Heavy-duty retail truck sales drop in March

Traton Group sales dropped 10% in Q1

Retail sales for Class 4 to Class 8 trucks decreased in March as demand fell due to macroeconomic uncertainty created by tariffs.

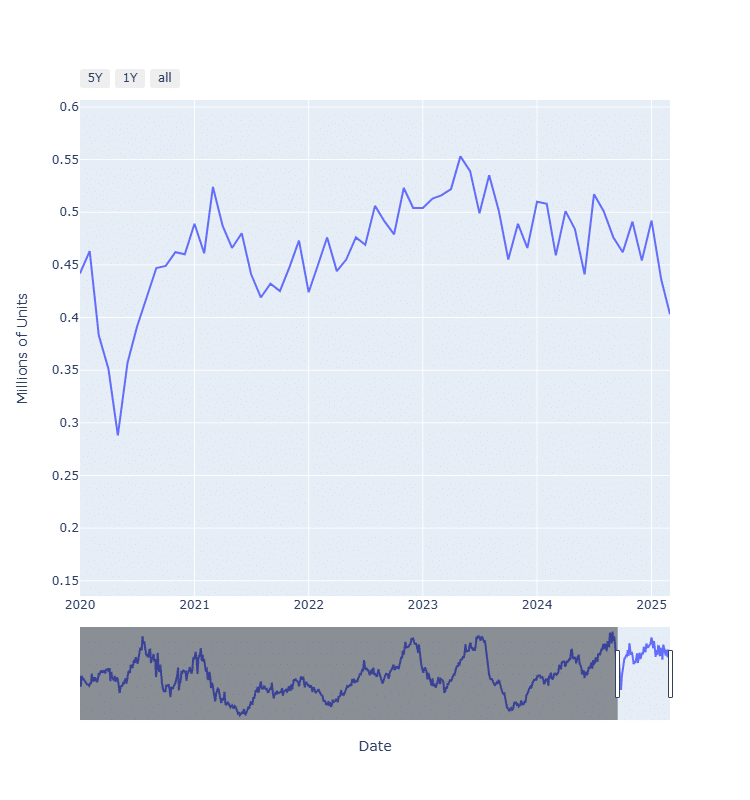

Equipment Finance News’ U.S. Heavy Duty Retail Truck Sales Index uses data from the Federal Reserve Bank of St. Louis and the U.S. Bureau of Economic Analysis. The index tracks the sales of heavy-duty trucks, which weigh more than 14,000 pounds and are in the Class 4 to Class 8 space.

Sales landed at 403,000 units in March, down 7.6% month over month and 12.2% year over year, according to the index. Sales during the first quarter of 2025 totaled 1.3 million units, down 9.9% YoY.

US Heavy Duty Retail Truck Sales

Meanwhile, commercial truck manufacturer the Traton Group reported net sales of 73,100 units, down 9.9% YoY, in Q1 amid a challenging market, with lower unit sales across subsidiaries Scania, MAN and International due to subdued demand in Europe and the United States and uncertainty surrounding tariffs, according to an April 9 Traton release.

However, another subsidiary, Volkswagen Truck & Bus, saw an increase in sales driven by strong momentum in Brazil and Argentina. All-electric vehicle sales rose 93.8% across the group.

