Used ag equipment market mixed as dealer inventory concerns persist

High-horsepower tractor inventory up 12% YoY

Used agriculture equipment inventories and values improved at auction in March, but dealers continue to face inventory challenges.

High-horsepower tractor inventories at auction remain elevated while new truck sales stagnate, according to Sandhills Global.

“Dealers are loaded with inventory we didn’t see, and dealers didn’t dump as much at year-end, so they went back to try and fix their pricing a little bit,” Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News. “The dealers will approach the auction market again and realize they need to get this stuff moved after they try here in the first quarter, or two quarters, of trying to move some of that stuff.”

Ag trade-in issues

Continued inventory pressures are affecting ag dealer trade-in markets and farmers continue to adjust, Ryan said.

“The majority of the dealers that are out there are not taking trades right now, so you’re looking at your typical farmer who their whole career, their whole lifetime, their transacting equipment has been done through the dealer where they’re trading-in,” he said. “Now these dealers are either not taking it completely or shooting them so low it makes zero sense because they just can’t afford it. You’re seeing these end users hit the used market, which they’ve never experienced before.”

Still, the trade-in situation continues to evolve as the ag market improves, Tim Corwin, sales representative, at Clinton, Mont.-based Golden Valley Tractor, told EFN,

“The used market is getting a little better,” he said. “There’s not as much out there, and that’s helpful to a lot of people, but I think that’s because there for a while, we were not able to trade for anything because we didn’t have that to sell.”

As a result, inventories and values remained mixed in March, according to Sandhills Global’s April 7 report.

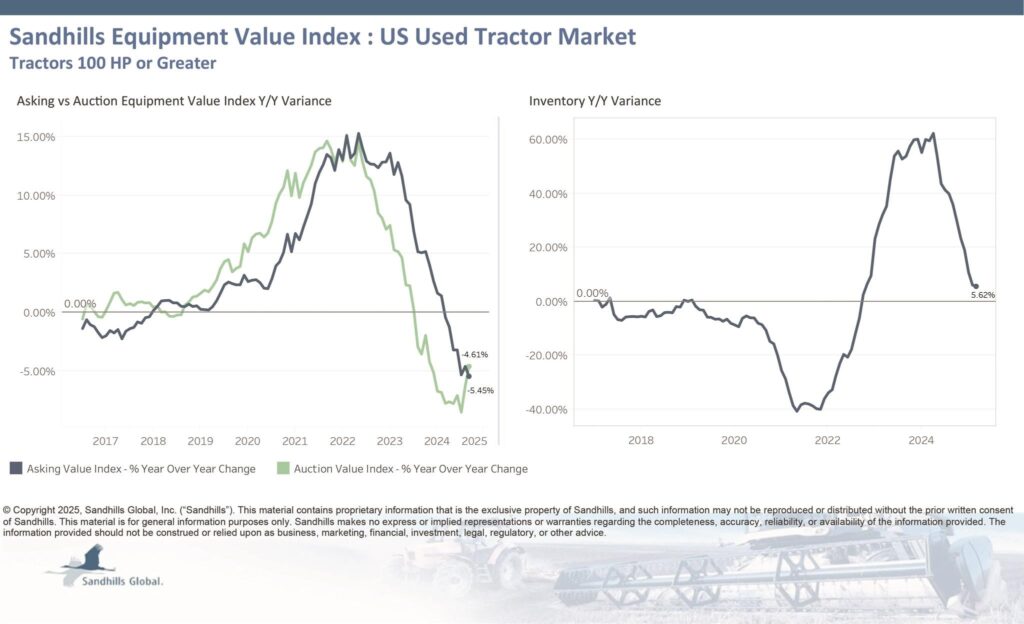

Used tractors, 100 horsepower or more

- Inventory increased 5.6% year over year and 1.7% month over month;

- Asking values fell 5.5% YoY and 0.5% MoM; and

- Auction values declined 4.6% YoY but rose 0.8% MoM.

