Core capital goods orders rise in August as tariff impacts ease

Durable goods new orders drop 2.9% MoM

New and unfilled orders for core capital goods increased in August as the impact of tariffs was felt less than expected.

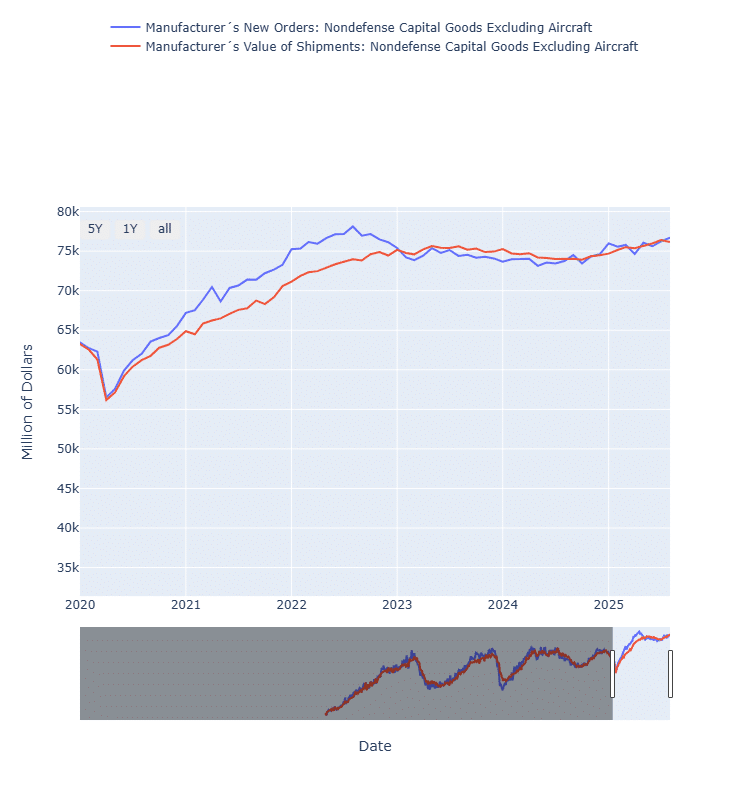

August’s seasonally adjusted value of core capital goods orders, which excludes aircraft and defense equipment, landed at $76.7 billion, up 4.1% year over year and 0.6% month over month, according to the Monthly Advance Report on Durable Goods Manufacturers’ Shipments Inventories and Orders, released by the U.S. Census Bureau today.

Seasonally adjusted shipments for core capital goods totaled $76.2 billion in August, up 3.3% YoY but down 0.3% MoM.

Seasonally adjusted new orders for durable goods in August landed at $312.1 billion, up 7.7% YoY and 2.9% MoM. Meanwhile, seasonally adjusted shipments for durable goods were $307.5 billion, up 6.3% YoY, but down 0.2% MoM.

Equipment finance new business volume rose by 2% year over year in August on a non-seasonally adjusted basis, according to the Equipment Leasing and Finance Association. Equipment finance new business volume during August suggested a 2.6% increase in new durable goods orders, so the forecast landed near the real result.

Tariff-related hesitation persists

August durable goods orders point to stronger business investment and consumer services spending, with net exports likely neutral for third-quarter growth, according to a Sept. 25 Wells Fargo research note.

“Tariff effects have been smaller and slower to materialize, and the consumer has time and time again flexed their resilience in times of uncertainty.” — Wells Fargo

“The latest batch of data certainly inject a bit of optimism to our assessment of current conditions, but the economy is still facing headwinds,” according to the note.

Durable goods shipments point to slower — but still positive — Q3 equipment investment. Meanwhile, core capital goods shipments fell MoM in August despite the positive YoY increase, according to the Wells Fargo note.

“The advance goods trade balance data also out this morning suggests net exports will be more of a neutral force on Q3 growth after the whipsaw effects in the first half of the year,” according to the note.

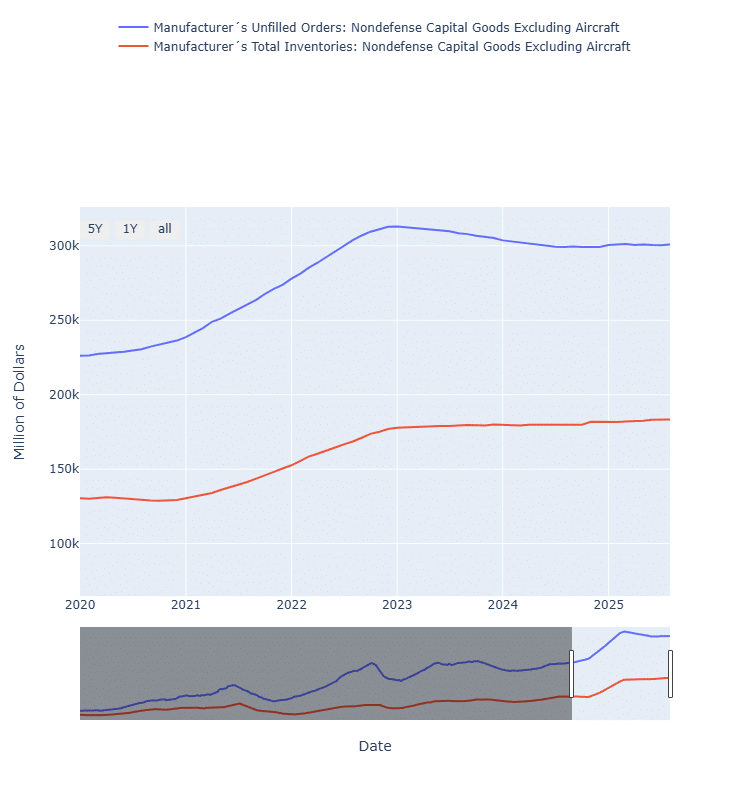

Unfilled orders, total inventories

Seasonally adjusted unfilled orders for core capital goods reached $300.9 billion in August, up 13.2% YoY and 0.2% MoM. Seasonally adjusted total inventories for core capital goods hit $183.1 billion in August, up 12.2% YoY, but down 0.04% MoM.

Seasonally adjusted unfilled orders for durable goods totaled $1.5 trillion in August, up 6.4% YoY and 0.7% MoM, according to the report. Seasonally adjusted total inventories for durable goods were $590.8 billion in August, up 11.5% YoY, but down 0.01% MoM.

Check out our exclusive industry data here.