Farmer outlook darkens as debt mounts

Index of Future Expectations dropped 16 points in August

Farmer sentiment continues to weaken amid growing debt loads and rising input costs, spelling trouble for the agriculture equipment market.

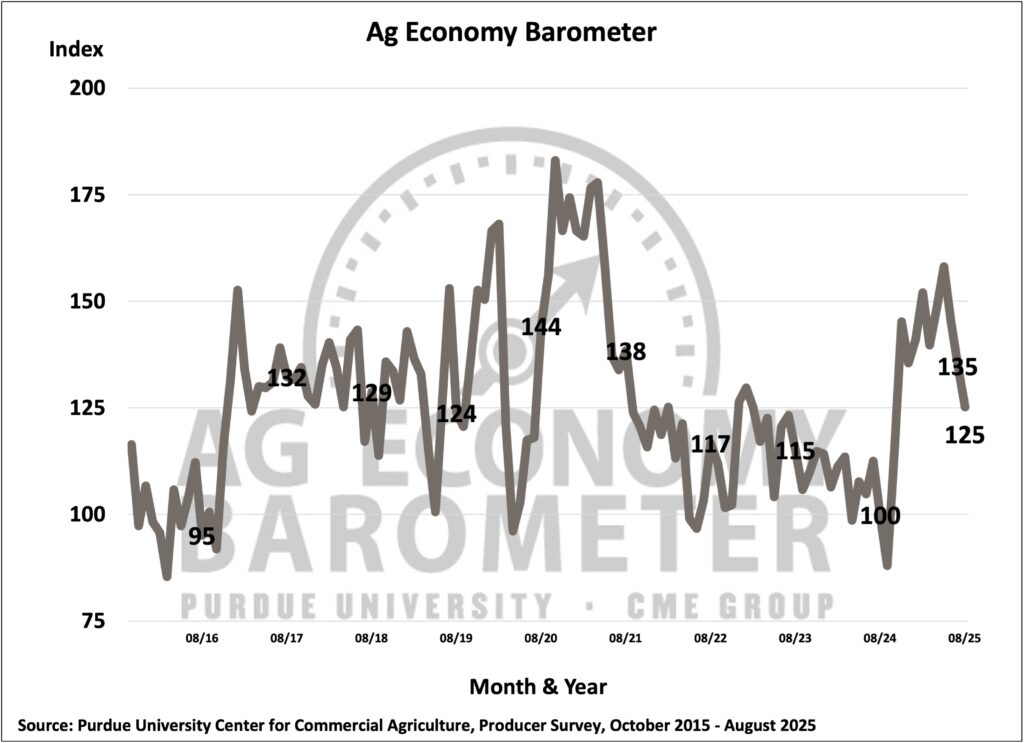

Purdue University’s Ag Economy Barometer, released Sept. 2, fell 10 points in August to 125, marking three straight months of decreases. About 400 farmers were surveyed from Aug. 11 to Aug. 15 for the index.

The Index of Current Conditions dipped two points to 127, and the Index of Future Expectations declined 16 points to 123, the lowest it’s been since September 2024. The steep drop in future expectations was a surprise given that many farmers have been expecting substantial subsidies under President Donald Trump to partially offset challenges tied to low commodity prices and tariffs, Michael Langemeier, associate director at the Center for Commercial Agriculture at Purdue, told Equipment Finance News.

“What that’s signaling to me is they’re getting a little more frustrated with the long-run outlook, and that may or may not include policy uncertainty,” he said.

Corn and soybean growers are “very concerned” about exports and “need more supplemental payments,” Langemeier said.

The American Relief Act of 2025, signed into law Dec. 21, 2024, allotted $31 billion in economic and disaster relief for farmers while extending the $418 billion 2018 Farm Bill through Sept. 30.

The distribution process for the money is unclear, making it difficult for dealers to make full-year projections, Bryan Knutson, president and chief executive of Titan Machinery, said during the company’s Aug. 28 earnings call.

“Exactly where net income comes in for the year remains heavily dependent on government support programs as the additional $20 billion to $30 billion in potential aid remains uncertain and will be important in determining the near-term trajectory of whole good equipment demand,” he said.

