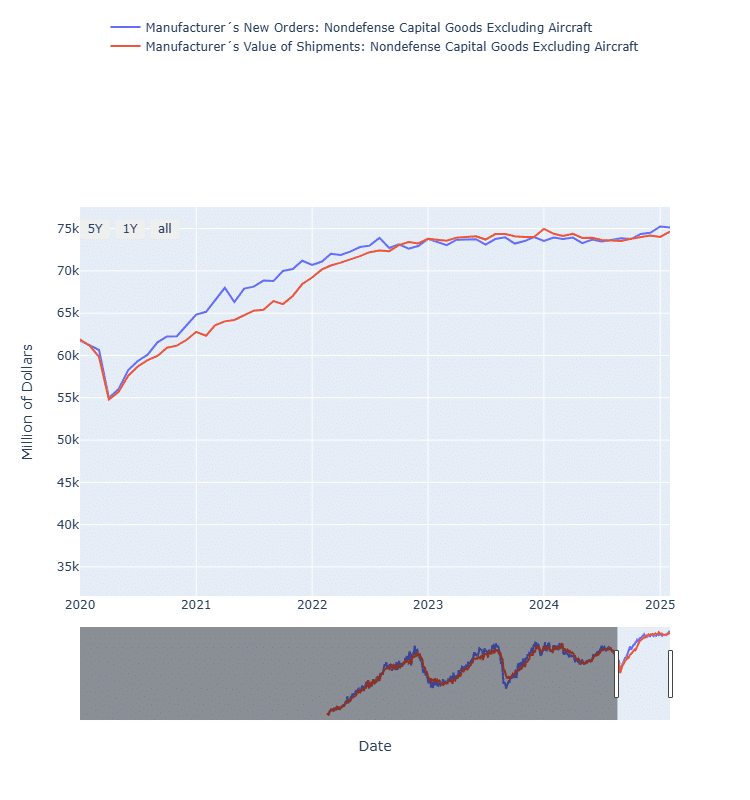

April’s seasonally adjusted value of core capital goods orders, excluding aircraft and defense equipment, was $74.8 billion, down 1.3% month over month following a revised March increase of 0.3%, according to the Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders, released by the U.S. Census Bureau today. Seasonally adjusted shipments for core capital goods totaled $75.4 billion in April, down 0.1% MoM from a revised 0.5% increase in March.

Seasonally adjusted new orders for durable goods landed at $296.3 billion in April, down 6.3% MoM after a revised 7.6% rise in March, as orders for aircraft and transportation equipment normalized. Meanwhile, seasonally adjusted shipments for durable goods were $300.6 billion, up 0.4% MoM following a revised 0.2% increase for March.

Information equipment remains strong

Despite declines in core capital goods and durable goods, investment continued for information processing equipment and technology while truck orders slipped, according to a Wells Fargo research note on the Census report.

“In a time when large capital outlays may feel irresponsible, businesses continue to funnel some dollars into information processing equipment, which can require less of an outlay than refitting machinery and can ultimately aid in [improving technologies],” according to the note.

“All told, core capital goods orders slipped by the most in six months, underscoring the weak underlying trend in demand today.”

Spending on IT and information processing equipment is strong because customers remain certain that the new technology is necessary for their operations, Chicago Federal Reserve Bank economist Martin Lavelle said recently at Equipment Finance Connect 2025 in Nashville, Tenn.

IT equipment is “really the consistent CapEx investment right now that contacts are willing to make, upgrade IT, bring on some AI for IT,” he said. They’re OK with spending on that because they know they’re going to need it at some point.”

Unfilled orders, total inventories

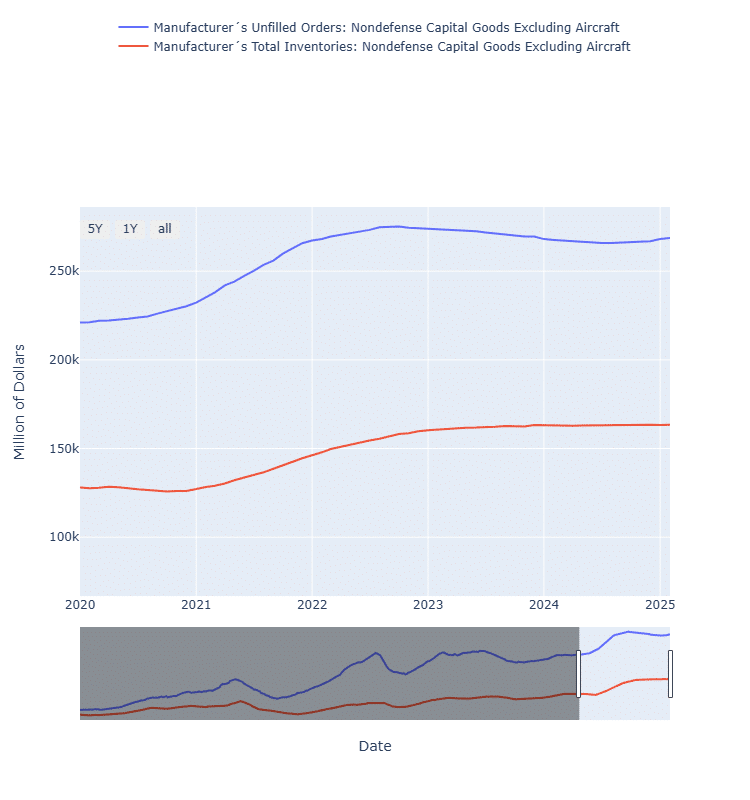

Seasonally adjusted unfilled orders for durable goods totaled $1.4 trillion in April, up 4.5 basis points (bps) MoM after a revised 1.6% rise in March, according to the report. Meanwhile, seasonally adjusted total inventories for durable goods finished at $586.7 billion in April, up 10 bps compared with a revised 20-bps increase in March.

Seasonally adjusted unfilled orders for core capital goods reached $300.5 billion in April, down 20 bps from a revised March increase by the Census Bureau. Seasonally adjusted total inventories for core capital goods hit $182 billion in April, down 1 bps after revision for March.

As tariffs have created uncertainty in the equipment industry, Lavelle continues to poll durable goods retailers in Detroit about how many of their product categories have different prices because of various tariff rates tied to when the items were imported in recent months, he said.

“There’s some inventory accumulation, but you’ve actually seen more industries talk about a pullback in orders over the last couple of months,” he said. “We’ll see what happens with that and even this inventory accumulation is not resulting in backlogs.”