Jumps in ag inventories drive down auction values

Combine values down nearly 3% YoY

Auction values for agriculture equipment continued their decline from the start of 2023, as rising inventories continue to drive down prices.

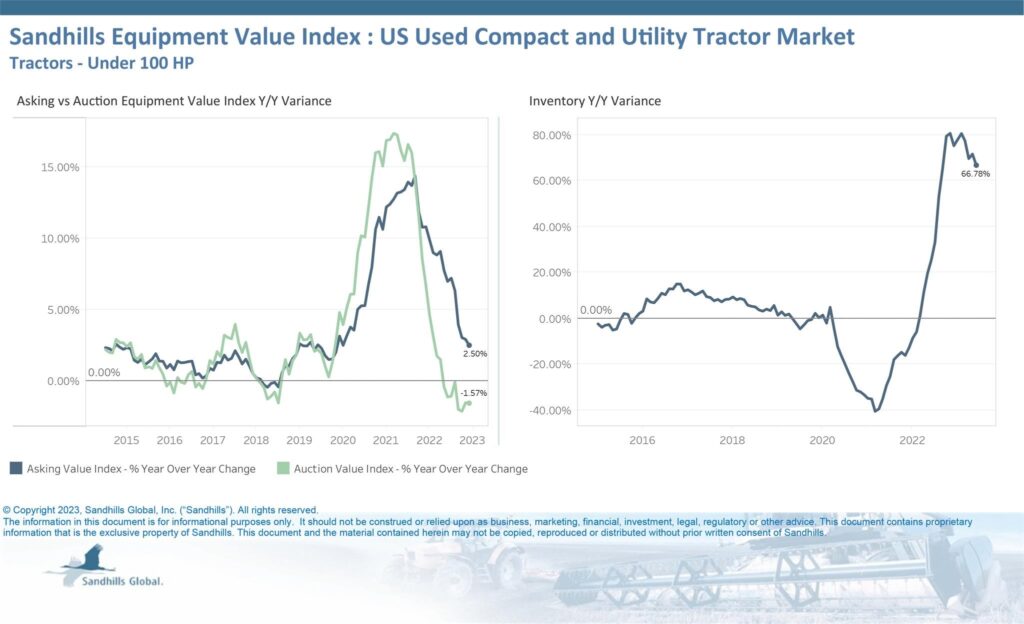

For used compact and utility tractors, asking values declined 0.1% month over month, but rose 2.5% year over year, while auction values declined 0.6% MoM and 1.6% YoY in June and continue to trend down as the market normalizes following pandemic highs.

Sale listings for used compact and utility tractors totaled $297.3 million, up 2.3% MoM, according to Sandhills Global data provided to Equipment Finance News. Inventory for compact and utility tractors, defined as any tractors under 100 horsepower, increased 3.4% MoM and 66.8% YoY in June and continues to trend upward, with tractors under 40 horsepower increasing the most, sequentially.

Combine equipment asking values declined 2.8% MoM but were up 6.6% YoY, while auction values declined 3.9% MoM and 2.7% YoY in June as asking values lagged auction values, according to Sandhills. Sale listings for combines totaled $1.7 billion, down 1.5% MoM and led by John Deere‘s $1.2 billion in sale listings. Inventory for combines decreased by 0.8% MoM but increased by 18.3% YoY in June.

“It’s about the same thing on the combines and the compact and utility tractors, typical trends that we saw on the month over the month before: Auction values and asking values are slowly trending down and inventory is starting to increase slightly,” Jim Ryan, equipment lease and finance manager at Sandhills Global, told EFN. “The ag side has stayed very steady for the year, you’re going to have your slow decline, but nothing that’s drastic.”

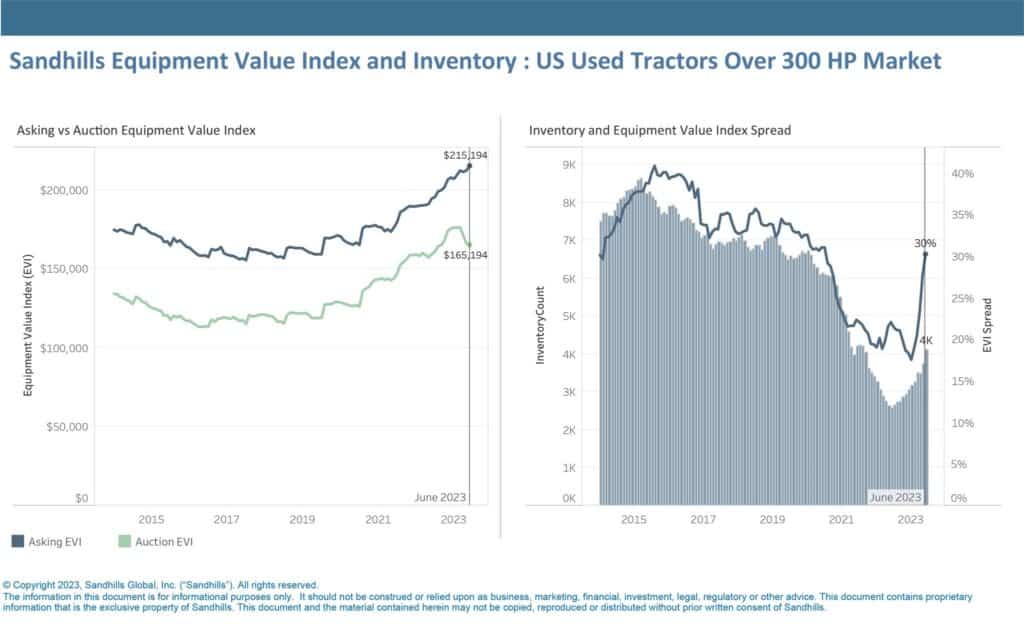

High-powered jump for high-horsepower tractors

Asking values for high-horsepower tractors rose 1.4% MoM and 10.6% YoY, while auction values declined 0.6% MoM but rose 3.7% YoY in June, widening the gap between the two values, according to Sandhills. Sale listings for used high-horsepower tractors, which Sandhills defines as tractors over 300 horsepower, totaled $1.3 billion. Inventory for high-horsepower tractors increased 10.3% MoM and 59.8% YoY in June and continues to trend upward.

“The high-horsepower tractors on the ag side were the biggest jump in inventory across any market last month,” Ryan said. “The high-horsepower tractor jump was one of the biggest jumps or factors on the ag side so far this year.”