Construction market stable as new year begins

Heavy-duty construction equipment values down 15% YoY

Construction equipment auction activity remains stable as demand for equipment shows strength despite a growing supply glut.

Demand, inventories and values for construction equipment remained mostly steady while other markets declined in December ahead of an expected seasonal uptick in the first quarter of 2024, Jim Ryan, equipment lease and finance manager at Sandhills Global, told Equipment Finance News. The transportation market saw values continue to dip and some operators parking trucks amid rising operating costs, contributing to a volatile market.

“In construction… you’re seeing inventory levels get to high marks,” he said. “When that happens, you’re going to see prices continue to go down. Maybe not plummeting like they have been on the transportation side, but it’s a slow burn.”

Northeastern equipment dealer Anderson Equipment is not expecting slowdowns to hit the dealership in the new year, Finance and Sales Administration Manager John Boy told EFN.

“First quarter is typically the ramping up phase when everyone’s finalizing their bids and getting everything done for this year,” he said. “We aren’t seeing any industry slowdowns as far as [our] sector pockets.”

Anderson Equipment operates in the construction, forestry and mining sectors, which did not have as drastic a slowdown in 2023 as the trucking industry, Boy said.

“Trucking was one of those sectors that slowed down [in 2023] and started to have more repossessions, and that was one of the indicators that people were watching,” he said. “In construction, whether it’s infrastructure, site development or new housing, I haven’t seen anything that would indicate any slowdown.”

New housing starts increased 14.8% month over month and 9.3% year over year to 1.56 million in November, according to a Dec. 19 report from the U.S. Census Bureau.

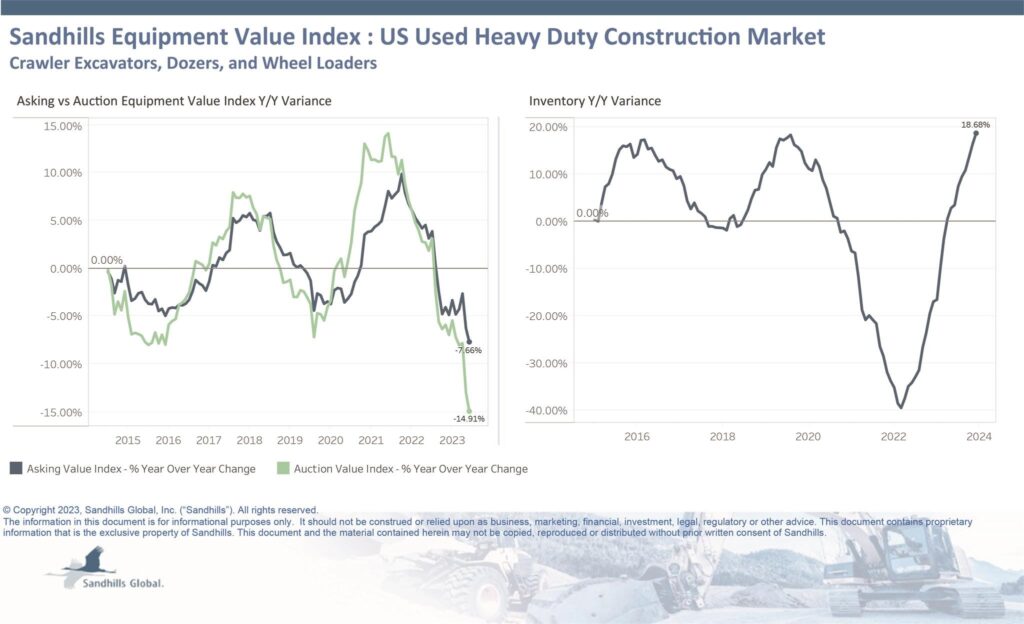

Heavy-duty construction values stay steady

- Retail, or asking, values dipped 1.4% MoM and 7.7% YoY for heavy-duty construction equipment;

- Auction values fell 1.8% MoM and 14.9% YoY; and

- Inventory for heavy-duty equipment declined 0.8% MoM but rose 18.7% YoY.

