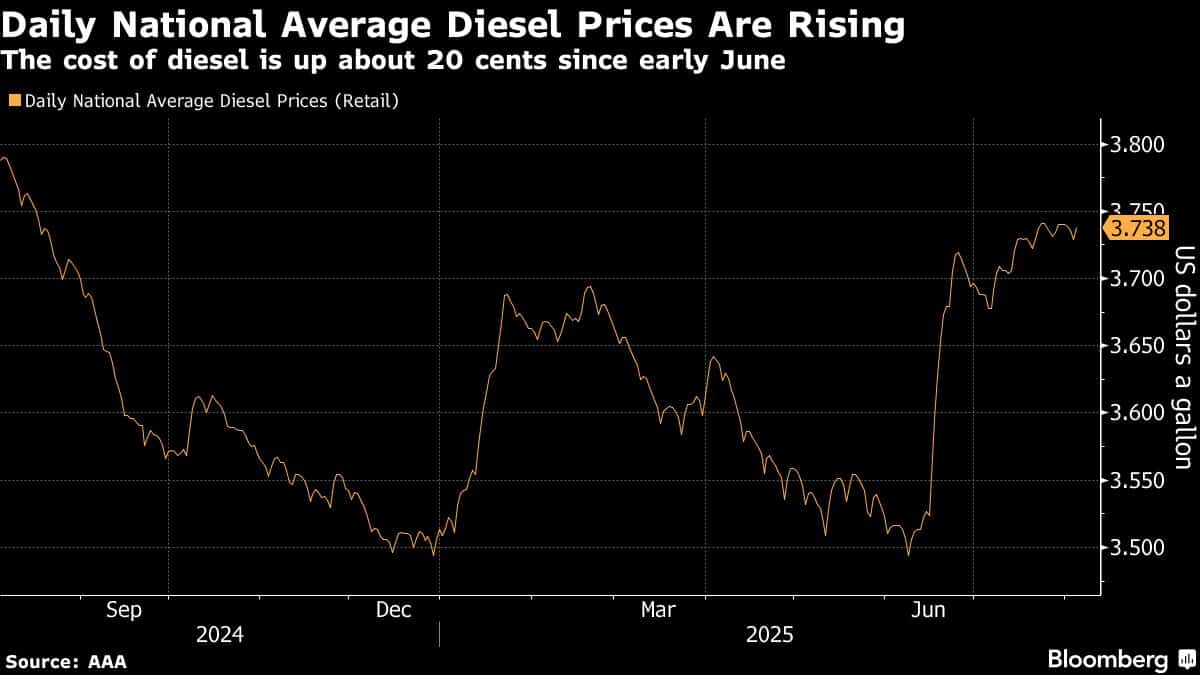

Diesel pump prices are surging in potential boost to inflation

Average price of diesel rose to $3.738 per gallon this week

US diesel prices at the pump have surged to the highest in almost a year as retail markets catch up with tightness in global supplies of the widely used fuel, threatening to boost inflation.

The national average price of a gallon of diesel has risen 7% since early June to $3.738 on Monday, near the highest since August 2024, American Automobile Association data show. The rally was sparked by a flareup in the conflict between Israel and Iran and has been sustained by outages at refineries in Europe and a dearth of distillate-rich crudes.

Diesel is a ubiquitous industrial and transportation fuel that’s vital to the economy because of its role in construction, trucking and agriculture, among other sectors. Some of those industries are already facing headwinds: US factory activity in July contracted at the fastest pace in nine months, while construction spending fell in June.

The rising cost of diesel threatens not only additional pain for a wide swath of industries, but also price pressures for consumers.

“As the industry is having to cover these increased prices, they pass those costs onto their customers, who then pass them on in the form of the final cost of goods to the consumer,” said Kendra Hems, president of the Trucking Association of New York.

US diesel stockpiles are lower than the five-year average for this time of year, even after building up for three straight weeks, according to Energy Information Administration data.

Diesel product margins increased in July as global stockpiles fell 10% to 15% year-over-year and financial demand for the product surged, according to Goldman Sachs Group Inc. Reduced diesel and crude feedstock for refineries outside of China and refinery intakes skewed toward lighter crudes more suitable for gasoline also drove diesel’s rally, Goldman Sachs analysts including Yulia Zhestkova Grigsby said in a note.

While industries should be able to cope if the current tightness eases, a hurricane, flood or power outage could disrupt that calculus, said Elaine Levin, president at Powerhouse, a company that designs and implements hedging strategies.

“We don’t have much room for error,” Levin said. “There’s so much of the system without a rainy day fund.”

White House policy could also affect the outlook for diesel. US President Donald Trump said last week that he would give Russia 10 days to reach a truce with Ukraine and reiterated his threat of additional levies on Moscow. Diesel prices skyrocketed during previous rounds of Russia sanctions and soared above $5 a gallon after the invasion of Ukraine in 2022.

Trump has also vowed to impose an additional penalty on India for buying Russian crude, a warning that came after Nayara Energy Ltd. reduced run rates at its refinery in west India following European Union sanctions.

“With a major Russian-owned refinery in India seeing challenges now sourcing Russian crude, it’s hard to know what the market response in terms of shifting supply might look like,” said Patrick De Haan, head of petroleum analysis at GasBuddy.