Large Ag drops as used farm equipment faces financial pressure

High-horsepower tractor asking values fell 5.7% YoY

Dealers are rapidly discounting and liquidating large ag equipment as falling values, weak second-buyer demand, and tighter farm finances push more producers and lessees to offload assets.

Dealers are rushing to liquidate large tractors and combines at steep discounts amid falling values and a weak second-buyer market, leaving many producers to break even or lose money despite strong yields, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“With the auction side, we started hearing a lot about farmers running into issues making their operating notes for this year,” he said. “Yields are higher, prices are lower, about -even, but you’re also operating harvest two, three weeks longer, which has operating costs.”

With farmers and dealers facing pressure from lower crop prices and increased operating costs, the road to yearend will be interesting for both sides, Ryan said.

“This next 30 days, we’ll see a good chunk of ag that will hit the market for [those] reasons,” he said. “Guys need cash flow, dealers need to liquidate and they can’t carry it over, so it’ll be interesting for the next 30 to 45 days.

Uncertainty is contributing to declining equipment values and rising ag lease returns, as lower farm incomes and shifting producer demand are leading more customers to turn in equipment rather than purchase it at lease end, Mark Loken, vice president at CoBank Farm Credit Leasing, said during the 2025 Equipment Leasing and Finance Association convention last month.

“We’ve seen liquidations of dealer inventory at auction, and the dealers are very disciplined about how long those assets will stay in their inventory,” he said. “Once it hits that, whatever the magic number is for them, they get rid of the equipment.”

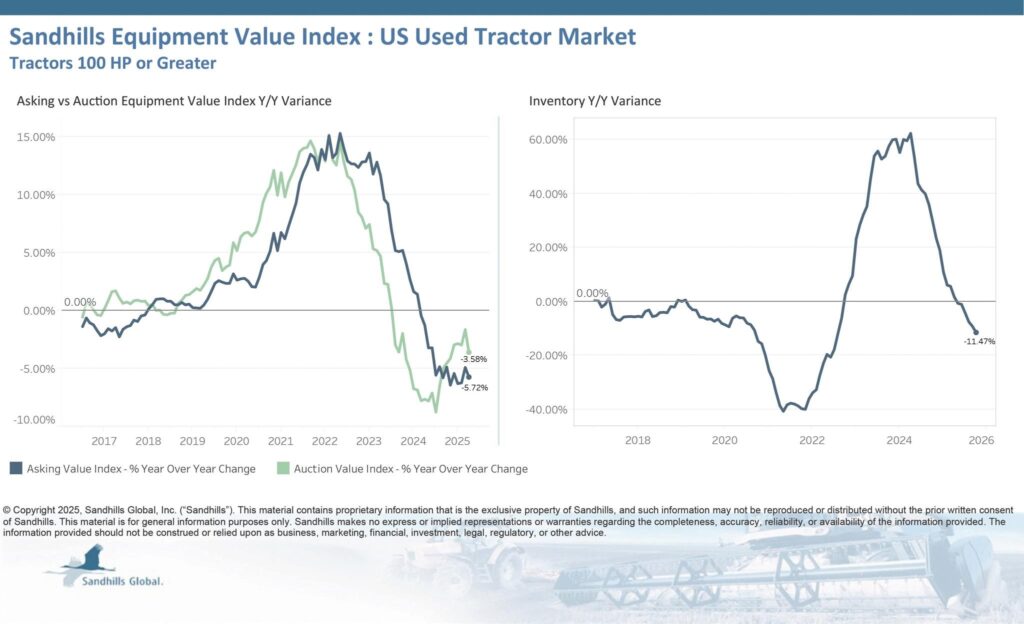

Used high-horsepower tractors (100 HP+)

- Inventory slipped 1.2% month over month and 11.5% year over year;

- Asking values dropped 1.5% MoM and 5.7% YoY; and

- Auction values declined 1.6% MoM and 3.6% YoY.

