Japan’s Big 3 construction equipment makers face challenges

For Komatsu, Kubota, Hitachi, demand and inventory present hurdles

Japan’s three largest construction equipment manufacturers — Komatsu, Kubota and Hitachi — face challenges related to tariffs, demand and inventory.

The U.S. and Japan reached a trade deal on July 23, which reduced tariffs to 15% from 25% for Japanese goods entering the U.S. market, including autos and commercial vehicles. The deal boosted Japanese equipment stocks, with Komatsu, Kubota, and Hitachi each gaining at least 3% on July 23 and forecasting tariff savings of $150 million to $200 million.

Read more about the U.S.-Japan trade deal here

Despite the positive market reaction and broader gains in Japan’s stock indices, these OEMs still face structural challenges, including production strategies and global economic headwinds headed into the second half of 2025, Graeme McDonald, heavy equipment analyst at Citi, told Equipment Finance News.

“You see the reaction in the stock market in the last couple of days, and the stock market is very happy that it’s 15%, not 25%, as it gives a little bit more clarity on the willingness of companies to invest, which is good,” he said.

“For those three big companies — Komatsu, Hitachi, Kubota — their problem at the moment is demand, certainly on the residential side, is soft, and their dealers probably still have a little bit too much inventory, so the second half of the year is still going to be a bit of a struggle.” — Graeme McDonald, heavy equipment analyst at Citi

Part of the challenge for the big three Japanese OEMs is the interest rate environment, despite a weak dollar, McDonald said.

“The currencies are weak, which is a help, and the tariff situation is not as bad as perhaps the worst-case scenario, so tick that box,” he said. “What we have to do now is wait for maybe rates in the U.S. to start to come down, and maybe we can start to see a bit of light at the end of the tunnel on the residential side.”

Komatsu faces steely outlook

Despite Komatsu’s market position, the company will face challenges due to the tariffs imposed on Japanese imports and the steel industry, which likely removes the possibility of expanding U.S.-based production, McDonald said.

“The reason they’re not in a big rush to [expand U.S. production] is because the cost of steel in the U.S. is double the global average, so they are going to deal with the tariffs,” he said. ‘They’ll probably look to pass most of that on in higher prices, but one thing that is not going to happen, even at 25%, is that they’re not looking to do more manufacturing in the U.S.”

About 50% of Komatsu products sold in the United States are manufactured in the U.S., Kiyoshi Hishinuma, general manager of the business coordination department at Komatsu, said during the company’s April 28 earnings call. Komatsu imports the other 50% to the U.S. from Japan, Thailand and Brazil.

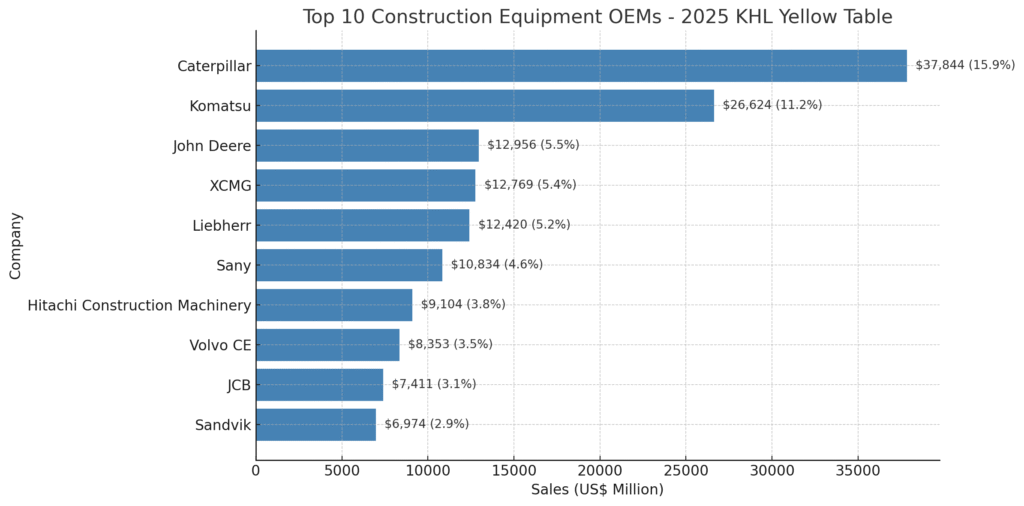

Komatsu is the largest Japanese construction OEM and the second-largest global construction OEM by market share at 11.2%, trailing only Caterpillar’s 15.9% market share, according to the 2025 Yellow Table published by international construction information firm KHL Group.

Kubota boosts U.S. production

Meanwhile, 70% of the products that agriculture and construction equipment manufacturer Kubota sells in the U.S. are imported from Japan, McDonald said. Under the new trade agreement, Kubota expects to increase manufacturing in the U.S., especially at its compact equipment facility in Kansas, he said.

“Kubota will do more in the U.S., especially more compact construction equipment, [compact track loaders] CTLs in particular,” he said.

Still, Kubota relies heavily on engines and transmissions from Japan, Thailand and China, McDonald said. While it may consider building a U.S. engine plant due to the scale of its presence, the required investment and high domestic steel costs pose significant hurdles.

Hitachi likely to expand in U.S.

Hitachi manufactures all the equipment sold in the U.S. in Japan. The company lowered its estimated tariff impact from $200 million to around $150 million following the announcement of the trade deal, McDonald said.

While no plans have been announced, it is increasingly likely that Hitachi will invest in U.S. production — potentially including excavator assembly — within the next two years, McDonald said.

“Maybe we won’t get an announcement for the next 12 to 24 months, but I don’t see how Hitachi continues to have [equipment] 100% exported from Japan.” — Graeme McDonald, heavy equipment analyst at Citi

Expanding U.S. production is a logical step for global expansion, as Hitachi gains global construction equipment market share. The company, in 2024, overtook Volvo Construction Equipment to become the seventh-largest OEM by market share in 2024 at 3.8%, according to the KHL Group’s Yellow Table.

Check out our exclusive industry data here.