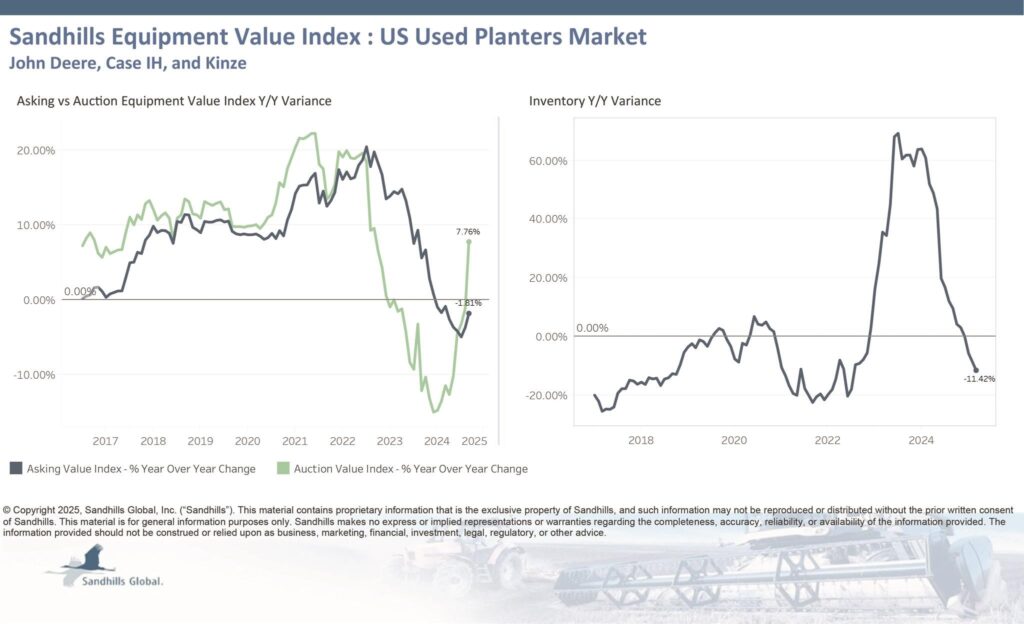

Used planters

- Inventory fell 11.2% YoY and 2% MoM;

- Asking values fell 1.8% YoY and 1.2% MoM; and

- Auction values rose 7.8% YoY despite a 2.5% decrease MoM.

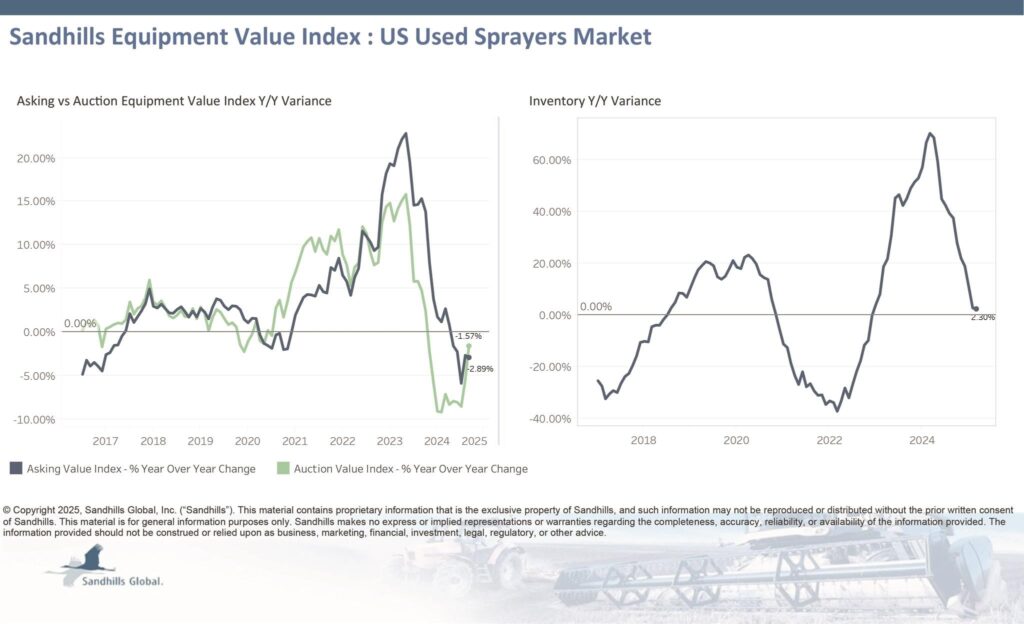

Used sprayers

- Inventory rose 2.3% YoY but declined 0.9% MoM and are trending down, according to the Sandhills report;

- Asking values dropped 2.9% YoY and 1.1% MoM; and

- Auction values declined 1.6% YoY but rose 1.1% MoM.