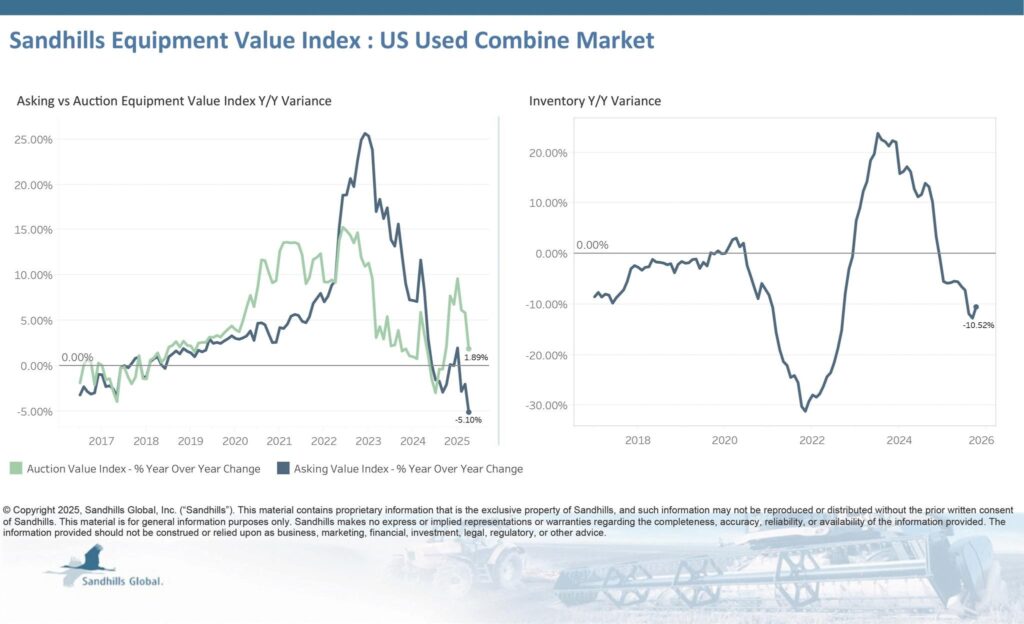

Used combines

- Inventory fell 4.8% MoM and 10.5% YoY;

- Asking values dropped 4.1% MoM and 5.1% YoY; and

- Auction values decreased 3.9% MoM but went up 1.9% YoY.

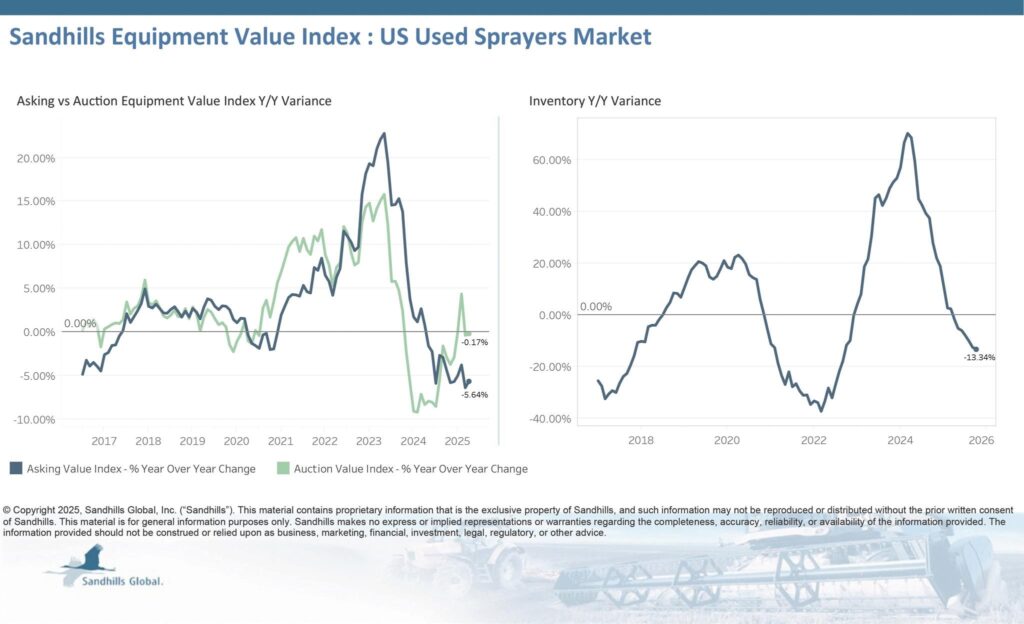

Used sprayers

- Inventory rose 1.4% MoM, but went down 13.3% YoY;

- Asking values increased 0.9% MoM but decreased 5.6% YoY; and

- Auction values inched up 0.7% MoM but slipped 0.2% YoY.