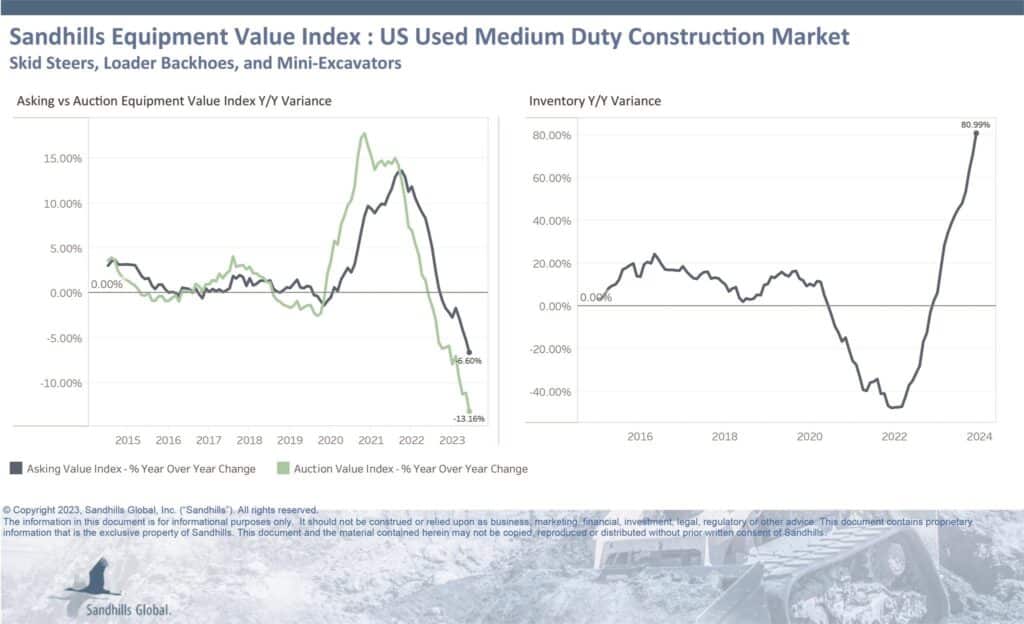

Medium-duty inventory hits 12-straight monthly increase

- Retail values for used, medium-duty construction equipment fell 1.4% MoM and 6.6% YoY;

- Auction values dropped 2.6% MoM and 13.2% YoY, marking 10 consecutive months of decline; and

- Medium-duty construction inventory continued rising for the 12th straight month, ticking up 2.8% MoM and jumping 81% YoY.

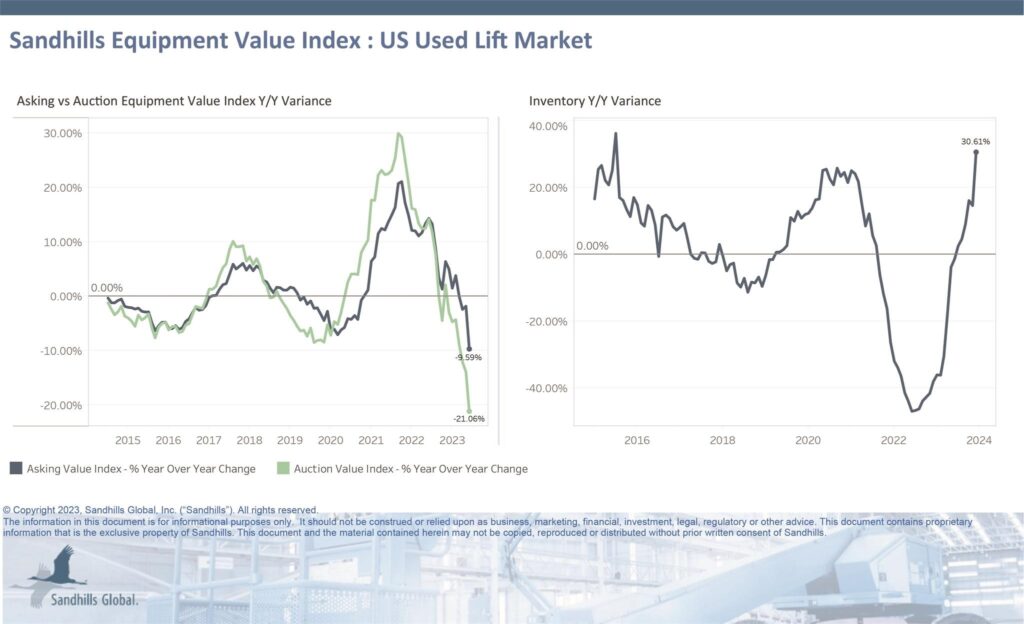

Lift values dip

- Retail values for used lifts dropped 5.7% MoM and 9.6% YoY;

- Auction values fell 5.6% MoM and 21.1% YoY; and

- Inventory rose 5.5% MoM and 30.6% YoY.

Registration is now available for Equipment Finance Connect. The dealer-centric equipment lending and leasing event of the year offers opportunities for dealers to learn new strategies, foster valuable partnerships and emerge with ideas to immediately apply to their businesses. Learn about Free Dealer Registration at EquipmentFinanceConnect.com.