Debt mounting

Despite the strain, farmers have been holding mostly steady with debt payments, but that is starting to change. Farm debt is projected to hit a record $561.8 billion this year, following an estimated $542.5 billion in 2024, according to the U.S. Department of Agriculture.

Small farms are especially vulnerable as they have minimal land equity to withstand economic setbacks, with more crop producers reporting weak balance sheets and increasing their operating loans due to unpaid debt, Langemeier said.

“And that’s really concerning,” he said. “If you combine those two questions there, you get a proxy for financial stress.”

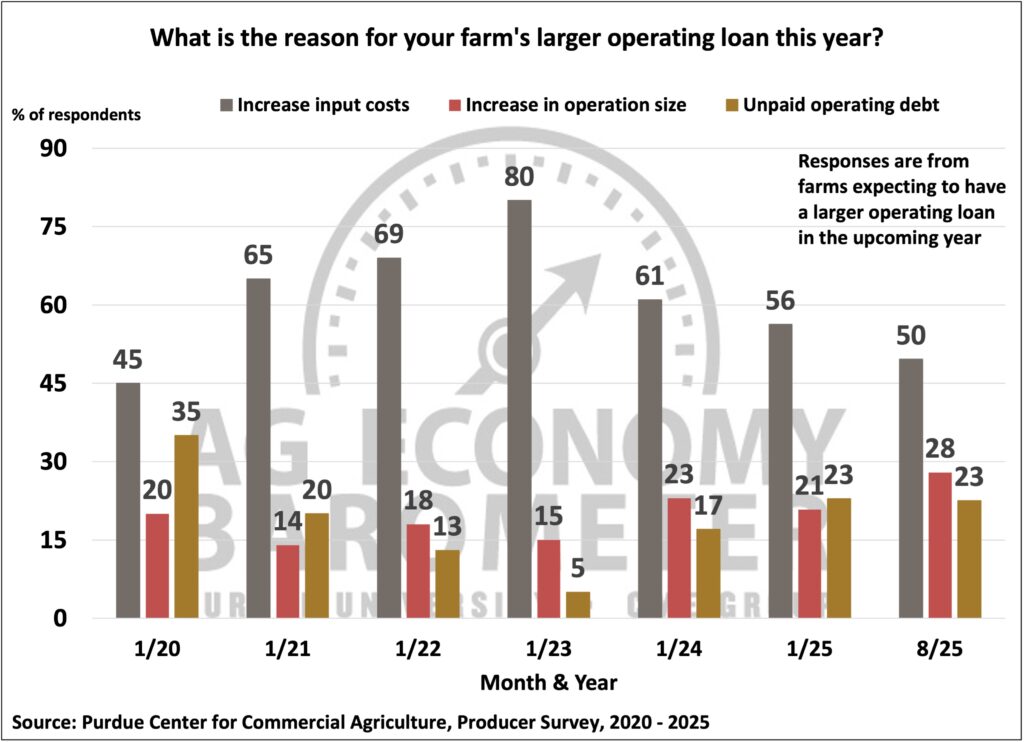

Rising input costs, including equipment, are also squeezing crop producers. Reflecting this, 50% of respondents to the Purdue survey cited higher input costs as the main reason for taking out larger operating loans this year.

Disparity growing between livestock, crop sectors

Livestock farmers are generally performing better financially than crop producers, with beef cattle operations experiencing record profits, according to the Purdue report.

Livestock prices rose 15.5% year over year in June, while crop prices fell 3.5% YoY, according to Wells Fargo’s Aug. 25 report on the state of agriculture.

Unfortunately for dealers, livestock producers don’t need to buy as much equipment or as often as crop producers, Langemeier said.

“When you take a look at some of the other farm types — swine, dairy, poultry — they tend to spend money on buildings and not so much farm equipment,” he said. “Even though the livestock [sector] is riding pretty high, it’s positive for the dealer, but it’s not near as positive as it would be if the crop was riding high.”

Check out our exclusive industry data here.