Proposed March 4 tariffs loom over equipment industry

Core capital goods orders rise 0.8% in January

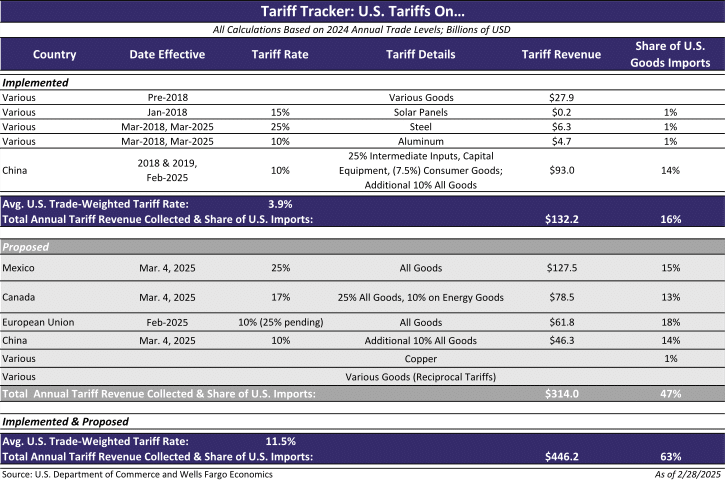

Looming tariff concerns continue to pressure the U.S. equipment industry, with another round of tariffs set to begin on March 4.

The threat of 25% tariffs on Canada and Mexico, including on commodities such as aluminum, steel and farm goods caused market volatility in early February, but President Donald Trump delayed implementing them after both countries increased border security.

But Trump said today that there would not be another reprieve and the tariffs would be implemented on March 4. Trump also is doubling a tariff on all Chinese goods to 20%. It is expected to also take effect on March 4.

The stock market reacted negatively to the news, with the Dow Jones Industrial Average falling 1.5%, or nearly 650 points. The technology-heavy Nasdaq composite lost 2.6%, or nearly 500 points.

Tariff impacts

The construction industry is likely to be among the hardest hit sectors because tariffs are expected to drive up steel and aluminum prices, according to a Feb. 12 S&P Global Ratings release.

“All else equal, the tariffs would increase costs to automakers, food processing and packaging including can manufacturers, construction projects including homebuilding and infrastructure, and possibly defense contractors,” according to the release. “Tariffs and nontariff barriers tend to disproportionately burden the small and midsize businesses.”

The tariffs will also present problems for the supply and value chains, David Binns, auto director of S&P Global Ratings, told Auto Finance News, a sister publication of Equipment Finance News.

“All of this is probably going to lead to some volatility in the supply chain, not to mention the fact that there’s inherent working capital increases, because if you just add on a price to the value, and you get paid in 60 days by the OEM, you’re going to have to absorb a little bit more extra working capital,” he said. “For a lot of the stronger, Tier 1 companies, they’ll be OK, but the Tier 2 and Tier 3 two companies, it’s going to be hard for them to have the financial flexibility and balance sheets to deal with that, which then could lead to more supply chain issues.”

Core capital goods orders up

Core capital goods orders were up 0.8% month over month in January following a 0.2% MoM revised increase in December, while shipments for core capital goods fell 0.3% MoM following a 0.3% revised increase in December. Orders for core capital goods over the past three months represent the largest increase in the index since mid-2022, according to a Feb. 27 Wells Fargo research note.

Core Capital Goods – Shipments & New Orders

“Part of the advance in underlying orders may reflect a pull-forward in demand ahead of potential tariff threats, as purchasing managers stockpile not just imported but domestic goods,” according to the note. Due to the increased core capital goods order activity in Nov., Dec., and Jan., “we should brace for some payback as that intention subsides mid to late in the year,” according to the note.

The third annual Equipment Finance Connect at the JW Marriott Nashville on May 14-15, 2025, is the only event for both equipment dealers and finance providers. Learn more and register here.