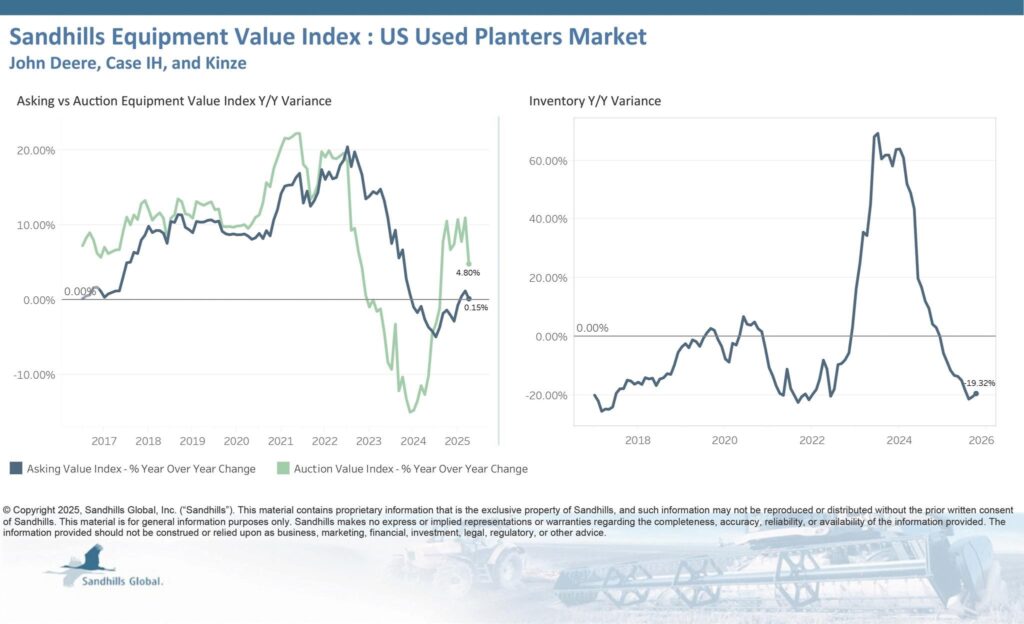

Used planters

- Inventory landed nearly flat, down 3 basis points MoM despite being up 19.3% YoY;

- Asking values dropped 2.3% MoM but rose 0.2% YoY; and

- Auction values declined 6.5% MoM but increased 4.8% YoY.

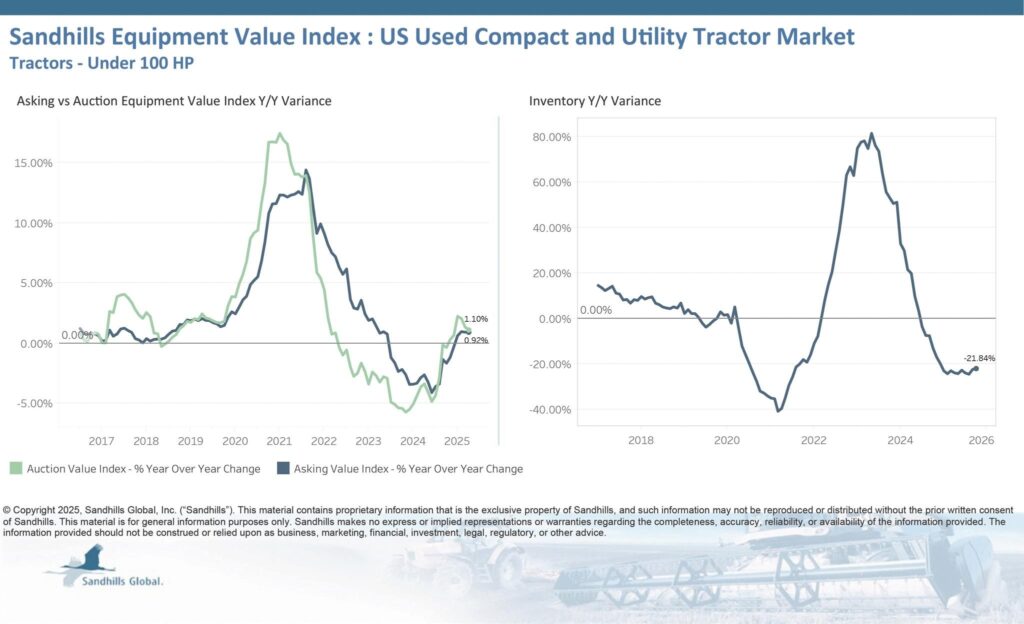

Used compact and utility tractors

- Inventory increased 1.6% MoM but decreased 21.8% YoY;

- Asking values dipped 0.1% MoM but inched up 0.9% YoY; and

- Auction values declined 0.4% MoM but rose 1.1% YoY.

Check out our exclusive industry data here.