Farmers’ financial sentiment improves

Farm Capital Investment Index rose 11 points YoY

Farmers’ sentiment regarding the industry’s financial performance, income trends and capital funding improved on the heels of a better-than-expected harvest season.

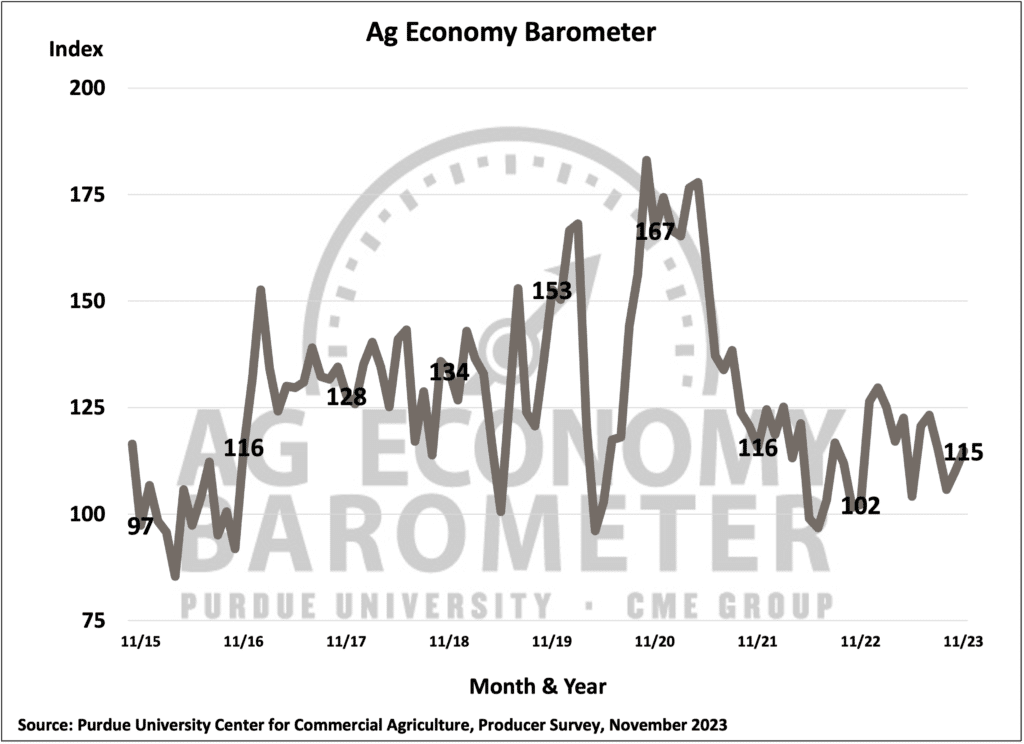

The Purdue University–CME Group’s Ag Economy Barometer, which measures current and future farm industry sentiment via a monthly survey of 400 farm producers, increased 12.7% year over year to 115 in November, according to the Purdue Center for Commercial Agriculture.

