Farm equipment market ticks up in November amid year-end sales

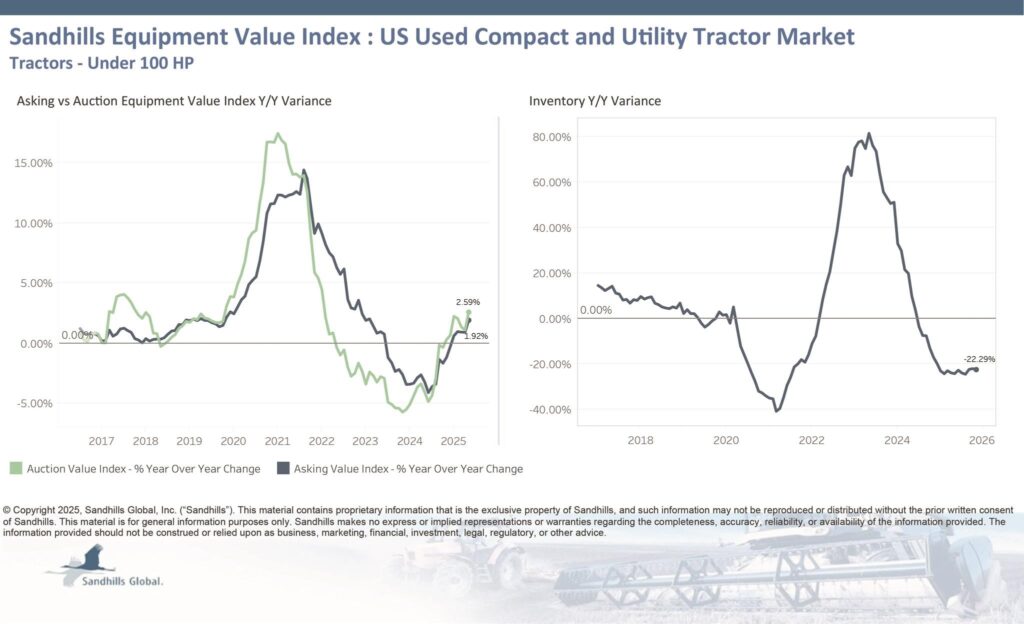

Compact, utility tractor inventory fell 22.3% YoY

Used farm equipment values improved slightly in November following months of declines, as typical year-end seasonality returned despite some sustained pressure on large equipment.

Transaction volume for farm equipment increased at yearend as farmers took advantage of the return of 100% bonus depreciation and the need to reduce taxable income, leading to improved retail and auction values, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

“You look at some of those bumps in auction values and it’s typically what we see yearend on this end,” he said. “It still doesn’t correct the amount that they’re losing. A lot of these dealerships are losing on those pieces, but for the auction numbers, it’s a boost.

Despite aggressive yearend liquidations, many dealers still face carrying excess inventory, forcing some larger dealerships to absorb significant losses after an already difficult year, Ryan said.

“It’s rally the troops to find the best way to go into next year. The farm bill will help overall … it’s a shot in the arm at the end of the day, and that’s what everyone was expecting.” — Jim Ryan, equipment lease and finance manager, Sandhills Global

Ag market mixed in 2025

The biggest concern in North American agriculture is large row-crop farming, including corn, soybeans, canola and wheat, where the scale of those operations directly affects demand for large equipment, Michael Sharov, partner in consulting firm Oliver Wyman’s Transportation and Advanced Industrials practice, told EFN.

“There’s no surprise here because that’s where the large equipment is used, and the large equipment is down across all OEMs that we’re talking about in agriculture,” he said.

Meanwhile, dairy and beef prices were a bright spot, with stable cash flow driven by export demand and herd growth supporting demand for forage equipment, Sharov said.

