Equipment finance digitalization continues to grow as dealers and lenders lean on digital contracting for compliance and security.

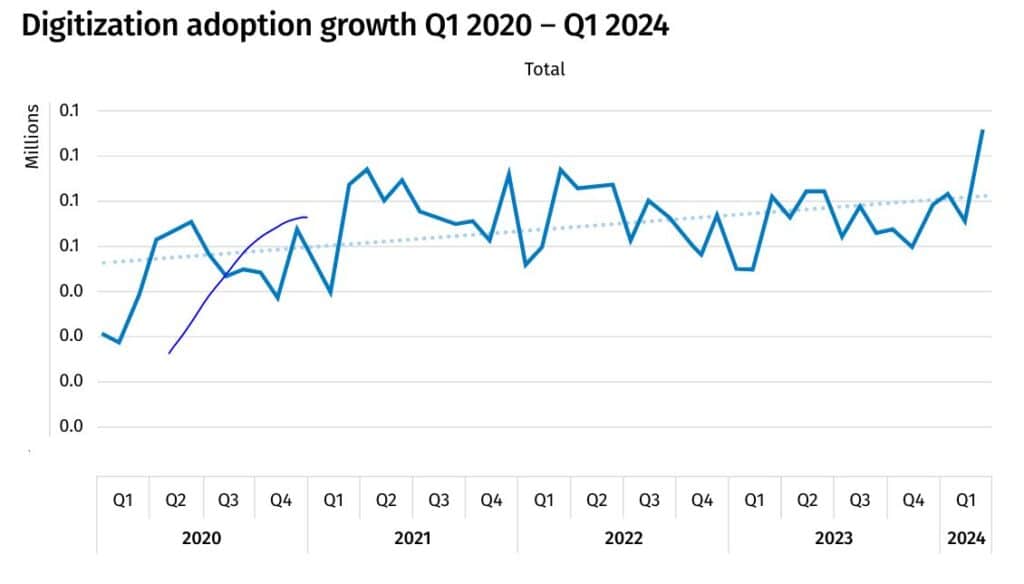

Equipment finance digital transactions, or e-contracting, increased 28% year over year in the first quarter, according to software provider Wolters Kluwer‘s’ Q1 2024 Equipment Lease Finance Digital Transformation Index. The index’s 118% growth over the past four years indicates positive adoption trends, Tim Yalich, head of motor vehicle strategy at Wolters Kluwer, told Equipment Finance News.

“The equipment lease and finance space is really an under-adopted digital environment from a digital lending ecosystem perspective,” he said. “When I see movement in the positive direction in this particular segment, that excites me because it does say that we’re seeing adoption.”

Digital contracting increased 19% quarter over quarter in Q1, according to the Digital Transformation Index. Still, Yalich warned about potential anomalies in the index, similar to the auto index, related to tax season.

“We certainly recognize … at the tail end of quarter one going into quarter two [there] is always the impact of income tax season where people get their refunds and go buy cars so volumes go up,” he said. “It could have the same net effect inside the equipment lease arena because the majority of the clients that we have an equipment lease [with] are dealing with some kind of motorized vehicle.”

Technology growth in ag transactions

Small agriculture was one of the largest areas for digital contracting growth in equipment finance during the quarter, Yalich said.

“The uptick was some spending or financing with agricultural type equipment, landscaping machinery, so your smaller size type of equipment that you might see landscapers or small farmers use, and watercraft,” he said. “That’s really where we’re seeing the types of clients with the largest impact or largest spikes.”

Agriculture and construction equipment manufacturer Kubota’s captive lender, Kubota Credit, continues to work with dealers to develop the most efficient financial services system, David Costa, chief technology officer at Kubota Credit, said during a panel on May 6 at Equipment Finance Connect 2024.

“With dealers, a lot of our focus and investment is about being able to deliver those services to the entity, securely, at the edge, and as well as possible,” he said. “The progression of technology has been very fast, and it’s given us a lot of opportunities just to refresh our investments in our core platforms. It’s also allowed us to become much more granular in our interactions.”

Investments in digitalization

While macroeconomic conditions such as interest rates can impact the Digital Transformation Index due to increased willingness for capital expenditures, the current rate environment indicates positivity for equipment finance digitalization, Yalich said.

“When I see a flat market, as far as economic growth, accelerate in digital adoption, it speaks loudly that there’s investments being made and there’s progressive pressure being made in the digital arena,” he said. “A great quarter or a great year in sales volume because of macroeconomic impacts will make this index look great, but when it’s a flat industry, a flat economic outlook, and it’s still going up, that’s a very positive sign for digital adoption.”