In an effort to focus attention and resources on expanding its market share, Volvo Construction Equipment has formed a separate business unit to focus on the growing compact equipment market.

Volvo Construction Equipment, part of Sweden’s Volvo Group, announced the separation of the new business on June 20.

“The importance of compact equipment in our industry has grown from 10 years ago,” Thomas Bitter, Volvo CE’s head of technology, told Equipment Finance News. “It was 35% of our industry in machine volume, but today it is 50% on average, and if you go to specific markets in Europe, it’s even more than that.”

The move will allow the company to have a separate income statement and performance markers while maintaining the infrastructure benefits of being part of Volvo Construction and the Volvo Group, Bitter said. Part of that infrastructure will be access to Volvo Financial Services, Volvo’s captive finance arm.

“We will use other business areas in our group, and Volvo Financial Services is playing a huge role in that when it comes to the financial part, but as well with additional services and solutions that we want to offer to our customers,” he said. “That is a safe haven for a business unit that has to stand on its own feet.”

Electrification on horizon

The growth in the compact equipment segment and the rise of electrification and other technologies are key factors moving forward, said Bitter, who will become the head of Volvo’s compact business unit in September though he has begun performing duties related to the role.

“Electrification and new technology in an ever-growing segment are strong elements to lead the discussion inside our company,” Bitter said. Globally, Volvo saw an 83.7% first-quarter growth in electric vehicle orders, according to the company’s earnings statement.

“When we started to reflect on what we have done and how we want to accelerate, it became obvious that we have to focus on the entire end-to-end business of compact equipment,” Bitter said, while adding that vendor and customer relationships were an important part of the process. “We wanted to have really dedicated people that look after compact equipment customers from all aspects.”

North American opportunities

Volvo Construction Equipment orders skyrocketed in Q1, with the company seeing 107% growth in the North American market, according to its earnings release. Order growth, market size and regional electrification demands present an opportunity for the new unit, Bitter said.

“North America is a huge market … Electrification [is] important there as well,” he said. “The way we prepare the introduction of our electric machines in the U.S. market and the North American market tells us that they are really islands that are lacking this kind of technology and want it.”

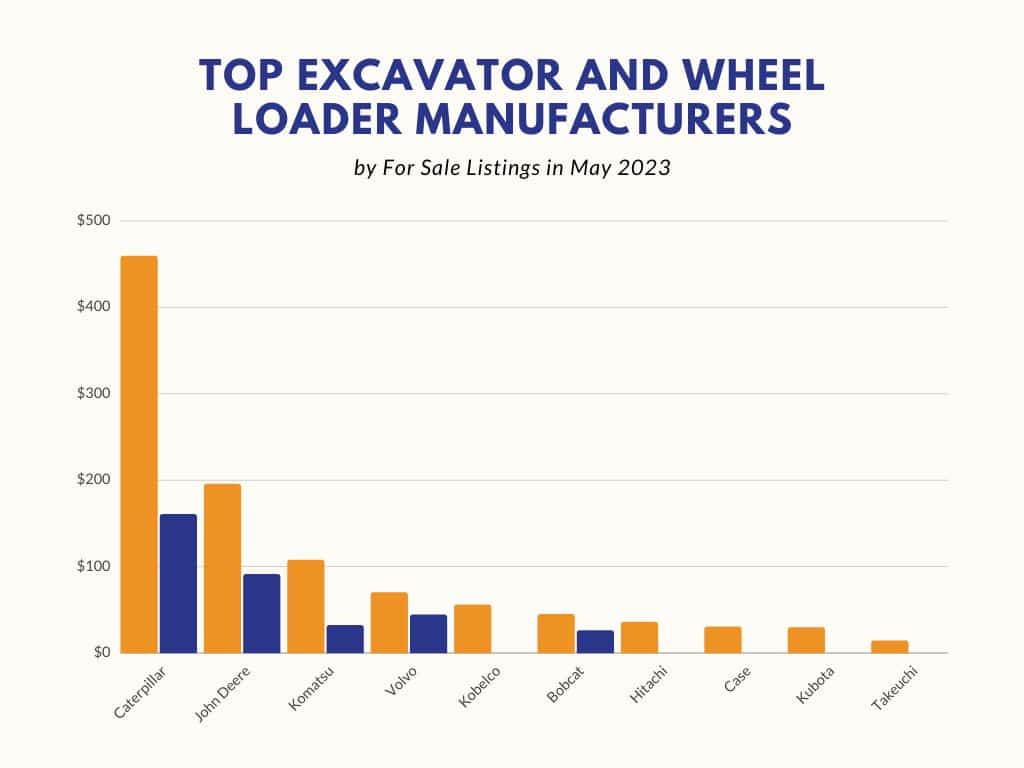

Volvo ranks in the top five in the overall excavator and overall wheel loader segments, based on for-sale listings, according to Sandhills Global.

Despite this, Volvo did not make the top six in inventory in the under 5 metric ton excavator segment, which is where its electric equipment operates, according to Sandhills’ data. As Volvo’s compact business unit looks to grow in the compact excavator and compact wheel loader segments, the communication and evaluations process will be key, Bitter said.

Communication with dealers

In discussions with dealers, Volvo concluded that changes were necessary to achieve the compact business unit’s goals, Bitter said.

“We are not the key player or a main player in compact equipment, but we want to grow,” he said.

Meanwhile, the new unit is working with dealers to develop strategies as use of electric equipment becomes more common, Bitter said.

“We will work with our dealers to define how we want to go to market, and that’s why the creation of the business unit happens now, because electrification will be a huge opportunity,” he said. “We look at the size of the applications of construction equipment and, for us, it’s mainly compact excavators and compact wheel loaders, then battery electric machines are the right answer.”