Equipment stocks experienced a turbulent week as new tariffs loomed, marked by major swings, before ultimately trending down due to uncertainty over tariffs.

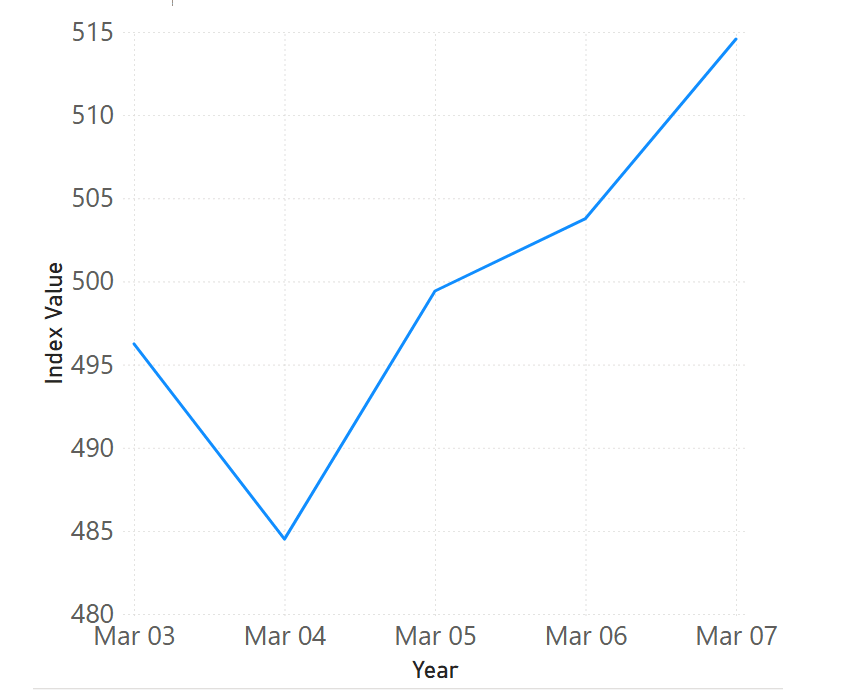

The Equipment Finance News Stock Index was down 2% at market close at 496.25 on March 3, the day before 25% tariffs on Canadian and Mexican imports were set to take effect. On March 4, the index fell another 2.4% to 484.50 as tariff concerns shook the market.

The index began rebounding, however, on March 5, rising 3.1% by market close, after President Donald Trump announced a one-month pause on tariffs for cars entering the United States from Canada and Mexico. By the end of the day on March 7, the EFN stock index stood at 514.58, up 3.7% from March 3.

Despite the recent volatility, the index has climbed 13.6% year over year as of March 7. It has dropped 1.9% since Jan. 21, a day after Trump took office, since markets were closed on on Jan. 20 in observance of Martin Luther King Day. Equipment makers feel effects on tariff uncertainty

As equipment stocks declined alongside the broader market on March 10 and 11, several major OEMs saw significant stock volatility.

OEMs continue to feel the impact of tariff speculation, as several prominent equipment makers have seen shares decline. Caterpillar shares closed down 1.58% today from market open; Deere shares closed down 2.72% today from market open; and Volvo shares closed down 2.56% today from market open.

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.