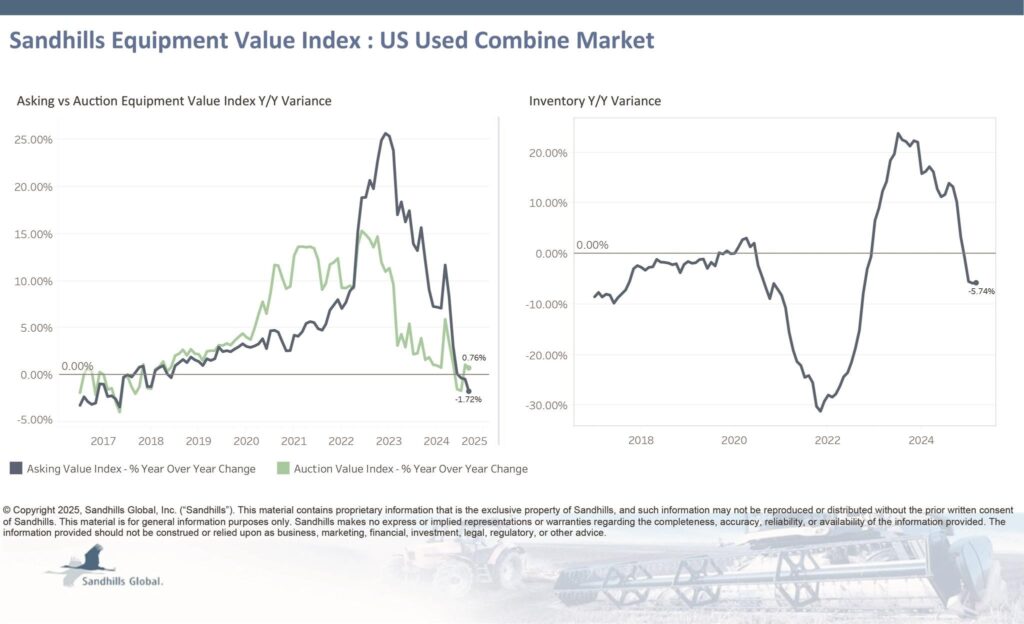

Used combines

- Inventory fell 5.7% YoY but rose 0.7% MoM;

- Asking values declined 1.7% YoY and 0.3% MoM and are trending sideways, according to Sandhills; and

- Auction values inched up 0.8% YoY but dipped 0.1% MoM.

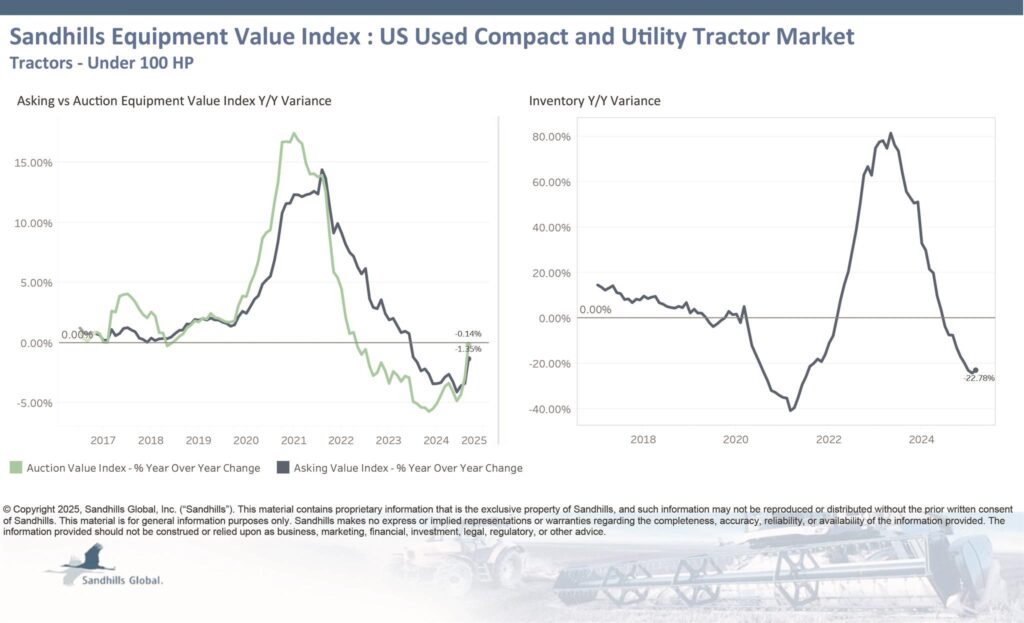

Used compact and utility tractors

- Inventory dropped 22.8% YoY and 4.6% MoM;

- Asking values fell 1.4% YoY, but rose 1.4% MoM; and

- Auction values were down 0.1% YoY, but up 2% MoM and are trending up, according to Sandhills report.

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.