CFPB funding in jeopardy following DOJ decision

Bureau relies on Federal Reserve earnings to operate

The Consumer Financial Protection Bureau may run out of funds to operate in early 2026 after the Department of Justice’s Office of Legal Counsel determined the agency cannot request funds from the Federal Reserve.

The CFPB under the 2010 Dodd-Frank Act is authorized to use funding from the “combined earnings of the Federal Reserve System.” However, the Fed has not been profitable since 2022.

In a Nov. 7 memorandum to the CFPB, the DOJ ruled that “the combined earnings of the Federal Reserve System” refers to Fed profits, therefore there are no funds to transfer to the CFPB, according to court documents.

CFPB Acting Director Russell Vought must request additional funds from Congress under its Appropriations Clause, according to the DOJ memorandum.

The bureau on Nov. 10 filed a notice with the U.S. District Court for the District of Columbia informing the court that it has sufficient funds to operate through Dec. 31.

It is not yet clear whether Congress will approve additional funding for the bureau, but recent actions show a significant pullback in the CFPB’s authority.

CFPB pullback

In June, the U.S. Senate removed the provision in President Donald Trump’s One Big Beautiful Bill to drop the CFPB’s funding to 0% from 12% of the Fed’s annual earnings, according to the American Financial Services Association. In the end, the bill nearly halved the funding cap to 6.5%.

In May 2024, the U.S. Supreme Court upheld the bureau’s funding mechanism, but arguments soon followed that the Fed had no earnings for the CFPB to draw from.

Editor’s note: The above portion of the article originally appeared in Auto Finance News, an Equipment Finance News sister publication.

The Department of Government Efficiency effectively shut down the CFPB back in February after President Donald Trump dismissed former Director Rohit Chopra and halted nearly all agency operations. With the CFPB’s funding in jeopardy, Section 1071 of the Dodd-Frank Act, which placed additional compliance burdens on small-business lenders by increasing demographic reporting requirements, also faces an uncertain future.

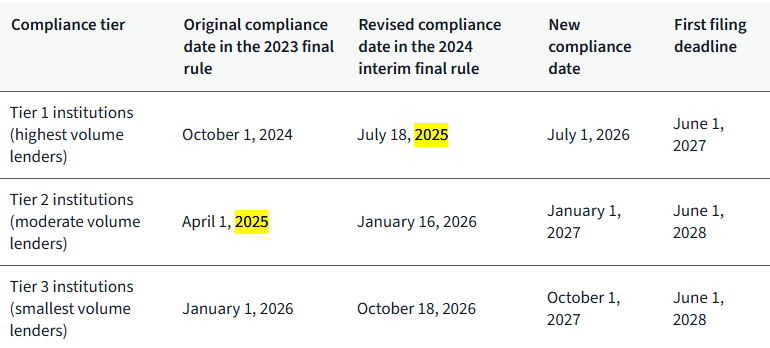

On June 18, the CFPB extended the section 1071 compliance deadlines by an additional year, marking the second extension of the deadlines since the initial final ruling in March 2023, according to the CFPB’s website.

Check out our exclusive industry data here.