Used Class 8 truck prices rise 16% YoY

Same-store dealer sales surged 22% YoY in June

Used Class 8 truck prices and same-store dealer sales rose in June as the market continued to see low freight rates, tariffs, and higher interest and insurance rates.

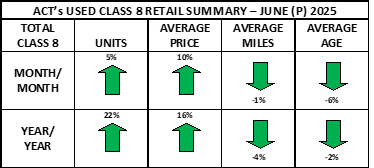

Average Class 8 truck retail sale prices rose 16% year over year and 10% month over month in June, according to a July 16 report by ACT Research. In addition, same-dealer sales for used Class 8 trucks rose 5% MoM and 22% YoY in June.

While same-dealer sales exceeded the historical seasonal expectation of a 3% MoM increase, auction sales and wholesale transactions faced challenges, Steve Tam, vice president at ACT Research, said in the report.

“Auction sales were out of sync with their typical third-month-of-the-quarter brawn, shedding 18% MoM,” he said. “Wholesale transactions also ran into headwinds, shrinking 16% month over month.”

June auction sales and prices for Class 8 day cabs faced especially high pressure, with asking values down 1.6% MoM and 6.3% YoY, and recording the largest auction value declines at 4.4% MoM and 9.9% YoY, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

Despite their versatility across industries, day cabs are currently seeing weak demand and limited market enthusiasm, he said.

Truck market remains under pressure

The transportation market continues to face challenges due to freight rates and tariffs, ACT’s Tam said in the report.

“Spot freight market capacity tightened further in June, but freight growth remains elusive,” he said. “The avoidance of tariffs appears to be the driving force behind used truck market results,” he said.

Rising truck prices, combined with higher interest rates and insurance costs, are squeezing operators, prompting dealers and lenders to find more flexible financing structures to keep trucks affordable, Kirk Mann, executive vice president and head of transportation at Mitsubishi HC Capital America, told EFN.

“Rising truck prices have been a real challenge, and it’s not just a challenge for the operator; it’s a challenge for the dealers, too, because they’re holding the inventory to sell,” he said. “Interest costs for the dealerships are rising as they hold on to inventory, especially right now.”

Register here for the free Equipment Finance News webinar “Technologies to Advance Your Equipment Financing Business” set for Thursday, July 17, at 11 a.m. ET.