North American traditional rental activity rose in 2024, as equipment-as-a-service companies benefited from an improving supply chain and stronger macroeconomic conditions.

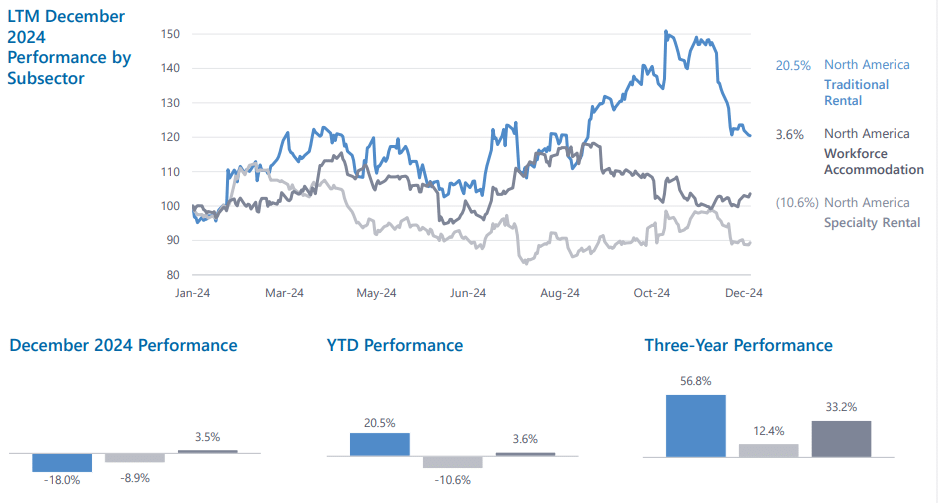

Equipment-as-a-service (EaaS) companies in North America maintained stability last year, as traditional rental activity increased 20.5% year over year and workforce accommodation rental activity rose 3.6% YoY, according to global investment bank Houlihan Lokey’s recently released EaaS market update.

Meanwhile North America specialty rental fell 10.6% YoY, according to the report. Despite the overall decline, United Rentals saw a 30.5% YoY growth in its specialty business, driven by industrial and construction megaprojects and investments in telematics and tracking technology, according to the company’s Jan. 29 earnings release.

EaaS companies built on earlier momentum as interest rate declines led to improved financing conditions, according to the report. A Federal Reserve rate cut in December further supported business investment, but inflation continued its downward trajectory, easing from 2.4% in September to 2.1% by December of 2024.

Demand in the EaaS sector remained strong, driven by infrastructure spending and strategic expansions, though M&A activity slowed toward yearend. EaaS mergers and acquisitions declined to 108 transactions in 2024, down 23.9% YoY, according to the report. Twenty deals were recorded in Q4 2024, down 40% from Q4 2023.

Equipment rental house M&A

The Ashtead Group, parent of Sunbelt Rentals, added 54 locations in North America, including 43 greenfields and 11 acquisitions during the nine months ended Jan. 31, 2025, according to the company’s earnings presentation.

Despite the growth, the second-largest global rental company continues to take a measured approach to M&A and opening new locations, CEO Brendan Horgan said during the company’s March 4 earnings call.

“The environment is interesting right now in terms of who there are buyers out there for some of these businesses, and we like our positioning with that, but we wouldn’t completely put the greenfield program on ice,” he said. “As we always do, we’ll assess where we want to be geographically.”

Herc Rentals, meanwhile, expanded its footprint with nine acquisitions in 28 locations and opened 23 new greenfield locations in 2024, according to the company’s Feb. 13 earnings release.

The third annual Equipment Finance Connect at the JW Marriott Nashville in Nashville, Tenn., on May 14-15, 2025, is the only event that brings together equipment dealers and lenders to share insights, attend discussions on crucial industry topics and network with peers. Learn more about the event and register here.