Farm bankruptcies rise, putting pressure on ag lenders

ELFA Convention 2025

Lenders in the agriculture equipment and agribusiness sectors are facing increased pressure amid the downturn in farm performance.

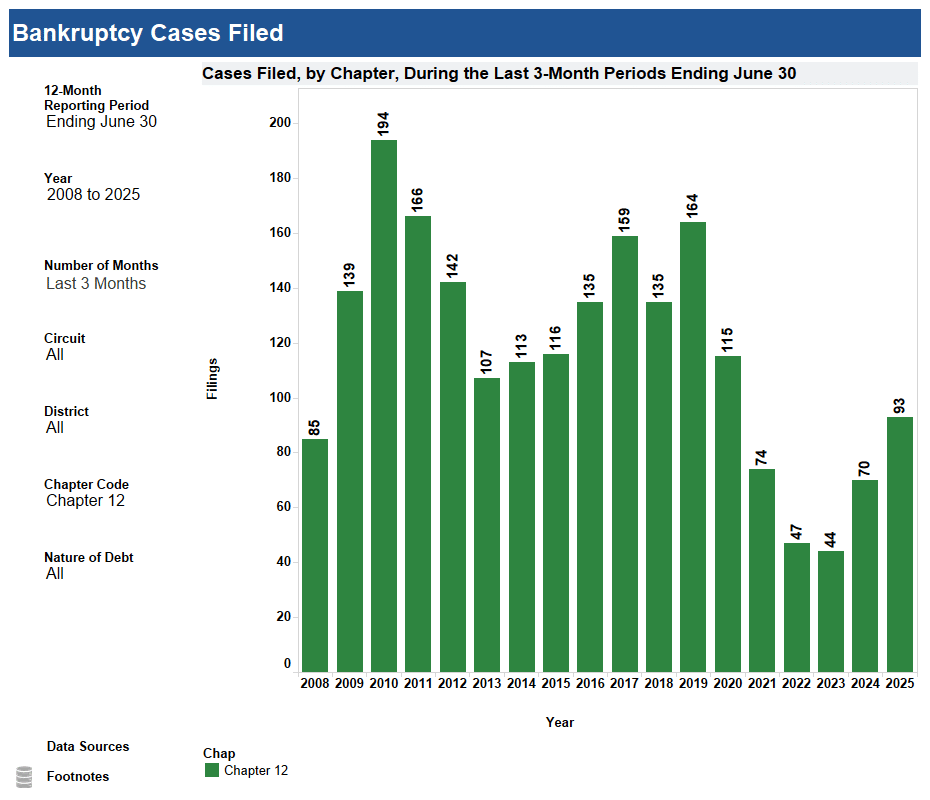

There were 93 Chapter 12 bankruptcy filings, which specifically cover family farms and fishermen, in the second quarter, up 32.9% year over year and the most since Q2 2020, according to the United States bankruptcy courts website. Q3 data is delayed due to the federal government shutdown.

Bankruptcies remain on the rise due to several negative market conditions, Brittany Ogden said during this week’s Equipment Leasing and Finance Association’s annual convention in Marco Island, Fla. Ogden is a partner and the national co-chair of bankruptcy, restructuring and creditor’s rights practice group, in the Madison, Wis., office of business law firm Quarles & Brady,

“That really isn’t a huge surprise for those that are paying attention to the commodities market, to the weather, to what is trending with tariffs in the administrative action,” she said.

Meanwhile, an increase in Chapter 7 bankruptcies, or liquidations, adds to burdens on the agricultural sector, Ogden said.

“They are still below the pre-pandemic level, but because of the interest rates, borrowing costs, geopolitical issues, tariffs, there’s been some concern [that Chapter 7 bankruptcies are] leading and causing [the downturn], too,” she said.

Lenders navigating ag risks

Managing agricultural and equipment finance risk is difficult for lenders because many factors — including weather, exports and market volatility — are beyond the control of producers and lenders, Mark Loken, vice president at CoBank Farm Credit Leasing, said during the convention.

“If you think you can manage all the risks, there’s stuff that you can identify, so you have to be committed to staying in agriculture,” he said. “There’s going to be cycles, there have been, and unfortunately, what’s good for some is not good for others.”

For example, row crop corn producers are struggling this year, while livestock and dairy operations are performing well as they rebound from downturns, Loken said.

“You can be in a certain part of ag that is very negative, but there are other parts of ag that are doing well, and so trying to manage [the] portfolio in that environment is really challenging.” — Mark Loken, vice president at CoBank Farm Credit Leasing.

Despite the rise in Chapter 12 and Chapter 7 bankruptcies, the shift in consumer demand toward beef and pork ahead of winter, as well as to specialty crops including fruits and nuts, represents market opportunities, Brent Boydston, founder and chief executive of Ag Center Solutions, said during the convention.

“If you’re looking for a place to potentially invest capital, look at your fabricators, your wholesalers and your processors for those products,” he said. “Maybe in a couple of years, you can take a look back at the corn soy markets, but right now, I would look at where the consumer dollar is being spent and look at that supply chain back through June.”

Check out our exclusive industry data here.