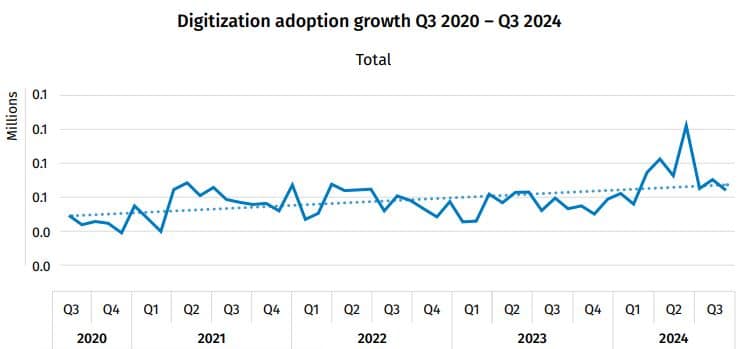

Adoption of digital transactions in equipment finance grew again annually as dealers and lenders turned to digital workflows for compliance and security despite a tight market limiting software investment.

Equipment finance digital transactions, or e-contracting, increased 21% year over year in the third quarter, according to software provider Wolters Kluwer‘s’ Q3 2024 Equipment Lease Finance Digital Transformation Index.

Still, e-contracting declined 23% quarter over quarter as poor investment conditions and seasonal decline limited overall growth, Tim Yalich, head of motor vehicle strategy at Wolters Kluwer, told Equipment Finance News.

“We’re feeling the market conditions in our index right now, so being down 23%, we’re still higher than we’ve been anytime in any other quarter in any other year we’ve been tracking,” he said. “The fact that we dropped from quarter two to quarter three, that’s more seasonal impact and normal aligning to sales volume.”

The index has grown 26% over the past four years, indicating overall positive adoption trends, Yalich said.

“As long as we are staying positive, and we’re in double digits of 26%, we are still seeing growth in the industry as far as adoption of digital workflows and process,” he said. “There’s not a lot of equipment financing happening going into the winter, so we should expect more of the same there. We see this in the other segments that we measure, too … there’s a plateauing each year.”

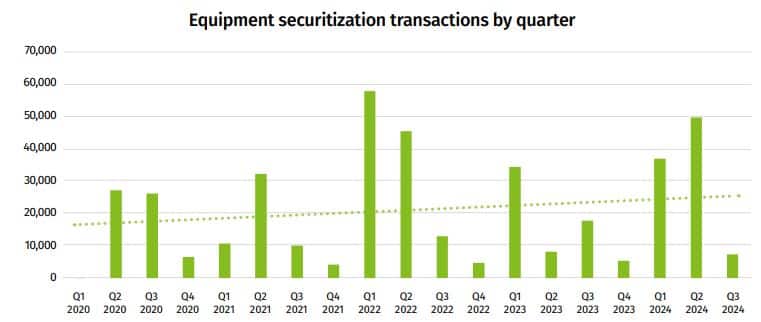

Securitization adoption rate up 54% over four years

In response to the sustained growth in digital transactions, Wolters Kluwer added an equipment securitization transaction tracker to the index, Yalich said.

“Because of the amount of digital loans coming into the marketplace, we recognize that there’ll be more and more digital loans being sold in the marketplace,” he said. “As digital adoption increases on the contracting side, that just means there’s going to be more digital loans for the monetization side of the house, that the volume of digital loans being monetized should continually increase.”

Equipment securitization transactions have increased by 54% over the past four years, according to Wolters Kluwer. Despite that, securitizations were down 85% quarterly and 59% YoY amid a market slowdown caused by interest rates and seasonal trends, Yalich said.

Digitalization in securitization

While factors such as interest rates and seasonality can limit securitization activity and demand for digitalization, the ability to access digital loans or e-contracting improves efficiency, Yalich said.

“There’s a lot of speed to market when you need to get the market quick, or you need to obtain some capital quickly, because you don’t have to move paper,” he said. “There’s a lot of data that comes with the digital, so you don’t have to go and do visual comparison or collection of data to get the analysis done, to price these pools and sell them.”