Farm equipment auction values up 3% YoY

Compact, utility tractor inventories up 72% YoY in May

Auction values for agricultural equipment were mixed in May as the market began to soften due to post-pandemic normalization and seasonality.

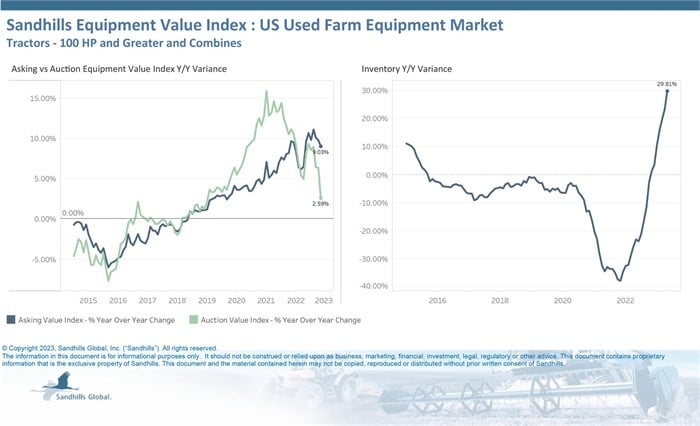

Asking and auction values for used farm equipment rose year over year in May, with asking values — essentially listing price — rising 9% YoY and auction values rising 2.6% YoY, according to Sandhills Global market reports. Sale listings for used farm equipment totaled $3.6 billion in May, with tractors greater than 100 horsepower totaling $1.9 billion and combines totaling $1.7 billion, according to data provided by Sandhills to Equipment Finance News.

Sandhills classifies tractors with 100 horsepower or greater and agricultural combines as farm equipment, and inventory in that equipment classification increased 29.8% YoY in May, led by a 10% month-over-month increase in tractors with more than 300 horsepower.

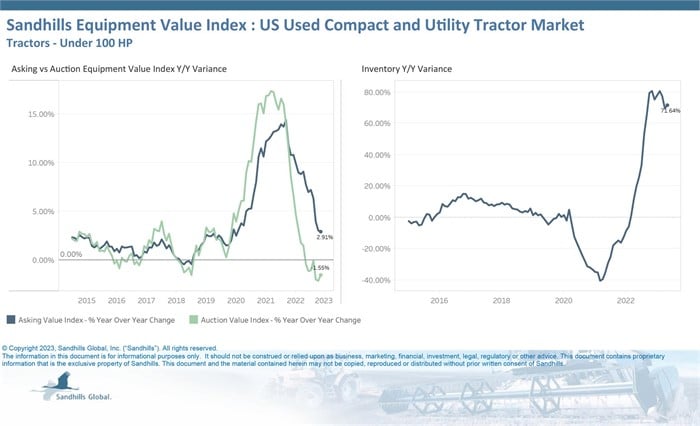

For used compact and utility tractors, asking values rose 2.9% YoY but auction values declined 1.6% YoY in May as the market continues to normalize following pandemic highs, according to Sandhills. Sale listings for used compact and utility tractors totaled $290.7 million, according to Sandhills data provided to EFN.

Inventory for compact and utility tractors, defined as any tractors under 100 horsepower, increased 71.6% YoY in May and continues to trend upward.

Ag industry outlook

Despite rising values, the ag industry shows signs of weakness, Jim Ryan, equipment lease and finance manager at Sandhills Global, told EFN.

“You’re starting to see little cracks in the armor on the ag side, as the combine market is starting to soften,” he said. “The downward trend in the combine market has continued, essentially, since the end of last year on the ag side.”

Still, the crossover within the equipment industry helps supplement the agriculture industry during times of low activity caused by seasonality, Ryan said.

“There’s a lot of crossover with these markets too, like construction people are using trailers or using day cab trucks and farmers are using skid steers,” he said. “Seasonality is there on the ag side and the construction side, but it does get diluted a little bit because there’s such a cross in that market.”