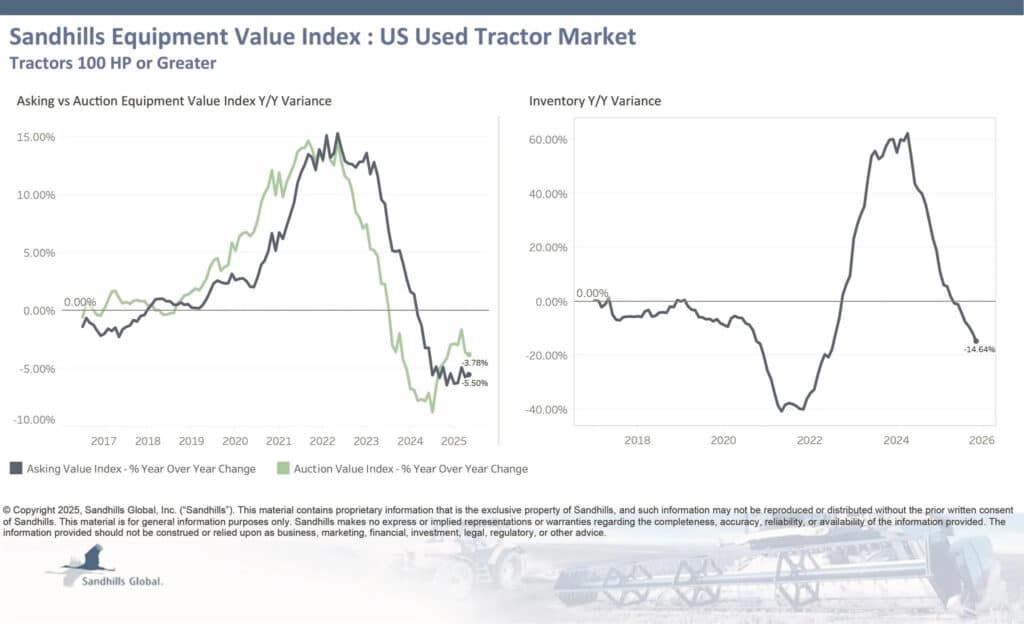

Used high-horsepower tractors (100 HP+)

- Inventory fell 3.4% month over month and 14.6% year over year;

- Asking values declined 1.3% MoM and 5.5% YoY; and

- Auction values inched up 0.1% MoM but remained down 3.8% YoY.

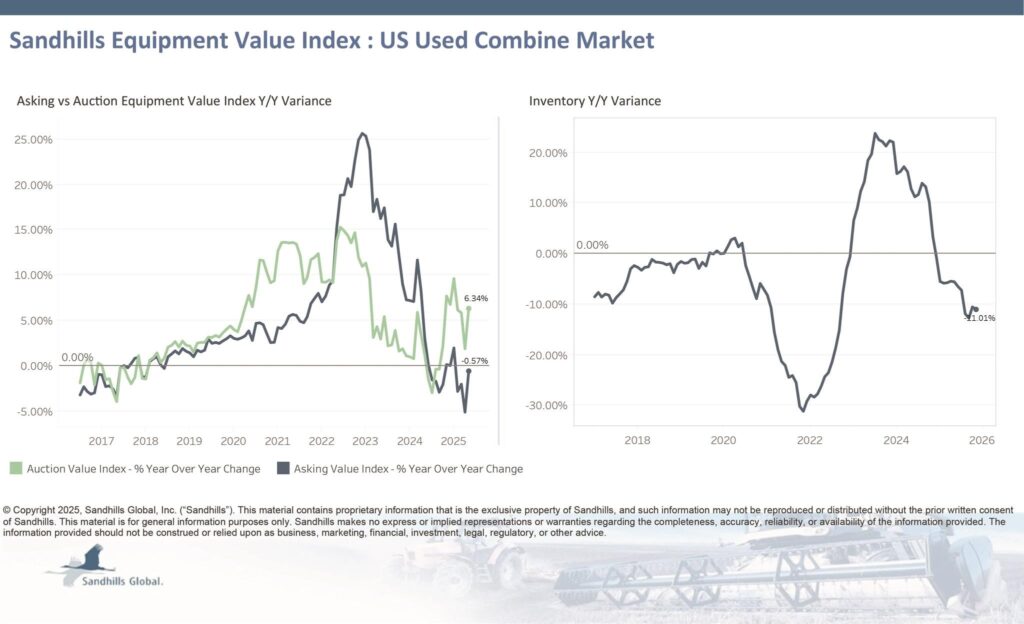

Used combines

- Inventory increased 0.7% MoM despite falling 11% YoY;

- Asking values rose 2.6% MoM but declined 0.6% YoY; and

- Auction values grew 5% MoM and 6.3% YoY.