Farm finances improve

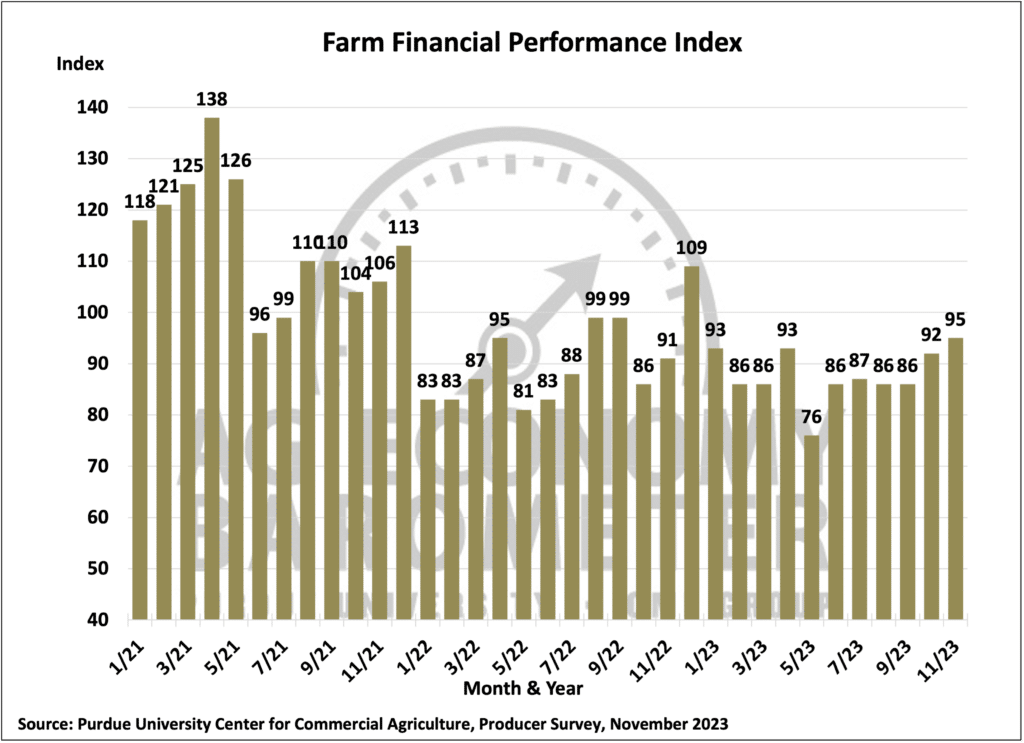

The Farm Financial Performance Index, which tracks farmer sentiment about farm finances compared with the previous year, also increased YoY — by three points to 95, according to the Purdue Center for Commercial Agriculture. The current index value of 95 is the highest point this year and part of an upward trend since May 2023’s three-year low.

Favorable sentiment in farm income is a good thing for equipment dealers, Bryan Knutson, president and chief operating officer of Titan Machinery, said during the company’s Nov. 30 earnings call.

“We remain in a position to deliver a strong fourth quarter based on positive fundamentals, such as healthy farmer cash receipts, which is supporting net farm income at levels well above historical averages, continued tax incentives surrounding Section 179, and bonus depreciation,” he said. Section 179 of the tax code allows businesses to deduct a certain cost of a piece of equipment when it first enters service, according to the. Internal Revenue Service.

The dealer group also maintains a “backlog of pre-sold units awaiting pre-delivery, inspection and final delivery to our customers,” Knutson said.

Capital conditions favorable

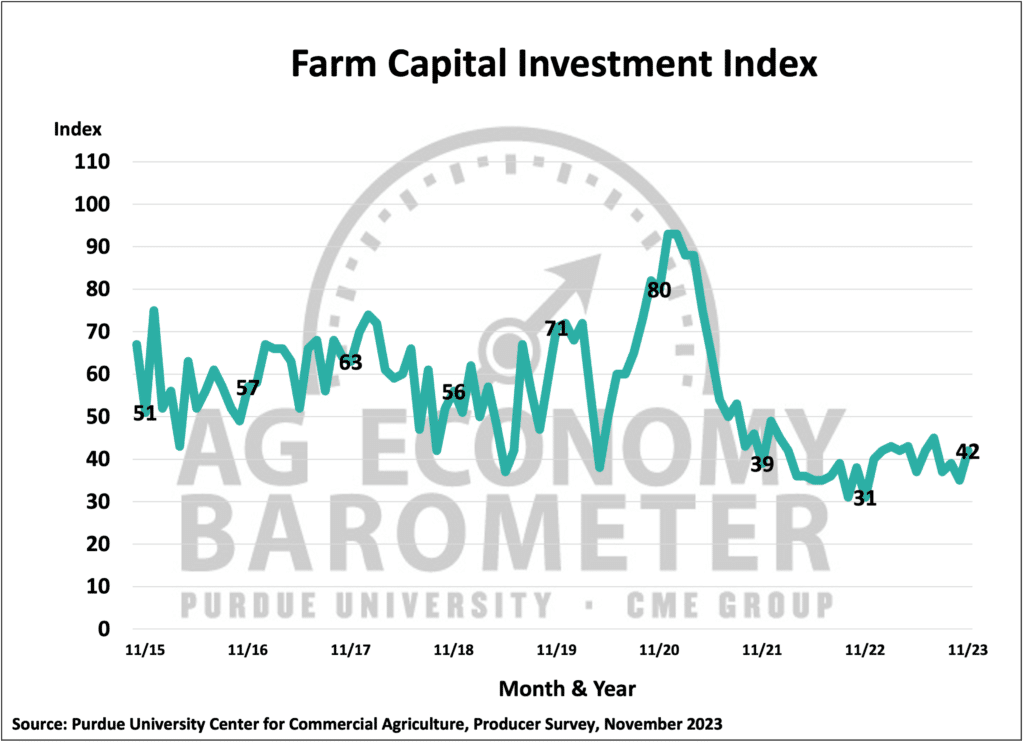

The Farm Capital Investment Index, which measures farmers’ willingness to make capital investments, increased by 11 points YoY in November to 42, up 7 points from this year’s low in October.