Heavy-duty truck orders slip

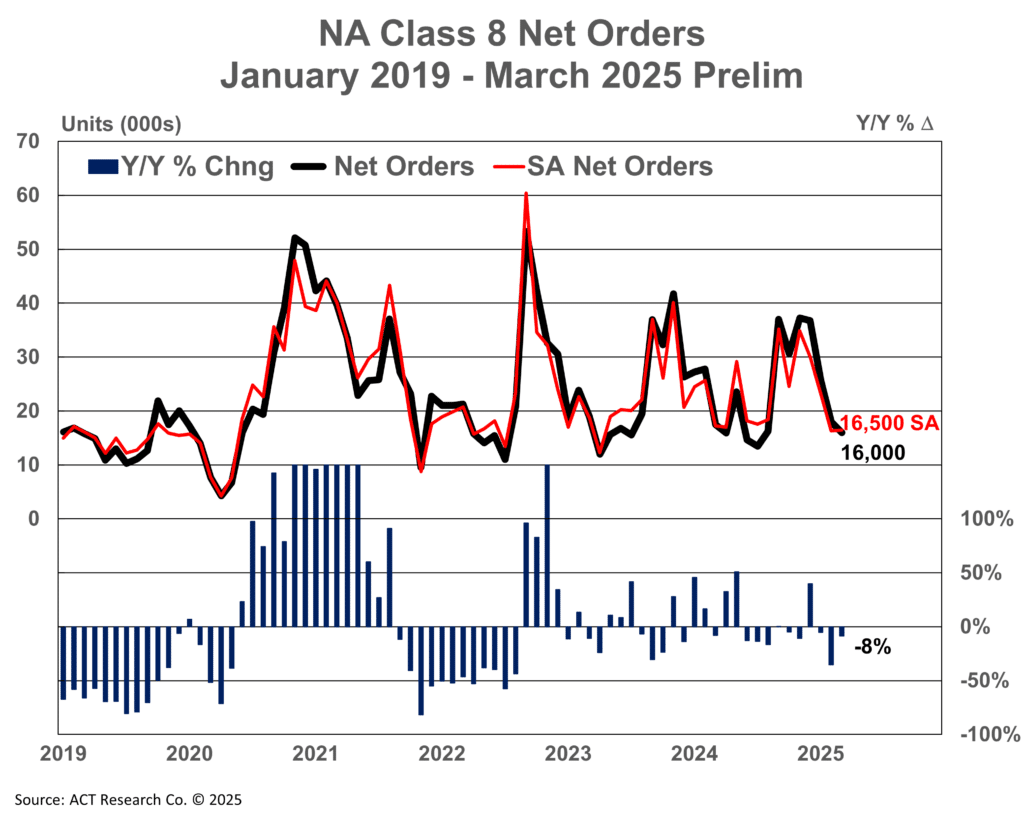

In addition to the recent decrease in sales, monthly orders for Class 5 to Class 8 trucks fell in March, according to ACT Research’s “State of the Industry: NA Classes 5-8 Report,” released April 2.

March North America Class 8 orders totaled 16,000 units, down 8.3% YoY, according to the report. The decline in sales and orders comes as uncertainty dominates the heavy-duty truck market, Carter Vieth, research analyst at ACT Research, said in the report.

“The first quarter of 2025 has been defined by one word: uncertainty,” he said. “Whether the slowdown in orders is a result of moderating economic activity, private fleets’ pausing expansion or a response to trade and policy uncertainty is difficult to surmise and remains an open question.”

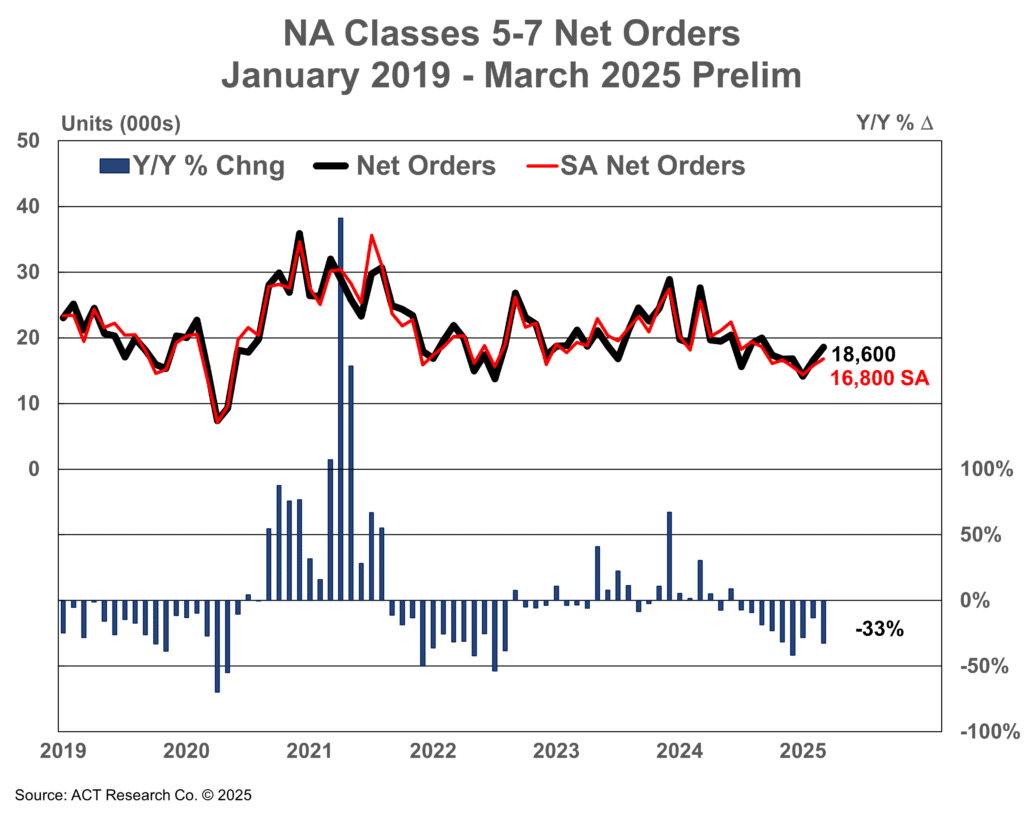

Medium-duty truck orders drop

Orders for Class 5 to Class 7 vehicles totaled 18,600 units, down 33% YoY, according to the report. Part of the continued pressure on the heavy-duty truck market stems from elevated dealer inventories and interest rates, Kirk Mann, executive vice president and head of transportation at Mitsubishi HC Capital America, said during the Commercial Vehicle Business Summit on April 2, a virtual event hosted by Work Truck Solutions.

“Dealers all across the country are sitting on a lot of inventory that they need to get out the door,” he said. “This threat of tariffs may actually pull forward some sales that might not have happened this quickly.”

As a result of the tariffs and current transportation inventory trends, truck customers continue to hang on to equipment longer, adding to the challenge for dealers, Peter Spitzer, commercial and fleet account manager at Ron Du Pratt Ford in Dixon, Calif., said during the Commercial Vehicle Business Summit on April 3.

“We don’t know how long these tariffs are going to go on and we don’t know consumer sentiment on a lot of things,” he said. “But what do we have control over, that’s what we’re focusing on at our store, how can we get … our share of it and how do we focus on that every single day.”

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.