Minneapolis-based equipment financier Honour Capital in April launched Honour Ag, a division that will focus exclusively on agriculture financing, and Honour Ags’s new Chief Executive Hollie Bunn expects demand for loans to continue despite the ag industry’s current downturn.

“We have assurances that these loans are going to continue,” Bunn told Equipment Finance News. The CEO came to Honour from Johnston, Iowa-based Growers Edge, where she served as chief operating officer and head of lending.

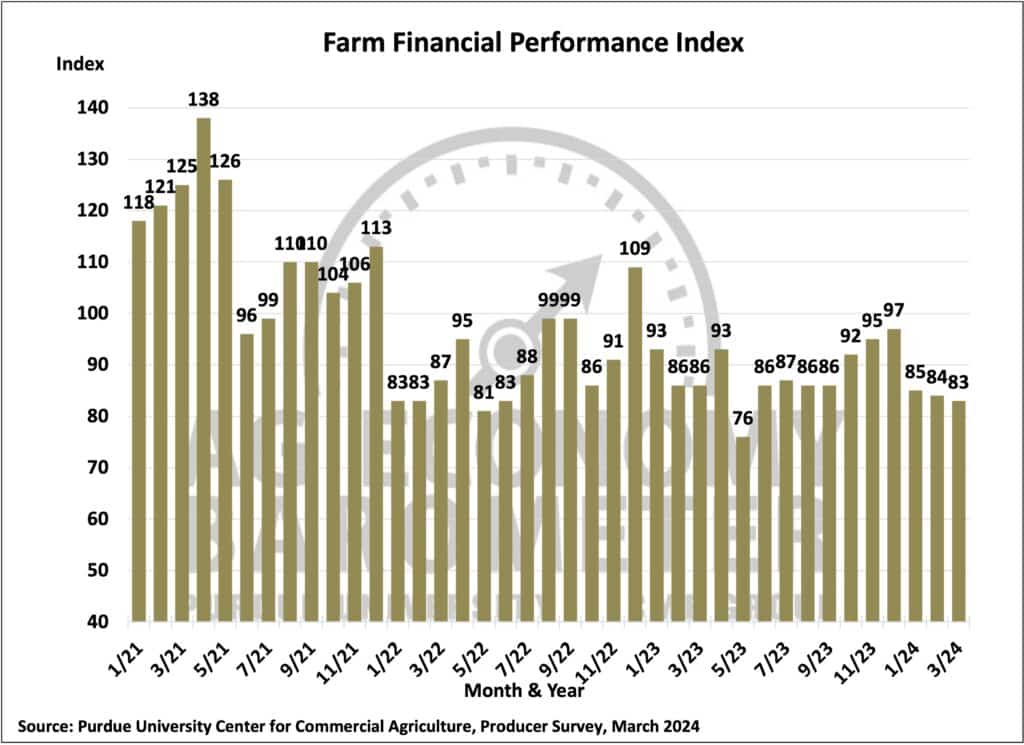

Bunn said all agricultural lenders should expect to endure a dip in loan activity as farmers struggle to make ends meet. The Farm Financial Performance Index, which tracks farmer sentiment on expenses versus earnings, has declined each month in the first quarter of 2024 and was 83 in March, down three points year over year.

Farmers aren’t keen to loosen their money clips, in part because of sinking commodity prices. Net farm income is projected to fall 25.5% year over year in 2025 to roughly $116 billion, the U.S. Department of Agriculture reported in February. With yields from crops falling and interest rates remaining high, farmers are feeling less incentive to enter financing agreements.

“The environment is kind of [on] the flip side in the past few years … farmers had a lot of cash coming in, they may have used this particular type of financing less than what they will going forward because cash will be tighter, and they’re going to want to have access to that liquidity,” Bunn said, referring to agriculture loans.

Following the “disruption” of the coronavirus pandemic, the industry may be regressing to the norm, Bunn added.

“What’s unique is that the high that we’ve recently had over the last several years is so much higher than where it had been, that the buildup of cash and the new purchases … happened at that point,” Bunn said. “There’s a lot of ‘wonkiness’ in the market, and it’s really unprecedented,” she added.

Honour Capital founder Brian Slipka told EFN that he has observed “a ton of illiquidity in the market right now” as farmers cling to cash. He acknowledged the pileup of used inventory on dealer lots, noting, “dealers are not moving stuff.” Slipka added that dealers are finding the costs to continue maintaining inventory are mounting as they struggle to offload their equipment.

“It’s harder for that farmer [or] grower to finance [ag equipment] as it is certainly more expensive than it was a year ago,” he added.

But Honour Ag leadership is convinced that now is as good a time as any to enter the market to offer farmers and growers new financing options. Bunn said the team will start with small-ticket lending.

“I think my concern—but it’s also an opportunity—is that growers are going to start feeling it this growing season, and they’re going to have to leverage equipment,” Slipka said. “I think you’re going to see a lot of higher rates for longer, and people are starting to get used to that.”

However, Bunn and Slipka both noted that there’s an opportunity for financing used machinery.

“I think you’re going to start seeing a bunch of used equipment” loans or leases,” Slipka said.