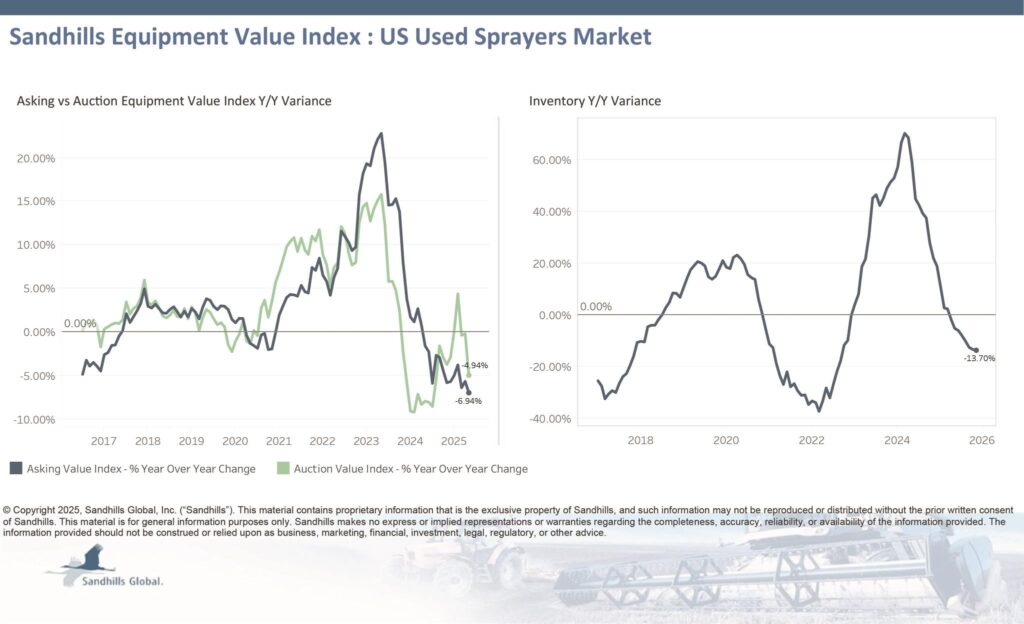

Used sprayers

- Inventory inched up 0.4% MoM, but went down 13.7% YoY;

- Asking values decreased 2.3% MoM and 6.9% YoY; and

- Auction values fell 2.6% MoM and 4.9% YoY.

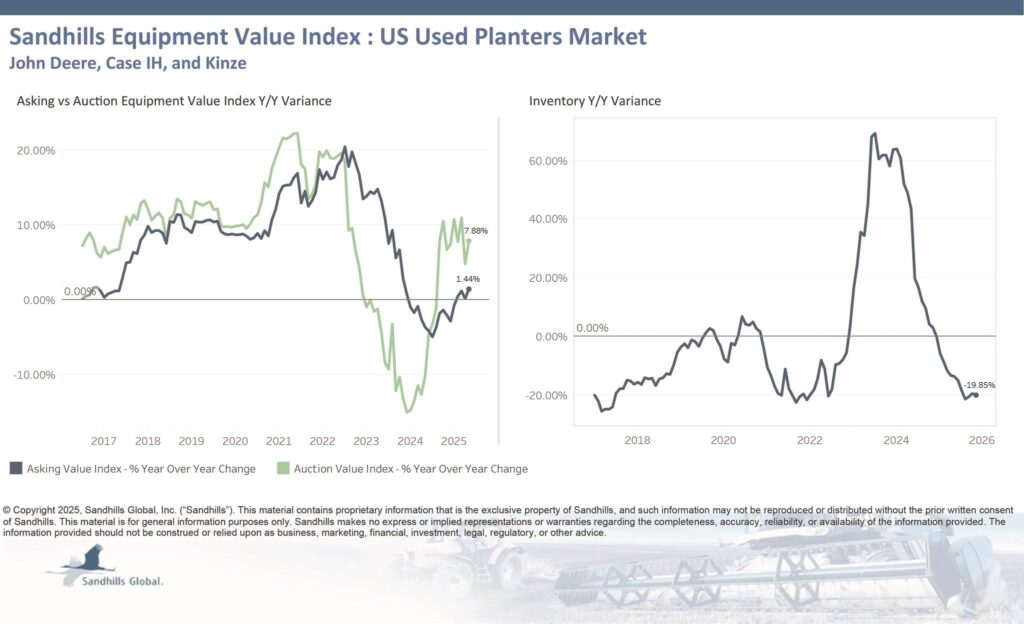

Used planters

- Inventory declined 2.3% MoM and 19.9% YoY;

- Asking values rose 0.6% MoM and 1.4% YoY; and

- Auction values increased 3.7% MoM and 7.9% YoY.

Used compact and utility tractors

- Inventory dropped 2.5% MoM and 22.3% YoY;

- Asking values went up 0.5% MoM and 1.9% YoY; and

- Auction values rose 0.6% MoM and 2.6% YoY.

Check out our exclusive industry data here.