Rising credit approvals are becoming a boon for the equipment finance industry as economic uncertainty hinders capital investment in some markets.

Equipment finance credit approvals rose 1.4 percentage points month over month in April to 77.4%, the highest rate in more than two years, according to the Equipment Leasing and Finance Association’s (ELFA) CapEx Finance Index, released today. Credit approvals have increased 3.1 percentage points so far in 2025.

While tariff-driven uncertainty is causing short-term challenges, higher approvals signal a positive long-term trend, Joseph Turner, senior vice president of strategic market development at First Citizens Bank’s equipment finance division, said in a panel discussion at the recent Equipment Finance Connect 2025 in Nashville, Tenn.

“I think approval rates have bounced back from a low in Q4 of last year,” he said. “In general, the pipeline of applicants remains pretty robust. … Borrowers are hanging in there.”

Rising approval rates also means lenders may be better positioned to take risks in the second half of 2025, Tom Mariani, a strategic adviser for equipment lenders and dealers at Rinaldi Advisory Services, said during the discussion.

“In the second half of ‘25, I think that credit will be more gettable. I think there will be more lenders in the marketplace. I think this will bring back some people that may have pulled back out of transportation and some of the other markets. … So, I think we have to get through a couple more months of tariff play, and then I think we’ll be able to see what the path forward is going to look like”

— Tom Mariani, strategic adviser, Rinaldi Advisory Services

Tariffs have yielded a mix of buyer hesitation and pull-forward purchasing before potential price hikes and surcharges. There are several “significant” economic reports set to be released in the coming weeks that could further “impact business and consumer confidence,” Daryn Lecy, chief operating officer and senior vice president of Oakmont Capital, stated in the ELFA report.

Originations dip 3.2%

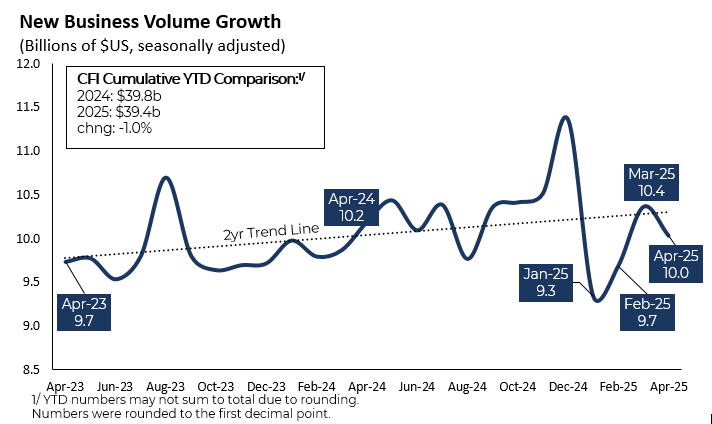

New business volume in equipment finance totaled $10 billion in April, down 3.2% from March, according to the report. New business volume through the first four months of 2025 was down 0.1% year over year.

However, charge-offs dropped 20 basis points (bps) to 0.4% after they reached their highest level since September 2020 in March. Delinquencies of more than 30 days fell more than 40 bps to 1.8%.

Decreased charge-offs and delinquencies “suggests more improvements in financial conditions are on the horizon,” ELFA President and Chief Executive Leigh Lytle stated in the report, marking a change of tune from the March report, when she stated that consumers could be experiencing financial stress due to economic uncertainty.

“Even if some of the impact from changing trade policy is delayed, the strength in financial conditions shows that it will take a lot more than uncertainty to knock the industry off course,” Lytle said.

Find more coverage from Equipment Finance Connect here.