Large capital investments were a concern for producers throughout 2023, Fred Seamon, executive director in agricultural markets at financial services and market research firm CME Group, told Equipment Finance News.

“During 2023, virtually all of the barometers asked the question: Why or why not is it not a good time to make large investments in their farm?” he said. Higher prices and inflation remained “major concerns” for producers and impacted investment sentiment throughout the year.

Still, a post-harvest slowdown will allow dealers to catch up with farmers’ needs in the fourth quarter, Titan Machinery’s Knutson said.

“Now that our customers are mostly done with harvest activities, we expect to catch up on delivering some of the incremental buildup of pre-sold units throughout the fourth quarter,” Knutson said. “Bolstering our service network and capacity remains a key priority for our organization, and we will continue to focus on recruiting, hiring and training skilled technicians.”

Technicians and a strong service network for farmers are key components for dealers, Wayne Fischer, director of parts service and technology at Montana-based equipment vendor Torgerson’s, told EFN.

“The company that can take care of the customer the quickest and the cleanest, they’re going to be the dealerships that sell the equipment,” he said.

Eyeing a positive future

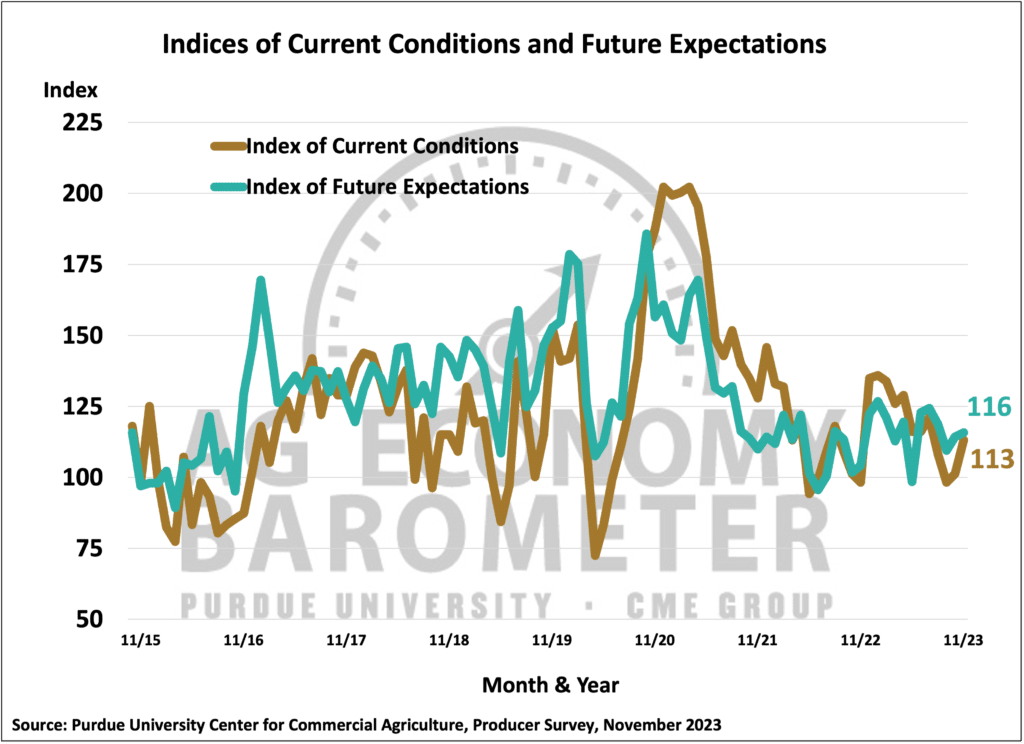

The Purdue Ag Economy Barometer’s Current Conditions Index in November rose by 15% YoY and the Future Expectations Index increased by 11% YoY, landing at a value of 113 and 116, respectively.

The improvement in current conditions was affected by the result of the recent harvest season, CME Group’s Seamon said.

Corn and soybean yield across the corn belt were better-than-expected, and corn prices have rallied, according to a William Baird research note. The optimism follows previous concerns about ag yields after a previous report from the U.S. Department of Agriculture back in August.

“The fact that we’re after harvest would suggest that the harvest period went well for farmers,” Seamon said. “Their expectations for the future were up as well. Based on the barometer results, they have a more positive outlook going forward.”