Used-truck inventories continue to rise and showed no sign of hitting the brakes in April.

Recent bankruptcies at trucking firms have caused more equipment to hit auctions, adding to the inventory crush and making it increasingly difficult for dealers to offload aging equipment from their lots.

The trucking industry is also coping with rising delinquencies and defaults on leases, as well as rising returns.

In coming months, “you’re going to get into situations like that to where there’s an abundance of lease returns” as companies go bankrupt or people trade in for newer equipment, which will also exacerbate the inventory issue, Sandhills Global Equipment Lease and Finance Manager Jim Ryan told Equipment Finance News.

Inventory was up in all categories of transportation surveyed by Sandhills in April, while asking and auction values fell.

U.S. trucking by the numbers

U.S. trucking by the numbers

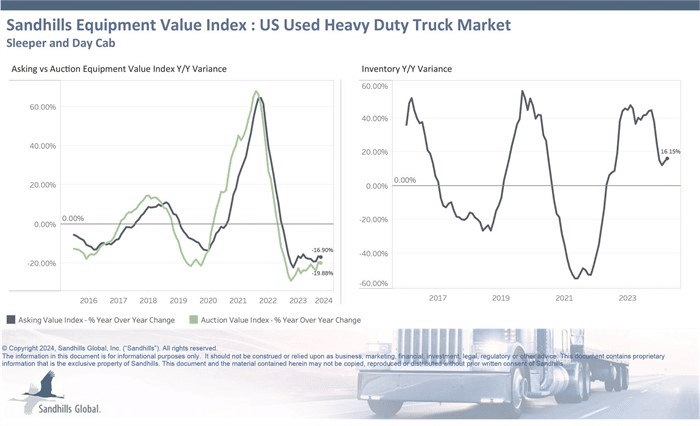

- Used heavy-duty truck inventory levels increased 16.5% year over year in April;

- Asking values for used heavy-duty trucks were down 16.9% YoY, while auction values fell 19.88% YoY;

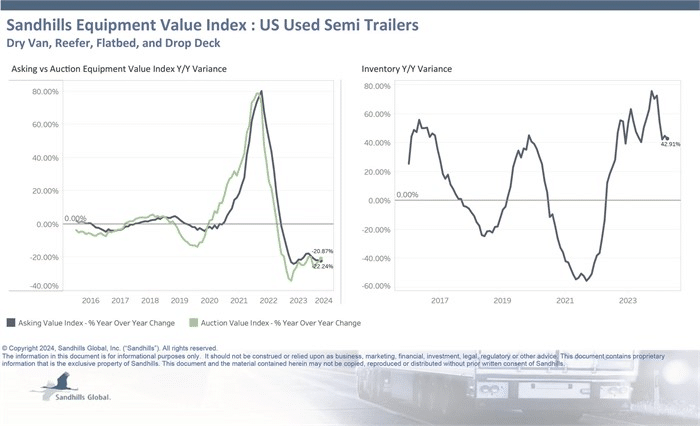

- Used-semitrailer inventory was up 42.91% YoY as of April;

- Asking values for used semitrailers dropped 22.24% YoY. Auction values dropped 20.78% YoY;

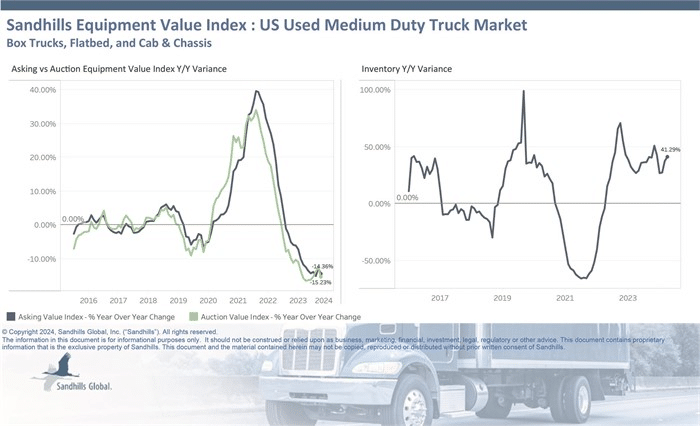

- Used medium-duty truck inventory rose 41.29% YoY in April; and

- Asking values for used medium-duty trucks dropped 14.36% YoY. Auction values were down 15.23% YoY in April.

Canadian heavy-duty trucking numbers

- Canadian used heavy-duty truck market inventory increased 33.7% YoY in April;

- Asking values declined 13.71% YoY in April, which Sandhills said was “a result of the downward trend persisting over time;” and

- Auction values were down 16.37% YoY.

More equipment, lower auction values

More equipment, lower auction values

The decline in auction values for semitrailers was partly driven by the subcategory of refrigerated trailers, which saw a 6.54% YoY decrease in auction values in April.

The sector has had an “abundance” of excess inventory, Ryan told Equipment Finance News.

“You’re seeing a lot of repossession reefer trailers hit the market now,” Ryan said. “Obviously, just the abundance of inventory has really driven down a lot of those prices and the values.”

Recent bankruptcy filings by trucking company Yellow and Pride Group, which owned Canadian subsidiary truck lessor TPine, are not helping the inventory crisis, Ryan added. A dealer familiar with the Canadian used-truck market said that he expects the bankruptcies to be a continued issue and noted that the TPine bankruptcy could add another 500 trucks to the used market in North American auction market.

With inventory rates already elevated, an influx of equipment from bankrupt companies compounds the issue, Ryan said.

“If you have some of these larger fleet companies or lending companies go out of business, those assets are actually going to hit the open market, whether its retail, wholesale [or] auction,” Ryan said.

Buying across the border

Buying across the border

“Crossover buyer market coming across borders” frequently is something Ryan said he’s observed.

“Wherever it’s sold, in Canada or the U.S., buyers are going to come from across the border,” Ryan noted.

While Canadian markets are facing the same inventory issues, Ryan said that moving older equipment to Mexican markets is a possible strategy for dealers. That said, the longer equipment languishes on dealer lots and depreciates, the less the eventual sale yield at auction might be.

Douglas Farley, director of finance and credit at Canadian dealer Calgary Peterbilt, said that “in general, we know that the used market has definitely softened lately and with expected equipment defaults on the sharp rise we will see that bring the used market way down.

Farley added, “My feeling was that the last auction in Alberta in February was not a very good one for used trucks. Pricing was soft.”

There’s still a massive backlog in inventory despite cross-border buying, Ryan noted.

“I’m not sure there is enough moving to make a huge difference, but you are starting to see some of that,” Ryan said of trucks auctioned in Mexico.